Credit Suisse Results Presentation Deck

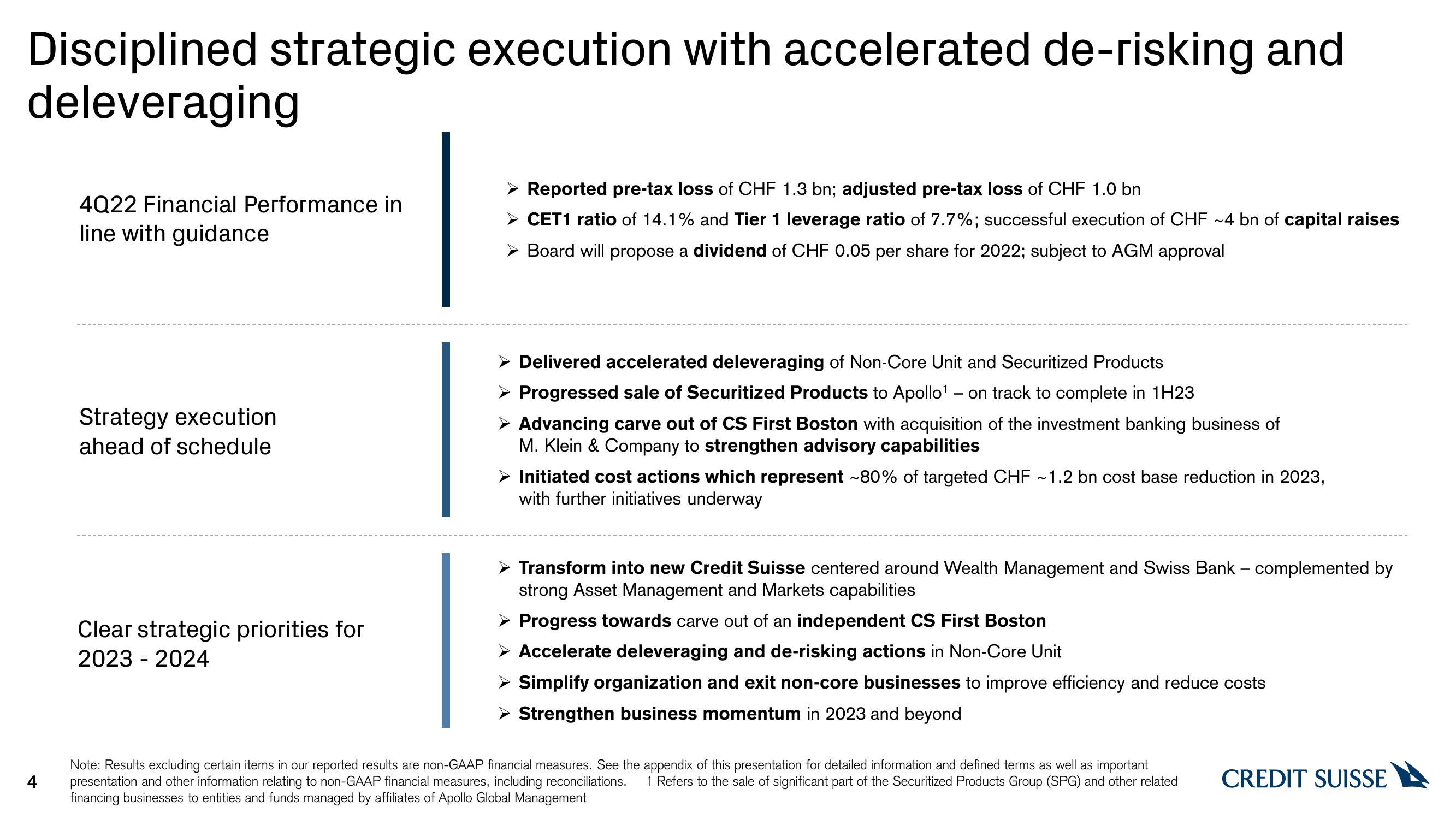

Disciplined strategic execution with accelerated de-risking and

deleveraging

4

4022 Financial Performance in

line with guidance

Strategy execution

ahead of schedule

Clear strategic priorities for

2023 2024

> Reported pre-tax loss of CHF 1.3 bn; adjusted pre-tax loss of CHF 1.0 bn

> CET1 ratio of 14.1% and Tier 1 leverage ratio of 7.7%; successful execution of CHF ~4 bn of capital raises

➤ Board will propose a dividend of CHF 0.05 per share for 2022; subject to AGM approval

► Delivered accelerated deleveraging of Non-Core Unit and Securitized Products

> Progressed sale of Securitized Products to Apollo¹ – on track to complete in 1H23

-

➤ Advancing carve out of CS First Boston with acquisition of the investment banking business of

M. Klein & Company to strengthen advisory capabilities

Initiated cost actions which represent ~80% of targeted CHF ~1.2 bn cost base reduction in 2023,

with further initiatives underway

Transform into new Credit Suisse centered around Wealth Management and Swiss Bank - complemented by

strong Asset Management and Markets capabilities

➤ Progress towards carve out of an independent CS First Boston

> Accelerate deleveraging and de-risking actions in Non-Core Unit

> Simplify organization and exit non-core businesses to improve efficiency and reduce costs

> Strengthen business momentum in 2023 and beyond

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Refers to the sale of significant part of the Securitized Products Group (SPG) and other related

financing businesses to entities and funds managed by affiliates of Apollo Global Management

CREDIT SUISSEView entire presentation