Bank of America Investment Banking Pitch Book

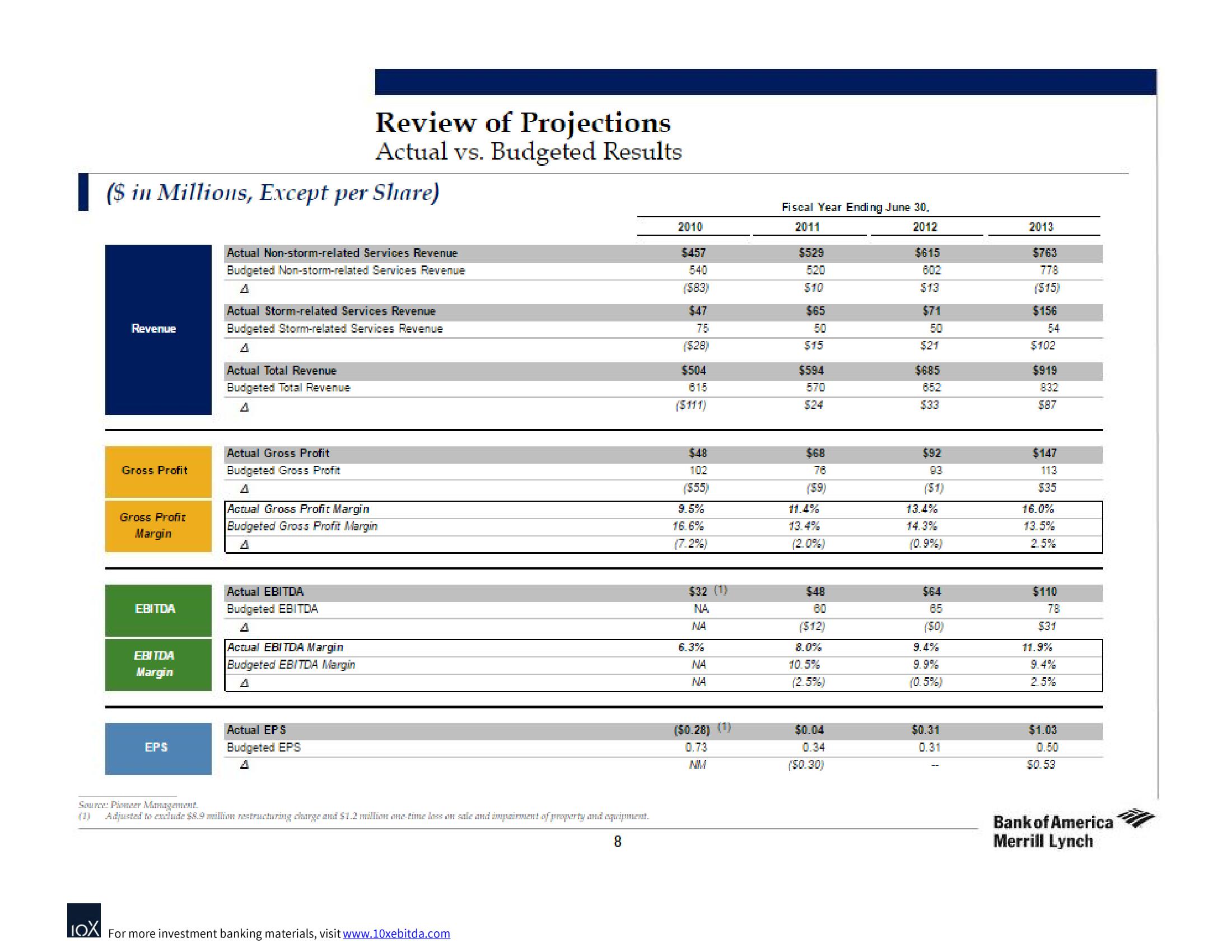

($ in Millions, Except per Share)

Revenue

Gross Profit

Gross Profit

Margin

EBITDA

EBITDA

Margin

EP'S

Actual Non-storm-related Services Revenue

Budgeted Non-storm-related Services Revenue

Actual Storm-related Services Revenue

Budgeted Storm-related Services Revenue

Actual Total Revenue

Budgeted Total Revenue

Actual Gross Profit

Budgeted Gross Profit

Review of Projections

Actual vs. Budgeted Results

Actual Gross Profit Margin

Budgeted Gross Profit Margin

A

Actual EBITDA

Budgeted EBITDA

A

Actual EBITDA Margin

Budgeted EBITDA Margin

Actual EPS

Budgeted EPS

Source: Pioneer Management.

Adjusted to exclude $8.9 million restructuring charge and $1.2 million one time lass on sale and impairment of property and equipment.

8

LOX For more investment banking materials, visit www.10xebitda.com

2010

$457

540

($83)

$47

75

($28)

$504

815

($111)

$48

10:2

(355)

9.5%

16.6%

(7.2%)

$32 (1)

NA

NA

6.3%

NA

NA

($0.28) (1)

0.73

Fiscal Year Ending June 30.

2011

2012

$529

5.20

$10

$65

50

$15

$594

570

$24

$68

78

11.4%

13.4%

$48

180

($12)

8.0%

10.5%

$0.04

($0.30)

$615

$13

$71

50

$21

$685

852

$33

$92

13.4%

(0.9%)

$64

(50)

9.4%

(0.5%)

$0.31

2013

$763

778

($15)

$156

54

$102

$919

832

587

$147

113

$35

16.0%

13.5%

2.5%

$110

78

$31

11.9%

$1.03

0.50

$0.53

Bank of America

Merrill LynchView entire presentation