Pershing Square Activist Presentation Deck

V. Developing a Response to the

Company

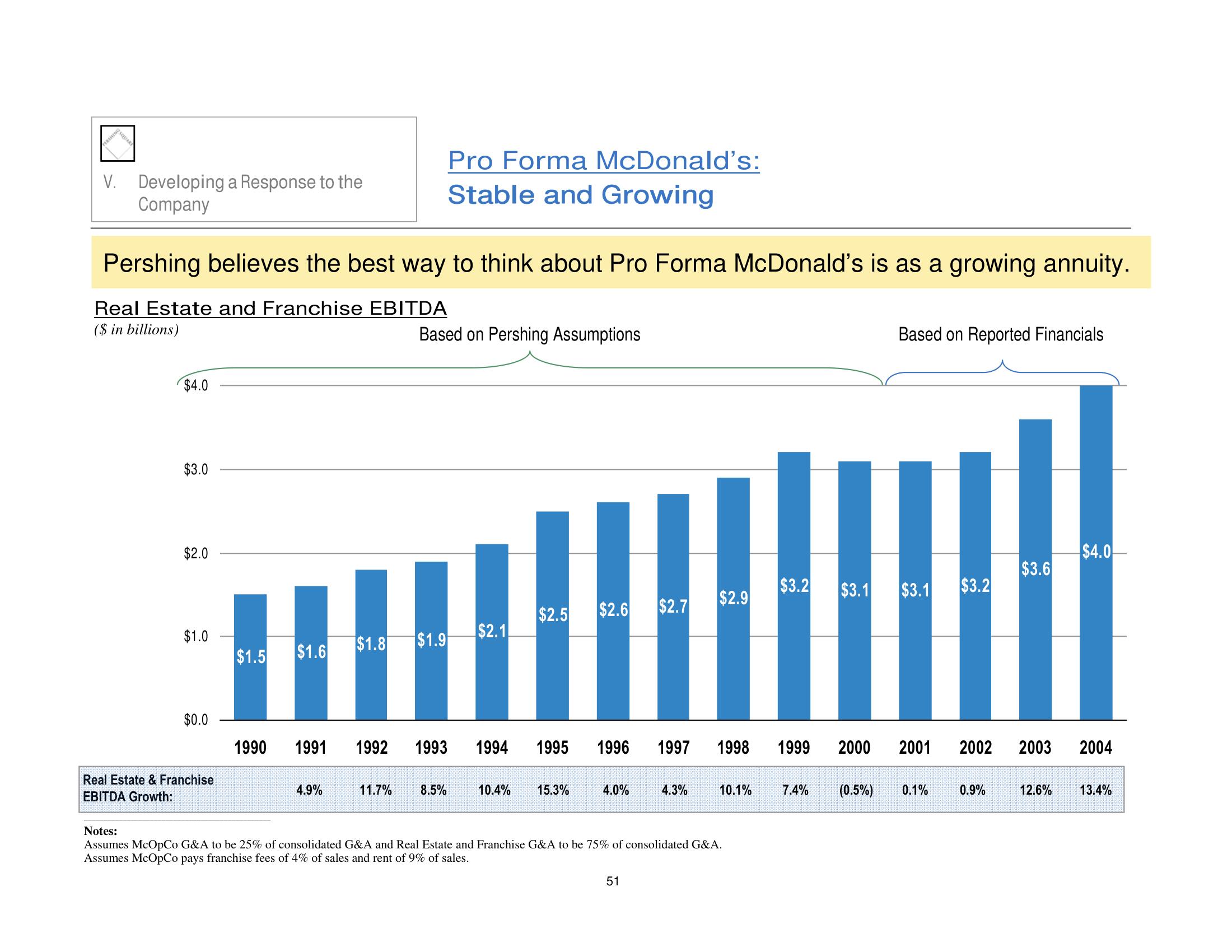

Pershing believes the best way to think about Pro Forma McDonald's is as a growing annuity.

Real Estate and Franchise EBITDA

($ in billions)

$4.0

$3.0

$2.0

$1.0

$0.0

Real Estate & Franchise

EBITDA Growth:

P

$1.5

1990

$1.6

4.9%

$1.8 $1.9

Pro Forma McDonald's:

Stable and Growing

Based on Pershing Assumptions

11.7%

8.5%

$2.1

$2.5 $2.6 $2.7

1991 1992 1993 1994 1995 1996 1997 1998 1999

10.4% 15.3%

4.0%

$2.9

4.3%

51

10.1%

Notes:

Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A.

Assumes McOpCo pays franchise fees of 4% of sales and rent of 9% of sales.

$3.2

7.4%

$3.1

Based on Reported Financials

(0.5%)

$3.1 $3.2

2000 2001 2002

0.1%

0.9%

$3.6

$4.0

2003 2004

12.6%

13.4%View entire presentation