Third Quarter 2022 Earnings Conference Call

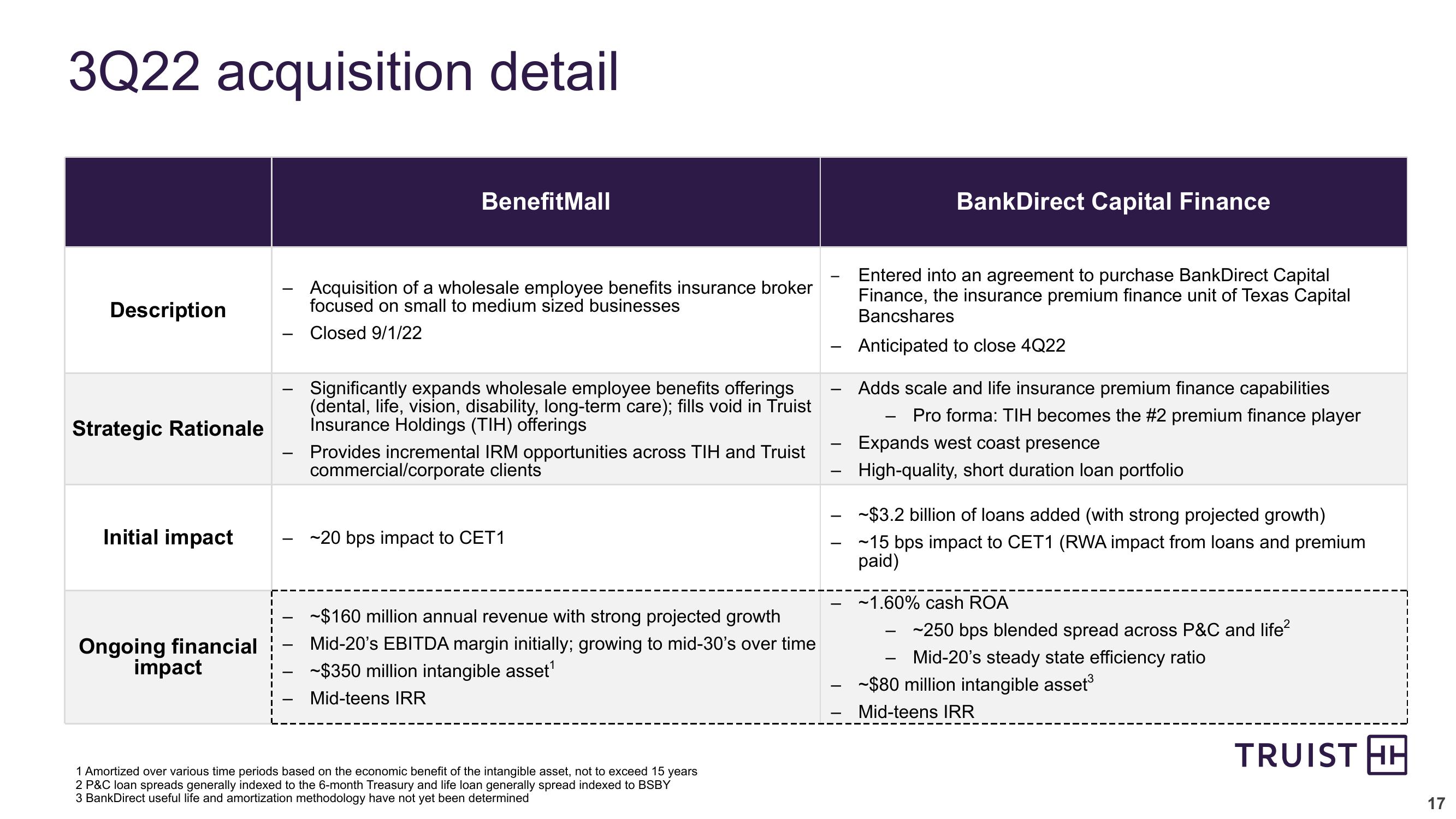

3Q22 acquisition detail

Description

Strategic Rationale

Initial impact

Ongoing financial

impact

I

BenefitMall

BankDirect Capital Finance

-

Acquisition of a wholesale employee benefits insurance broker

focused on small to medium sized businesses

Closed 9/1/22

Significantly expands wholesale employee benefits offerings

(dental, life, vision, disability, long-term care); fills void in Truist

Insurance Holdings (TIH) offerings

Provides incremental IRM opportunities across TIH and Truist

commercial/corporate clients

~20 bps impact to CET1

~$160 million annual revenue with strong projected growth

Mid-20's EBITDA margin initially; growing to mid-30's over time

~$350 million intangible asset¹

Mid-teens IRR

Entered into an agreement to purchase BankDirect Capital

Finance, the insurance premium finance unit of Texas Capital

Bancshares

Anticipated to close 4Q22

Adds scale and life insurance premium finance capabilities

-

Pro forma: TIH becomes the #2 premium finance player

Expands west coast presence

High-quality, short duration loan portfolio

~$3.2 billion of loans added (with strong projected growth)

~15 bps impact to CET1 (RWA impact from loans and premium

paid)

~1.60% cash ROA

-

~250 bps blended spread across P&C and life²

Mid-20's steady state efficiency ratio

~$80 million intangible asset³

Mid-teens IRR

1 Amortized over various time periods based on the economic benefit of the intangible asset, not to exceed 15 years

2 P&C loan spreads generally indexed to the 6-month Treasury and life loan generally spread indexed to BSBY

3 BankDirect useful life and amortization methodology have not yet been determined

TRUIST HH

17View entire presentation