Evercore Investment Banking Pitch Book

Preliminary Valuation of SIRE Common Units

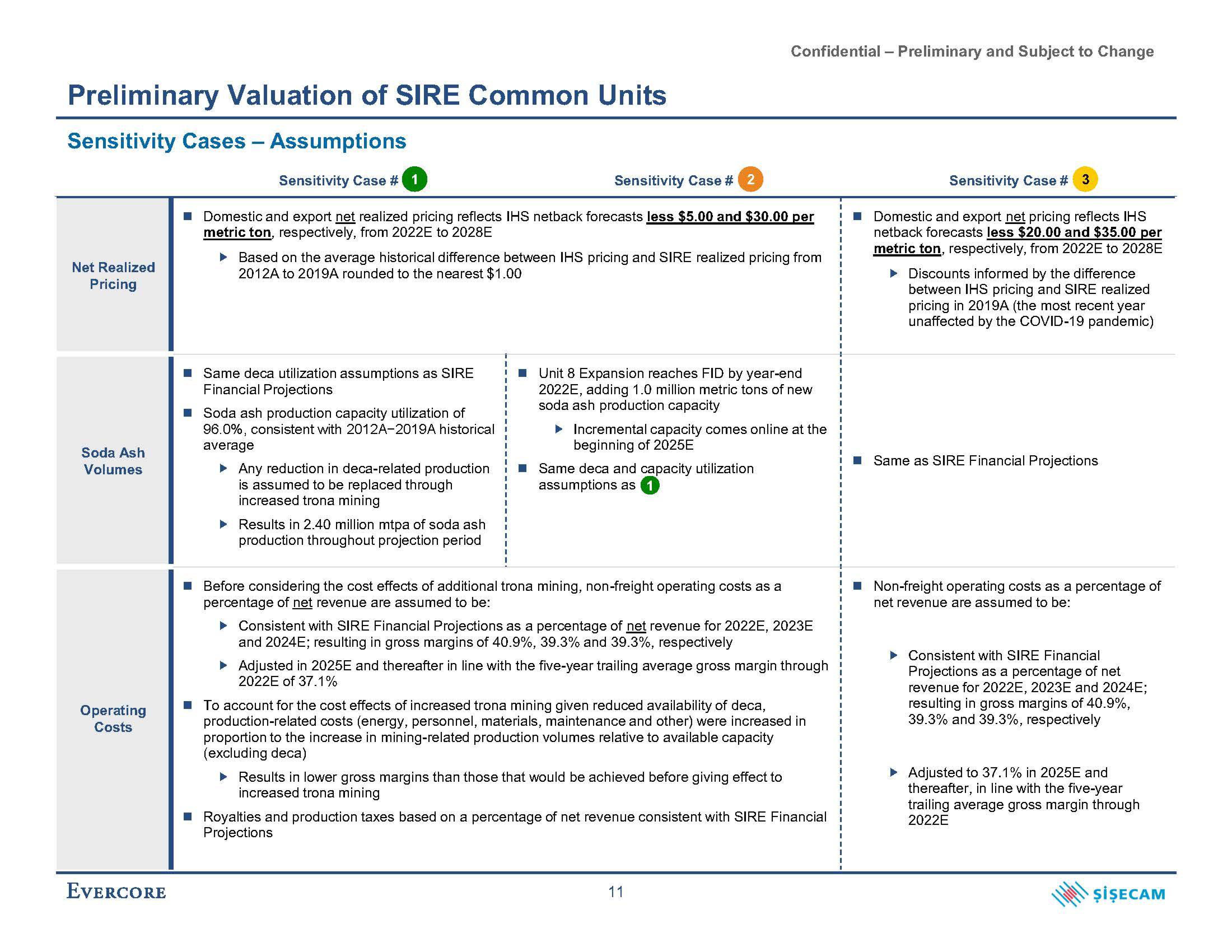

Sensitivity Cases - Assumptions

Sensitivity Case # 1

Sensitivity Case # 2

■ Domestic and export net realized pricing reflects IHS netback forecasts less $5.00 and $30.00 per

metric ton, respectively, from 2022E to 2028E

Net Realized

Pricing

Soda Ash

Volumes

Operating

Costs

EVERCORE

► Based on the average historical difference between IHS pricing and SIRE realized pricing from

2012A to 2019A rounded to the nearest $1.00

■ Same deca utilization assumptions as SIRE

Financial Projections

■ Soda ash production capacity utilization of

96.0%, consistent with 2012A-2019A historical

average

▸ Any reduction in deca-related production

is assumed to be replaced through

increased trona mining

► Results in 2.40 million mtpa of soda ash

production throughout projection period

■ Unit 8 Expansion reaches FID by year-end

2022E, adding 1.0 million metric tons of new

soda ash production capacity

Confidential - Preliminary and Subject to Change

►Incremental capacity comes online at the

beginning of 2025E

■ Same deca and capacity utilization

assumptions as 1

■ Before considering the cost effects of additional trona mining, non-freight operating costs as a

percentage of net revenue are assumed to be:

► Consistent with SIRE Financial Projections as a percentage of net revenue for 2022E, 2023E

and 2024E; resulting in gross margins of 40.9%, 39.3% and 39.3%, respectively

▸ Adjusted in 2025E and thereafter in line with the five-year trailing average gross margin through

2022E of 37.1%

■ To account for the cost effects of increased trona mining given reduced availability of deca,

production-related costs (energy, personnel, materials, maintenance and other) were increased in

proportion to the increase in mining-related production volumes relative to available capacity

(excluding deca)

► Results in lower gross margins than those that would be achieved before giving effect to

increased trona mining

■ Royalties and production taxes based on a percentage of net revenue consistent with SIRE Financial

Projections

11

Sensitivity Case # 3

■ Domestic and export net pricing reflects IHS

netback forecasts less $20.00 and $35.00 per

metric ton, respectively, from 2022E to 2028E

▸ Discounts informed by the difference

between IHS pricing and SIRE realized

pricing in 2019A (the most recent year

unaffected by the COVID-19 pandemic)

■ Same as SIRE Financial Projections

■ Non-freight operating costs as a percentage of

net revenue are assumed to be:

► Consistent with SIRE Financial

Projections as a percentage of net

revenue for 2022E, 2023E and 2024E;

resulting in gross margins of 40.9%,

39.3% and 39.3%, respectively

►Adjusted to 37.1% in 2025E and

thereafter, in line with the five-year

trailing average gross margin through

2022E

ŞİŞECAMView entire presentation