Ares US Real Estate Opportunity Fund III

Ares U.S. Opportunistic Strategy Track Record (¹)

Demonstrated track record that has exceeded target returns

■

■

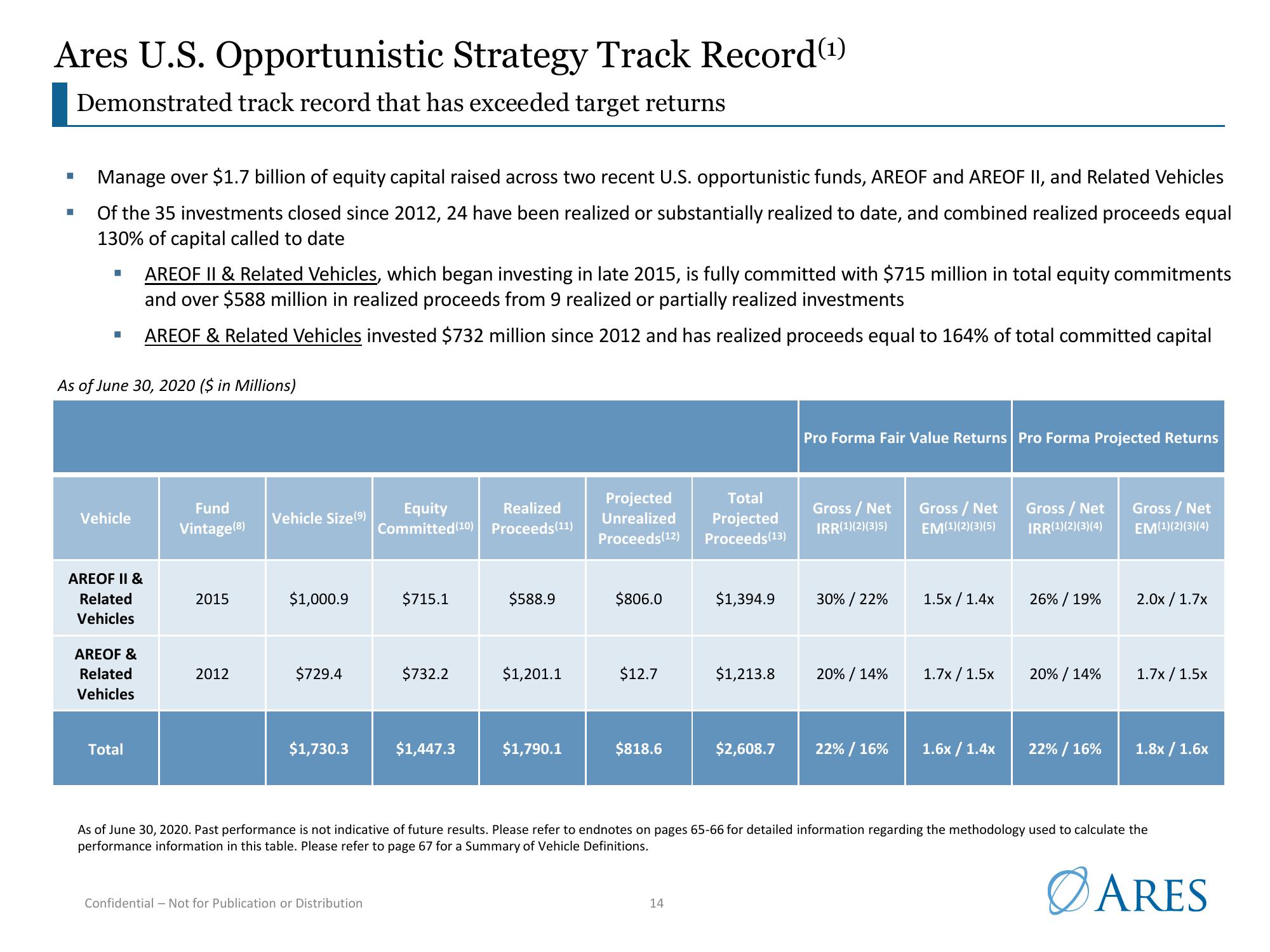

Manage over $1.7 billion of equity capital raised across two recent U.S. opportunistic funds, AREOF and AREOF II, and Related Vehicles

Of the 35 investments closed since 2012, 24 have been realized or substantially realized to date, and combined realized proceeds equal

130% of capital called to date

H

■

As of June 30, 2020 ($ in Millions)

Vehicle

AREOF II &

Related

Vehicles

AREOF &

Related

Vehicles

AREOF II & Related Vehicles, which began investing in late 2015, is fully committed with $715 million in total equity commitments

and over $588 million in realized proceeds from 9 realized or partially realized investments

AREOF & Related Vehicles invested $732 million since 2012 and has realized proceeds equal to 164% of total committed capital

Total

Fund

Vintage (8)

2015

2012

Vehicle Size(⁹)

$1,000.9

$729.4

$1,730.3

Equity Realized

Committed (10) Proceeds (11)

Confidential - Not for Publication or Distribution

$715.1

$732.2

$1,447.3

$588.9

$1,201.1

$1,790.1

Projected

Unrealized

Proceeds(12)

$806.0

$12.7

$818.6

Total

Projected

Proceeds (13)

14

$1,394.9

$1,213.8

$2,608.7

Pro Forma Fair Value Returns Pro Forma Projected Returns

Gross / Net

IRR(1)(2)(3)5)

30% / 22%

20% / 14%

22% / 16%

Gross / Net

EM(1)(2)(3)(5)

1.5x / 1.4x

1.7x/ 1.5x

1.6x / 1.4x

Gross / Net

IRR(1)(2)(3)(4)

26% / 19%

20% / 14%

22% / 16%

Gross / Net

EM(1)(2)(3)(4)

2.0x / 1.7x

1.7x / 1.5x

As of June 30, 2020. Past performance is not indicative of future results. Please refer to endnotes on pages 65-66 for detailed information regarding the methodology used to calculate the

performance information in this table. Please refer to page 67 for a Summary of Vehicle Definitions.

ARES

1.8x/ 1.6xView entire presentation