Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

PERFORMANCE

ASSET QUALITY

BBUKPLC metrics³

-

CET1 ratio

Average UK leverage ratio

LCR4

Liquidity pool

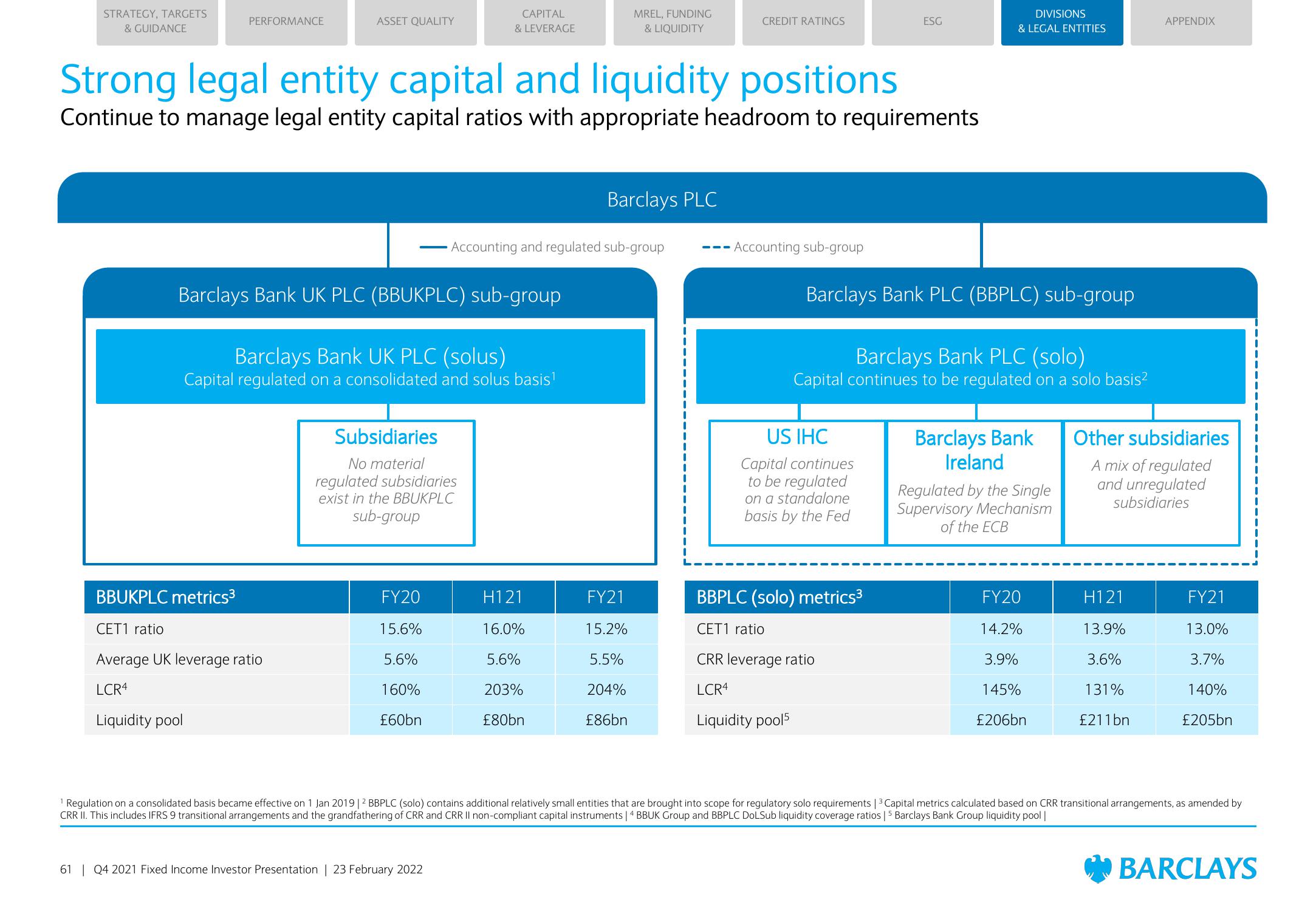

Strong legal entity capital and liquidity positions

Continue to manage legal entity capital ratios with appropriate headroom to requirements

Barclays Bank UK PLC (BBUKPLC) sub-group

Barclays Bank UK PLC (solus)

Capital regulated on a consolidated and solus basis¹

CAPITAL

& LEVERAGE

Subsidiaries

No material

regulated subsidiaries

exist in the BBUKPLC

sub-group

FY20

15.6%

5.6%

160%

£60bn

Accounting and regulated sub-group

61 | Q4 2021 Fixed Income Investor Presentation | 23 February 2022

MREL, FUNDING

& LIQUIDITY

H121

16.0%

5.6%

203%

£80bn

Barclays PLC

FY21

15.2%

5.5%

204%

£86bn

CREDIT RATINGS

I

I

I

Accounting sub-group

ESG

Barclays Bank PLC (BBPLC) sub-group

US IHC

Capital continues

to be regulated

on a standalone

basis by the Fed

DIVISIONS

& LEGAL ENTITIES

Barclays Bank PLC (solo)

Capital continues to be regulated on a solo basis²

BBPLC (solo) metrics³

CET1 ratio

CRR leverage ratio

LCR4

Liquidity pool5

Barclays Bank

Ireland

Regulated by the Single

Supervisory Mechanism

of the ECB

FY20

14.2%

3.9%

145%

£206bn

APPENDIX

Other subsidiaries

A mix of regulated

and unregulated

subsidiaries

H121

13.9%

3.6%

131%

£211bn

FY21

13.0%

3.7%

140%

£205bn

1 Regulation on a consolidated basis became effective on 1 Jan 2019 | 2 BBPLC (solo) contains additional relatively small entities that are brought into scope for regulatory solo requirements | ³ Capital metrics calculated based on CRR transitional arrangements, as amended by

CRR II. This includes IFRS 9 transitional arrangements and the grandfathering of CRR and CRR II non-compliant capital instruments | 4 BBUK Group and BBPLC DOLSub liquidity coverage ratios | 5 Barclays Bank Group liquidity pool |

BARCLAYSView entire presentation