Apollo Global Management Investor Day Presentation Deck

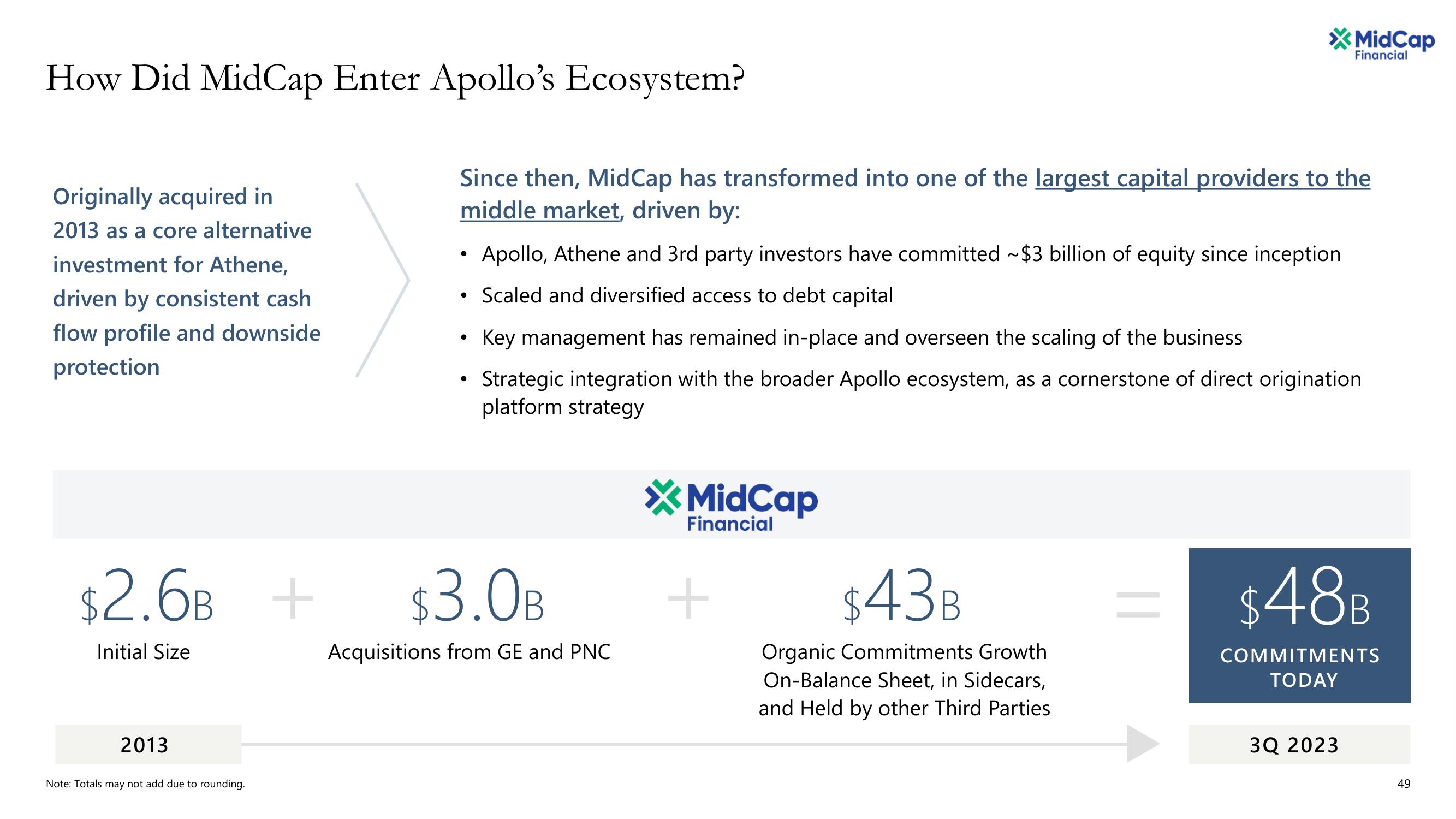

How Did MidCap Enter Apollo's Ecosystem?

Originally acquired in

2013 as a core alternative

investment for Athene,

driven by consistent cash

flow profile and downside

protection

$2.6B

Initial Size

2013

Note: Totals may not add due to rounding.

+

Since then, MidCap has transformed into one of the largest capital providers to the

middle market, driven by:

●

●

Apollo, Athene and 3rd party investors have committed ~$3 billion of equity since inception

Scaled and diversified access to debt capital

Key management has remained in-place and overseen the scaling of the business

• Strategic integration with the broader Apollo ecosystem, as a cornerstone of direct origination

platform strategy

$3.0B

Acquisitions from GE and PNC

*MidCap

Financial

*MidCap

Financial

+

$43B

Organic Commitments Growth

On-Balance Sheet, in Sidecars,

and Held by other Third Parties

=

$48B

COMMITMENTS

TODAY

3Q 2023

49View entire presentation