Investor Presentation

Illustrative Unit Economics

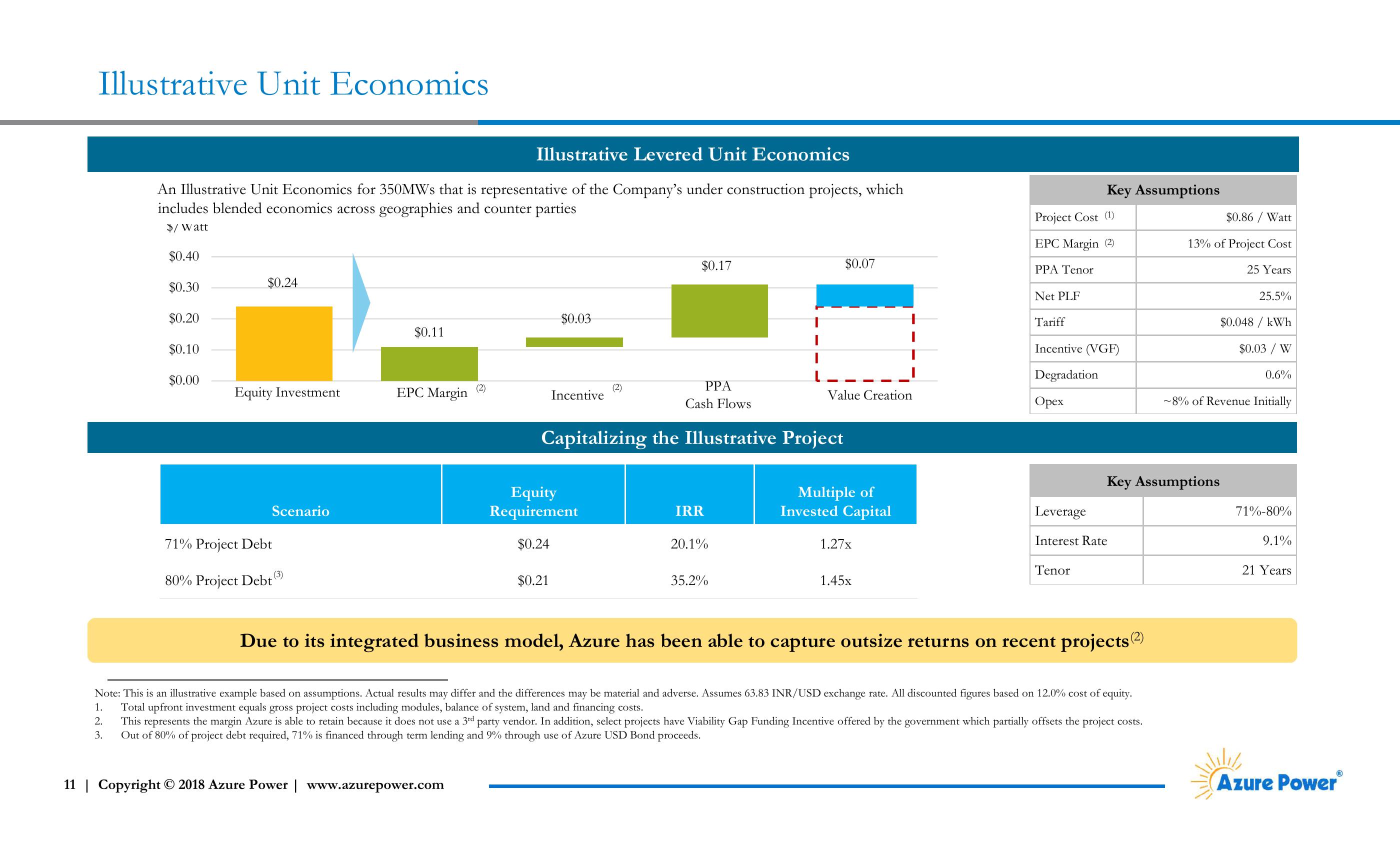

Illustrative Levered Unit Economics

An Illustrative Unit Economics for 350MWs that is representative of the Company's under construction projects, which

includes blended economics across geographies and counter parties

$/ Watt

$0.40

$0.30

$0.24

$0.20

$0.03

$0.11

$0.10

$0.00

Equity Investment

EPC Margin

(2)

(2)

Incentive

Key Assumptions

$0.86 / Watt

13% of Project Cost

25 Years

25.5%

$0.048 / kWh

Project Cost (1)

EPC Margin (2)

$0.17

$0.07

PPA Tenor

Net PLF

Tariff

Incentive (VGF)

Degradation

Value Creation

Opex

PPA

Cash Flows

Capitalizing the Illustrative Project

$0.03 / W

0.6%

~8% of Revenue Initially

Key Assumptions

Scenario

Equity

Requirement

IRR

Multiple of

Invested Capital

Leverage

71%-80%

71% Project Debt

$0.24

20.1%

1.27x

Interest Rate

9.1%

Tenor

21 Years

(3)

80% Project Debt

$0.21

35.2%

1.45x

Due to its integrated business model, Azure has been able to capture outsize returns on recent projects (2)

Note: This is an illustrative example based on assumptions. Actual results may differ and the differences may be material and adverse. Assumes 63.83 INR/USD exchange rate. All discounted figures based on 12.0% cost of equity.

Total upfront investment equals gross project costs including modules, balance of system, land and financing costs.

1.

2.

3.

This represents the margin Azure is able to retain because it does not use a 3rd party vendor. In addition, select projects have Viability Gap Funding Incentive offered by the government which partially offsets the project costs.

Out of 80% of project debt required, 71% is financed through term lending and 9% through use of Azure USD Bond proceeds.

11 | Copyright © 2018 Azure Power | www.azurepower.com

Azure PowerⓇView entire presentation