Commercial Metals Company Results Presentation Deck

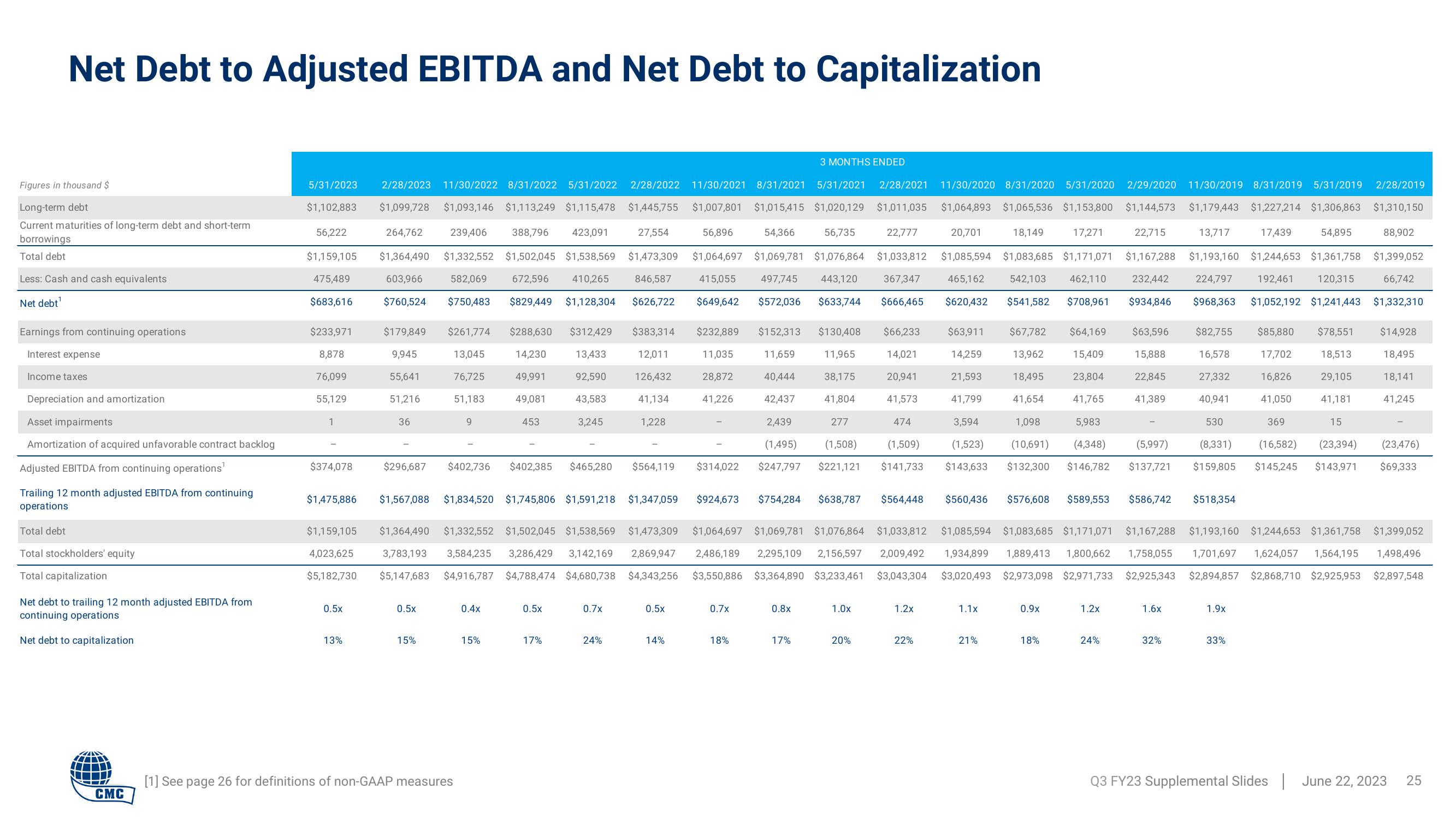

Net Debt to Adjusted EBITDA and Net Debt to Capitalization

Figures in thousand $

Long-term debt

Current maturities of long-term debt and short-term

borrowings

Total debt

Less: Cash and cash equivalents

Net debt¹

Earnings from continuing operations

Interest expense

Income taxes

Depreciation and amortization

Asset impairments

Amortization of acquired unfavorable contract backlog

Adjusted EBITDA from continuing operations¹

Trailing 12 month adjusted EBITDA from continuing

operations

Total debt

Total stockholders' equity

Total capitalization

Net debt to trailing 12 month adjusted EBITDA from

continuing operations

Net debt to capitalization

CMC

5/31/2023 2/28/2023 11/30/2022 8/31/2022 5/31/2022 2/28/2022 11/30/2021 8/31/2021 5/31/2021 2/28/2021 11/30/2020 8/31/2020 5/31/2020 2/29/2020 11/30/2019 8/31/2019 5/31/2019 2/28/2019

$1,102,883 $1,099,728 $1,093,146 $1,113,249 $1,115,478 $1,445,755 $1,007,801 $1,015,415 $1,020,129 $1,011,035 $1,064,893 $1,065,536 $1,153,800 $1,144,573 $1,179,443 $1,227,214 $1,306,863 $1,310,150

56,896

54,366 56,735 22,777 20,701

17,271

$1,064,697 $1,069,781 $1,076,864 $1,033,812

415,055 497,745 443,120 367,347

$649,642 $572,036 $633,744 $666,465

$1,085,594 $1,083,685 $1,171,071

465,162 542,103 462,110

$620,432 $541,582 $708,961

56,222

$1,159,105

475,489

$683,616

$233,971

8,878

76,099

55,129

1

$374,078

$1,475,886

0.5x

264,762 239,406 388,796 423,091

$1,364,490 $1,332,552 $1,502,045 $1,538,569 $1,473,309

603,966 582,069 672,596 410,265 846,587

$760,524 $750,483 $829,449 $1,128,304 $626,722

13%

$179,849

9,945

55,641

51,216

36

$261,774

13,045

76,725

51,183

$296,687 $402,736

0.5x

9

15%

$1,159,105 $1,364,490 $1,332,552 $1,502,045 $1,538,569 $1,473,309

4,023,625 3,783,193 3,584,235 3,286,429 3,142,169 2,869,947

$5,182,730 $5,147,683 $4,916,787 $4,788,474 $4,680,738 $4,343,256

[1] See page 26 for definitions of non-GAAP measures

$1,567,088 $1,834,520 $1,745,806 $1,591,218 $1,347,059

0.4x

$288,630 $312,429 $383,314

13,433 12,011

92,590 126,432

43,583

41,134

3,245

14,230

49,991

49,081

453

15%

$402,385 $465,280 $564,119

27,554

0.5x

17%

1,228

0.7x

24%

0.5x

14%

$232,889 $152,313

11,035 11,659

28,872

41,226

$130,408 $66,233

11,965

14,021

40,444 38,175 20,941

42,437 41,804 41,573

2,439

277

474

(1,495) (1,508) (1,509)

$314,022 $247,797 $221,121 $141,733

$924,673 $754,284 $638,787 $564,448

$1,064,697 $1,069,781 $1,076,864

2,486,189. 2,295,109 2,156,597

$3,550,886 $3,364,890 $3,233,461

$1,033,812

2,009,492

$3,043,304

0.7x

3 MONTHS ENDED

18%

0.8x

17%

1.0x

20%

1.2x

22%

18,149

$63,911 $67,782 $64,169

14,259

13,962 15,409

21,593 18,495 23,804

41,799 41,654 41,765

3,594

1,098

5,983

(1,523) (10,691) (4,348) (5,997)

$143,633 $132,300 $146,782 $137,721

1.1x

21%

$560,436 $576,608 $589,553 $586,742

0.9x

13,717 17,439

$1,167,288 $1,193,160 $1,244,653 $1,361,758

232,442 224,797 192,461 120,315

$934,846 $968,363 $1,052,192 $1,241,443

18%

22,715

1.2x

24%

$63,596

15,888

22,845

41,389

$1,085,594 $1,083,685 $1,171,071 $1,167,288 $1,193,160 $1,244,653 $1,361,758 $1,399,052

1,934,899 1,889,413 1,800,662 1,758,055 1,701,697 1,624,057 1,564,195 1,498,496

$3,020,493 $2,973,098 $2,971,733 $2,925,343 $2,894,857 $2,868,710 $2,925,953 $2,897,548

1.6x

32%

$518,354

$85,880 $78,551

17,702 18,513

16,826 29,105

41,181

530

369

15

(8,331) (16,582) (23,394) (23,476)

$159,805 $145,245 $143,971 $69,333

$82,755

16,578

27,332

40,941

1.9x

54,895

41,050

33%

88,902

$1,399,052

66,742

$1,332,310

$14,928

18,495

18,141

41,245

Q3 FY23 Supplemental Slides June 22, 2023

25View entire presentation