Momentus SPAC Presentation Deck

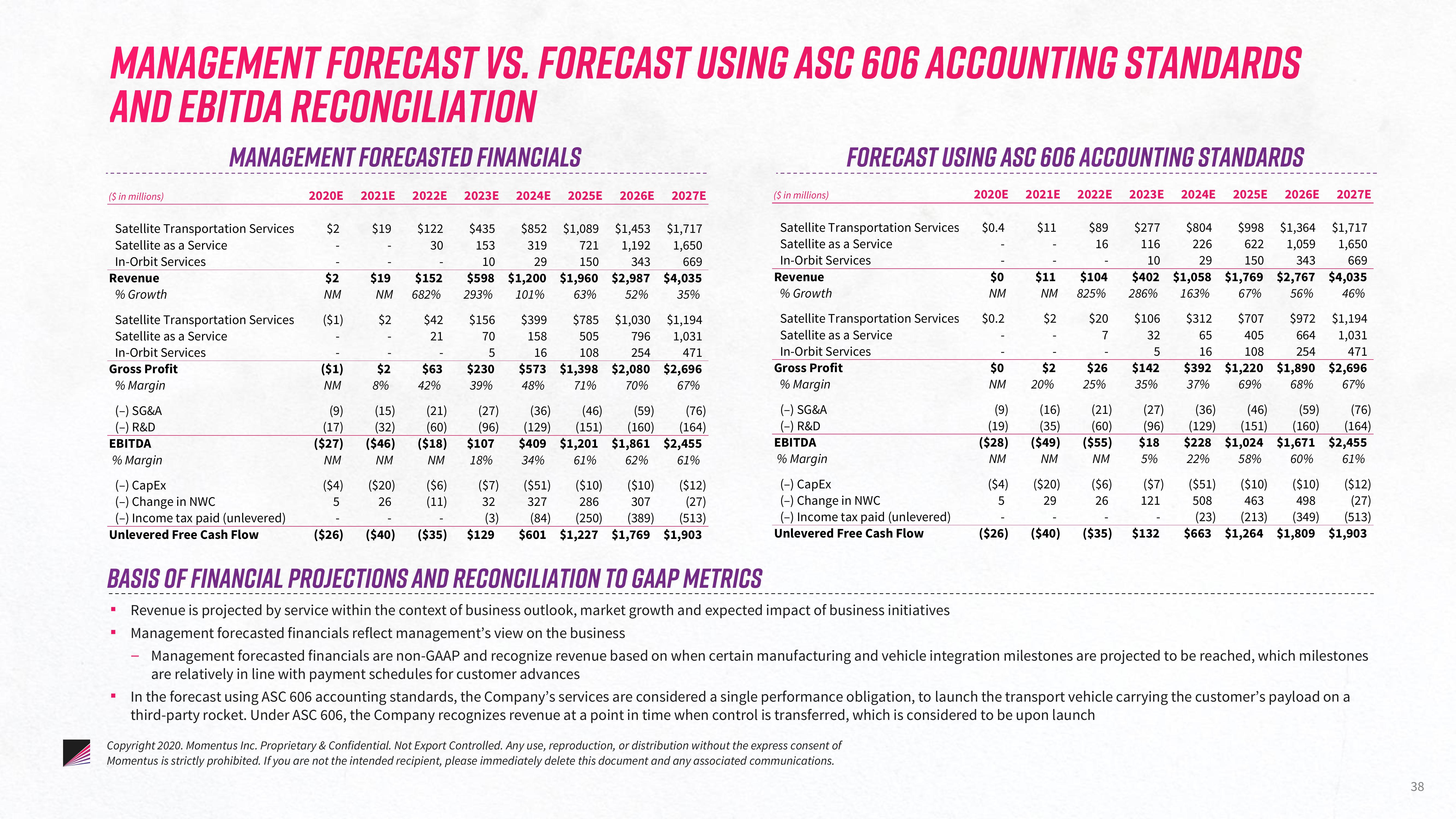

MANAGEMENT FORECAST VS. FORECAST USING ASC 606 ACCOUNTING STANDARDS

AND EBITDA RECONCILIATION

MANAGEMENT FORECASTED FINANCIALS

($ in millions)

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Revenue

% Growth

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Gross Profit

% Margin

(-) SG&A

(-) R&D

EBITDA

% Margin

(-) CapEx

(-) Change in NWC

(-) Income tax paid (unlevered)

Unlevered Free Cash Flow

2020E 2021E 2022E 2023E

■

$2

$2

NM

($1)

($1)

NM

(9)

(17)

$19 $122 $435 $852 $1,089 $1,453 $1,717

30

153

319

721 1,192 1,650

10 29 150 343 669

$19 $152 $598 $1,200 $1,960 $2,987 $4,035

NM 682% 293% 101% 63% 52% 35%

$399

$785 $1,030 $1,194

158 505 796

16 108 254 471

$573 $1,398 $2,080 $2,696

71%

$2

$156

70

5

$230

39% 48%

70%

67%

$2

8%

(15)

(32)

$42

21

(21)

(60)

($27) ($46) ($18)

NM

NM

NM

($4)

5

($20)

26

($26) ($40)

$63

42%

($6)

(11)

(27)

(96)

$107

18%

($7)

32

2024E 2025E 2026E 2027E

(3)

($35) $129

(76)

(129) (151) (160) (164)

(36) (46) (59)

$409 $1,201 $1,861 $2,455

34%

61%

62%

61%

($51)

($10)

($10)

($12)

327

307

(27)

286

(84) (250) (389) (513)

$601 $1,227 $1,769 $1,903

($ in millions)

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Revenue

% Growth

Satellite Transportation Services

Satellite as a Service

In-Orbit Services

Gross Profit

% Margin

(-) SG&A

FORECAST USING ASC 606 ACCOUNTING STANDARDS

(-) R&D

EBITDA

% Margin

(-) CapEx

(-) Change in NWC

(-) Income tax paid (unlevered)

Unlevered Free Cash Flow

BASIS OF FINANCIAL PROJECTIONS AND RECONCILIATION TO GAAP METRICS

Revenue is projected by service within the context of business outlook, market growth and expected impact of business initiatives

Management forecasted financials reflect management's view on the business

2020E 2021E 2022E 2023E 2024E 2025E 2026E 2027E

Copyright 2020. Momentus Inc. Proprietary & Confidential. Not Export Controlled. Any use, reproduction, or distribution without the express consent of

Momentus is strictly prohibited. If you are not the intended recipient, please immediately delete this document and any associated communications.

$0.4

$0

NM

$0.2

$0

NM

(9)

(19)

($28)

NM

16

$11 $89 $277 $804 $998 $1,364 $1,717

116 226 622 1,059 1,650

10

29 150 343 669

$402 $1,058 $1,769 $2,767 $4,035

286% 163% 67% 56% 46%

$312 $707 $972 $1,194

65 405 664 1,031

16 108 254 471

$392 $1,220 $1,890 $2,696

37% 69% 68% 67%

($4)

5

$11 $104

NM 825%

$2

$2

20%

$20 $106

7

32

(16)

(35)

($49)

NM

($20) ($6)

29

26

($7)

121

($26) ($40) ($35) $132

$26 $142

25% 35%

(21)

(60)

($55)

NM

(27)

(96)

$18

5%

(46) (59)

(36)

(76)

(129) (151) (160) (164)

$228 $1,024 $1,671 $2,455

22% 58% 60% 61%

($51) ($10) ($10)

508 463 498

(23) (213) (349) (513)

$663 $1,264 $1,809 $1,903

($12)

(27)

Management forecasted financials are non-GAAP and recognize revenue based on when certain manufacturing and vehicle integration milestones are projected to be reached, which milestones

are relatively in line with payment schedules for customer advances

In the forecast using ASC 606 accounting standards, the Company's services are considered a single performance obligation, to launch the transport vehicle carrying the customer's payload on a

third-party rocket. Under ASC 606, the Company recognizes revenue at a point in time when control is transferred, which is considered to be upon launch

38View entire presentation