Hertz Investor Presentation Deck

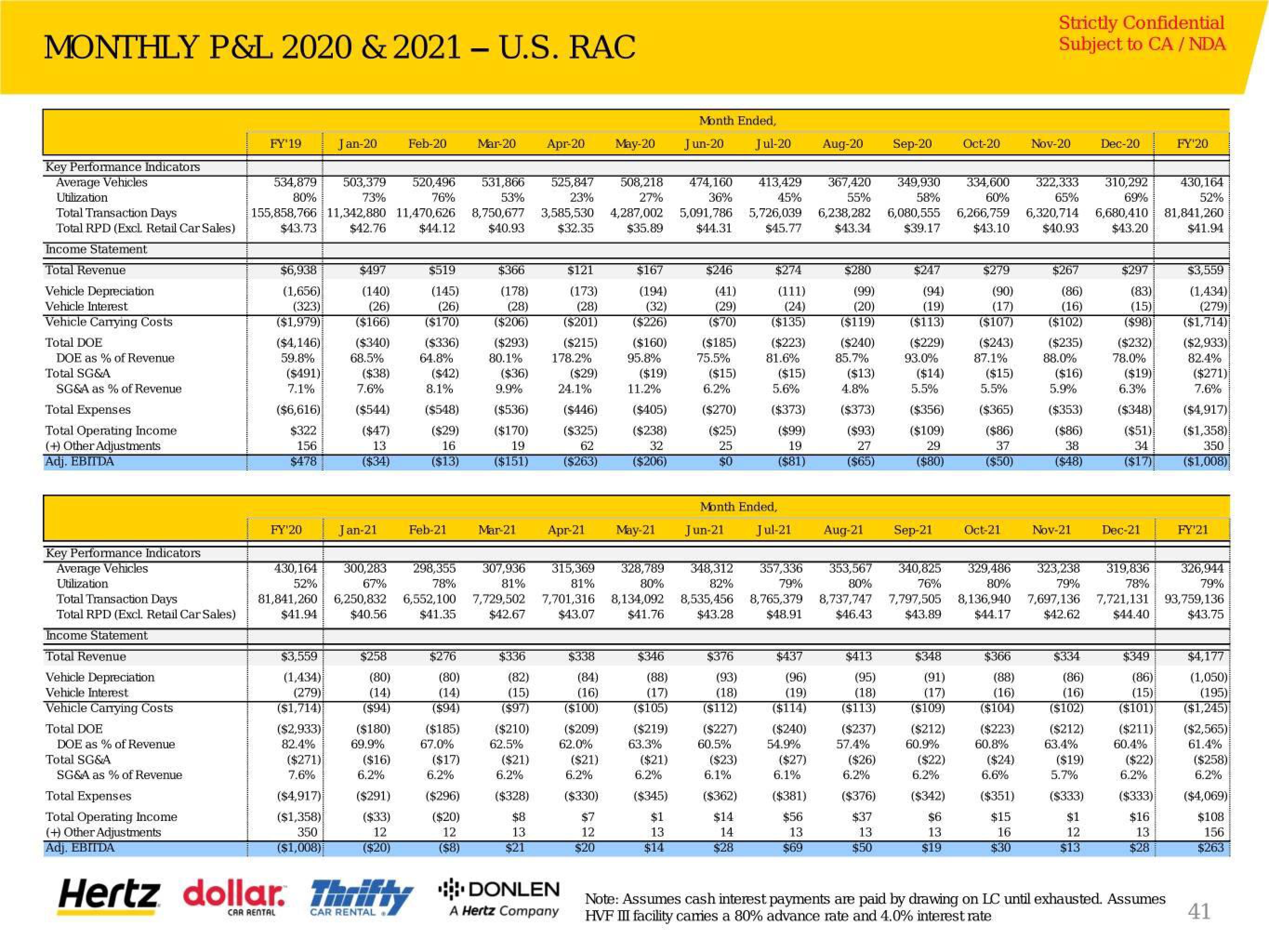

MONTHLY P&L 2020 & 2021 - U.S. RAC

Key Performance Indicators

Average Vehicles

Utilization

Total Transaction Days

Total RPD (Excl. Retail Car Sales)

Income Statement

Total Revenue

Vehicle Depreciation

Vehicle Interest

Vehicle Carrying Costs

Total DOE

DOE as % of Revenue

Total SG&A

SG&A as % of Revenue

Total Expenses

Total Operating Income

(+) Other Adjustments

Adj. EBITDA

Key Performance Indicators

Average Vehicles

Utilization

Total Transaction Days

Total RPD (Excl. Retail Car Sales)

Income Statement

Total Revenue

Vehicle Depreciation

Vehicle Interest

Vehicle Carrying Costs

Total DOE

DOE as % of Revenue

Total SG&A

SG&A as % of Revenue

Total Expenses

Total Operating Income

(+) Other Adjustments

Adj. EBITDA

FY'19

534,879

80%

$6,938

(1,656)

(323)

($1,979)

503,379 520,496 531,866

73%

76%

53%

155,858,766 11,342,880 11,470,626 8,750,677

$43.73 $42.76 $44.12 $40.93

($4,146)

59.8%

($491)

7.1%

($6,616)

$322

156

$478

FY'20

81,841,260

$41.94

$3,559

(1,434)

(279)

($1,714)

($2,933)

82.4%

Jan-20

($271)

7.6%

($4,917)

($1,358)

350

($1,008)

Hertz dollar.

$497

(140)

(26)

($166)

($340)

68.5%

($38)

7.6%

($544)

($47)

13

($34)

Jan-21

430,164 300,283 298,355

52%

67%

78%

6,250,832 6,552,100

$40.56 $41.35

$258

(80)

(14)

($94)

($180)

69.9%

($16)

Feb-20

6.2%

($291)

($33)

12

($20)

$519

(145)

(26)

($170)

($336)

64.8%

($42)

8.1%

($548)

($29)

16

($13)

Feb-21

$276

(80)

(14)

($94)

($185)

67.0%

($17)

Mar-20 Apr-20

6.2%

($296)

($20)

12

($8)

$366

(178)

(28)

($206)

($293)

80.1%

($36)

9.9%

($536)

($170)

19

($151)

$336

(82)

(15)

($97)

($210)

62.5%

($21)

Mar-21 Apr-21

6.2%

($328)

$8

13

$21

525,847 508,218 474,160

23%

27%

36%

3,585,530 4,287,002 5,091,786

$32.35 $35.89 $44.31

$121

(173)

(28)

($201)

307,936 315,369

81%

81%

7,729,502 7,701,316

$42.67 $43.07

($215)

178.2%

($29)

24.1%

dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

A Hertz Company

($446)

($325)

62

($263)

$338

(84)

(16)

($100)

($209)

62.0%

($21)

May-20

6.2%

($330)

$7

12

$20

$167

(194)

(32)

($226)

($160)

95.8%

($19)

11.2%

($405)

($238)

32

($206)

$346

(88)

(17)

($105)

($219)

Month Ended,

Jun-20 Jul-20 Aug-20 Sep-20

63.3%

($21)

$246

(41)

(29)

($70)

May-21 Jun-21

6.2%

($345)

$1

13

$14

($185)

328,789 348,312

80%

82%

8,134,092 8,535,456

$41.76 $43.28

75.5%

($15)

6.2%

($270)

($25)

25

$0

$376

(93)

(18)

($112)

($227)

Month Ended,

60.5%

($23)

413,429 367,420 349,930

45%

55%

58%

6.1%

($362)

$14

14

$28

$274

(111)

(24)

($135)

($223)

334,600 322,333 310,292

60%

65%

69%

5,726,039 6,238,282 6,080,555 6,266,759 6,320,714 6,680,410

$45.77 $43.34 $39.17 $43.10 $40.93 $43.20

81.6%

($15)

5.6%

($373)

($99)

19

($81)

Jul-21

$437

(96)

(19)

($114)

($240)

54.9%

($27)

6.1%

$280

(99)

(20)

($119)

($381)

$56

13

$69

($240)

85.7%

($13)

4.8%

($373)

($93)

27

($65)

357,336 353,567 340,825

79%

80%

76%

8,765,379 8,737,747 7,797,505

$48.91 $46.43 $43.89

$413

(95)

(18)

($113)

($237)

57.4%

$247

(94)

(19)

($113)

Aug-21 Sep-21

($26)

($229)

6.2%

($376)

$37

13

$50

93.0%

($14)

5.5%

($356)

($109)

29

($80)

$348

(91)

(17)

($109)

($212)

60.9%

($22)

Oct-20

6.2%

($342)

$6

13

$19

$279

(90)

(17)

($107)

($243)

87,1%

($15)

5.5%

($365)

($86)

37

($50)

Oct-21

$366

(88)

(16)

($104)

($223)

60.8%

Strictly Confidential

Subject to CA/ NDA

($24)

Nov-20

6.6%

($351)

$15

16

$30

$267

(86)

(16)

($102)

($235)

88.0%

($16)

5.9%

($353)

($86)

38

($48)

Nov-21

$334

(86)

(16)

($102)

($212)

63.4%

329,486 323,238 319,836 326,944

80%

79%

78%

79%

8,136,940 7,697,136 7,721,131 93,759,136

$44.17 $42.62 $44.40

$43.75

($19)

Dec-20

5.7%

($333)

$1

12

$13

$297

(83)

(15)

($98)

($232)

78.0%

($19)

6.3%

($348)

($51)

34

($17)

Dec-21

$349

(86)

(15)

($101)

($211)

60.4%

($22)

6.2%

($333)

$16

13.

$28

FY'20

430,164

52%

81,841,260

$41.94

Note: Assumes cash interest payments are paid by drawing on LC until exhausted. Assumes

HVF III facility cames a 80% advance rate and 4.0% interest rate

$3,559

(1,434)

(279)

($1,714)

($2,933)

82.4%

($271)

7.6%

($4,917)

($1,358)

350

($1,008)

FY'21

$4,177

(1,050)

(195)

($1,245)

($2,565)

61.4%

($258)

6.2%

($4,069)

$108.

156

$263

41View entire presentation