AMD Results Presentation Deck

30

APPENDICES

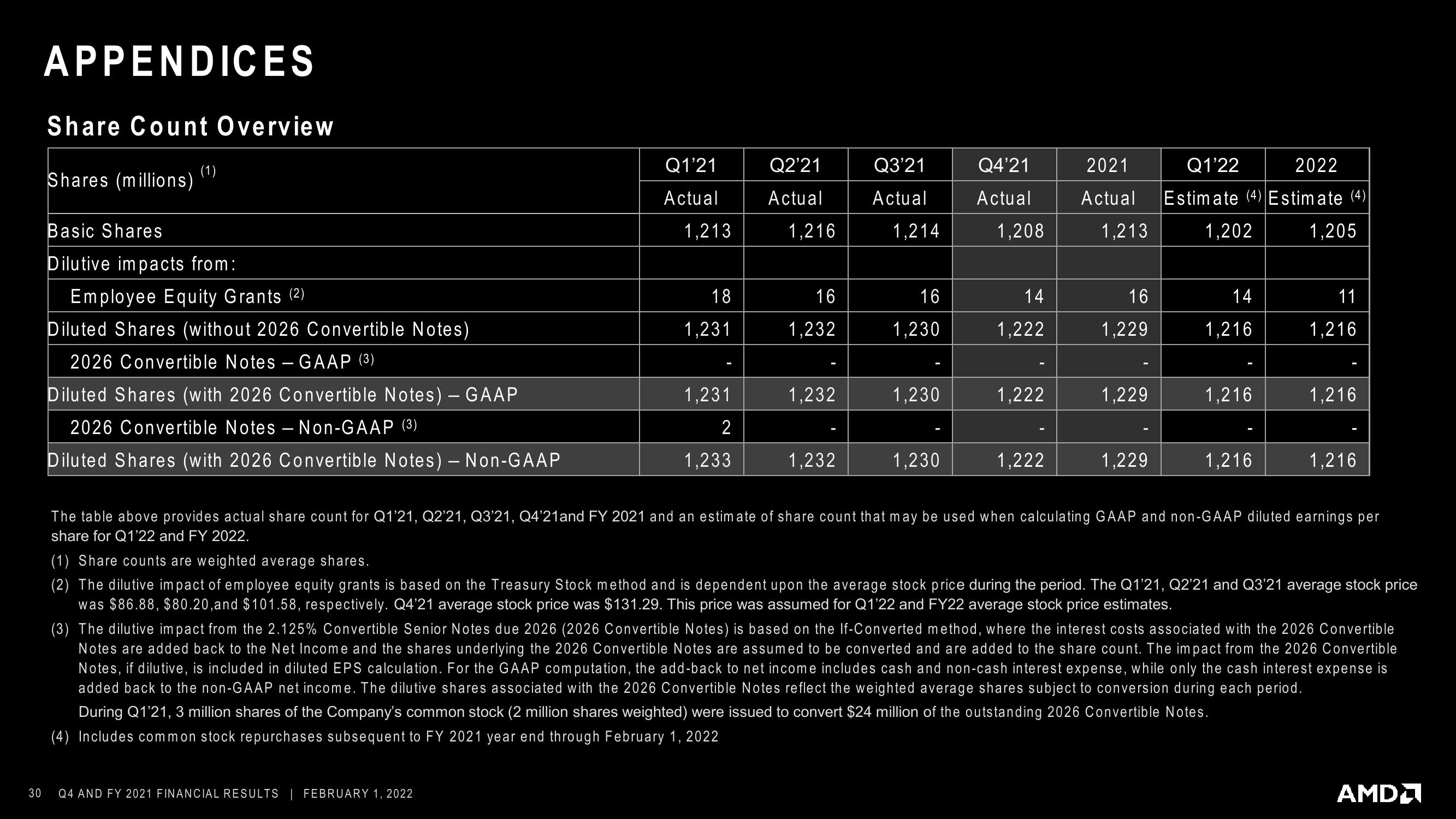

Share Count Overview

Shares (millions)

(1)

Basic Shares

Dilutive impacts from:

Employee Equity Grants (2)

Diluted Shares (without 2026 Convertible Notes)

2026 Convertible Notes - GAAP (3)

Diluted Shares (with 2026 Convertible Notes) - GAAP

2026 Convertible Notes - Non-GAAP (3)

Diluted Shares (with 2026 Convertible Notes) - Non-GAAP

Q1'21

Actual

1,213

18

1,231

Q4 AND FY 2021 FINANCIAL RESULTS | FEBRUARY 1, 2022

1,231

2

1,233

Q2'21

Actual

1,216

16

1,232

1,232

1,232

Q3'21

Actual

1,214

16

1,230

1,230

1,230

Q4'21

Actual

1,208

14

1,222

1,222

1,222

2021

Q1'22

2022

Actual Estimate (4) Estimate (4)

1,213

1,202

1,205

16

1,229

1,229

1,229

14

1,216

1,216

1,216

11

1,216

1,216

1,216

The table above provides actual share count for Q1'21, Q2'21, Q3'21, Q4'21and FY 2021 and an estimate of share count that may be used when calculating GAAP and non-GAAP diluted earnings per

share for Q1'22 and FY 2022.

(1) Share counts are weighted average shares.

(2) The dilutive impact of employee equity grants is based on the Treasury Stock method and is dependent upon the average stock price during the period. The Q1'21, Q2'21 and Q3'21 average stock price

was $86.88, $80.20, and $101.58, respectively. Q4'21 average stock price was $131.29. This price was assumed for Q1'22 and FY22 average stock price estimates.

(3) The dilutive impact from the 2.125% Convertible Senior Notes due 2026 (2026 Convertible Notes) is based on the If-Converted method, where the interest costs associated with the 2026 Convertible

Notes are added back to the Net Income and the shares underlying the 2026 Convertible Notes are assumed to be converted and are added to the share count. The impact from the 2026 Convertible

Notes, if dilutive, is included in diluted EPS calculation. For the GAAP computation, the add-back to net income includes cash and non-cash interest expense, while only the cash interest expense is

added back to the non-GAAP net income. The dilutive shares associated with the 2026 Convertible Notes reflect the weighted average shares subject to conversion during each period.

During Q1'21, 3 million shares of the Company's common stock (2 million shares weighted) were issued to convert $24 million of the outstanding 2026 Convertible Notes.

(4) Includes common stock repurchases subsequent to FY 2021 year end through February 1, 2022

AMDView entire presentation