Baird Investment Banking Pitch Book

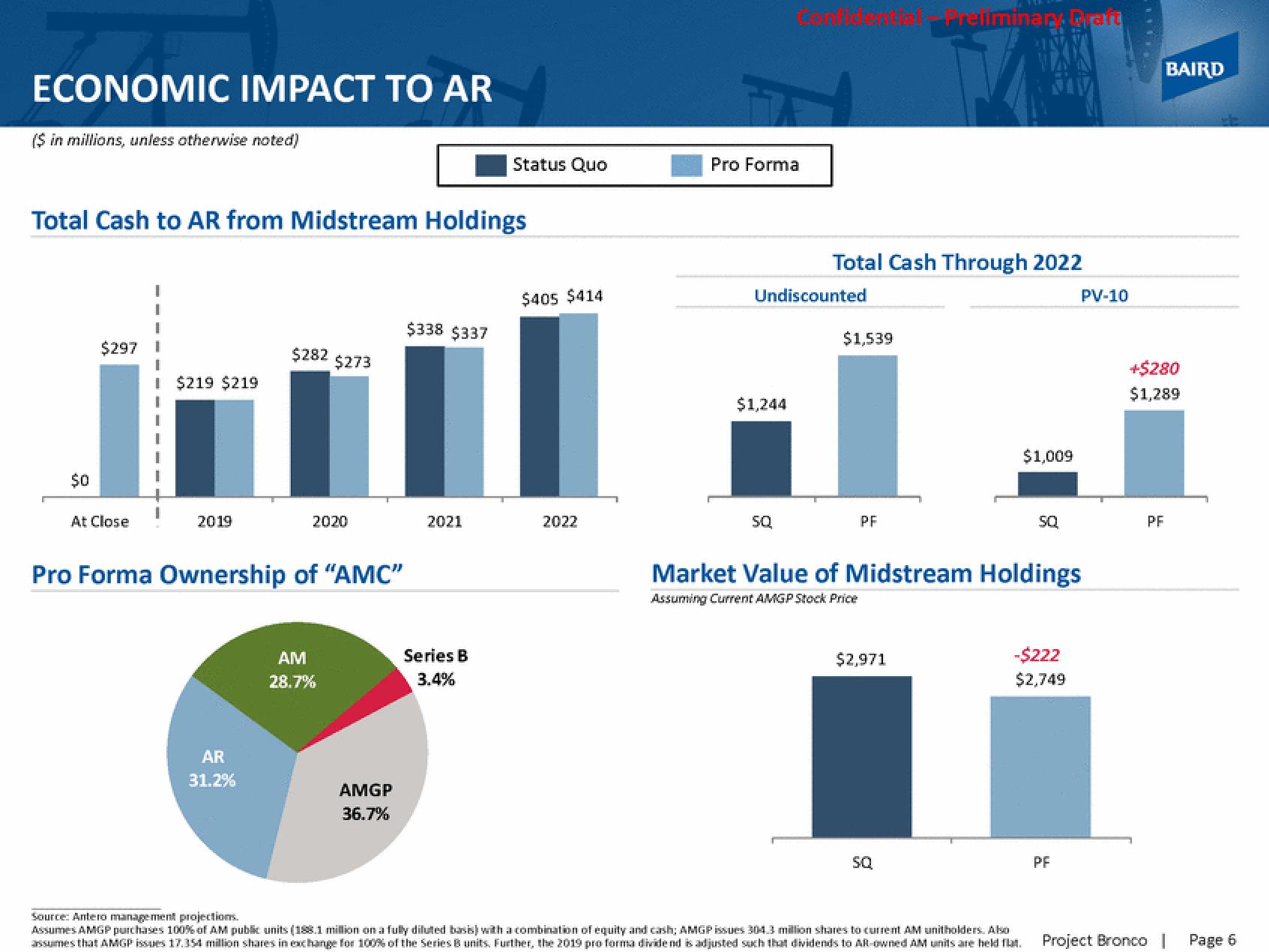

ECONOMIC IMPACT TO AR

($ in millions, unless otherwise noted)

Total Cash to AR from Midstream Holdings

$0

$297

At Close

I

$219 $219

2019

$282 $273

AR

31.2%

2020

Pro Forma Ownership of "AMC"

AM

28.7%

AMGP

36.7%

$338 $337

2021

Status Quo

ries

3.4%

$405 $414

2022

Pro Forma

Undiscounted

$1,244

SQ

Total Cash Through 2022

$1,539

PF

Preliminary Praft

$2,971

SQ

$1,009

Market Value of Midstream Holdings

Assuming Current AMGP Stock Price

SQ

-$222

$2,749

Source: Antero management projections.

Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with a combination of equity and cash; AMGP issues 304.3 million shares to current AM unitholders. Also

assumes that AMGP issues 17.354 million shares in exchange for 100% of the Series B units. Further, the 2019 pro forma dividend is adjusted such that dividends to AR-owned AM units are held flat.

PV-10

PF

+$280

$1,289

PF

BAIRD

Project Bronco

Page 6View entire presentation