Zegna Results Presentation Deck

●

●

FY 2022 GUIDANCE

SUCCESSFULLY

Monitoring and adapting to complex environment

●

Frmonos

Ermenegildo Zegna Group

egna Group

MOVING FORWARD MORE QUICKLY THAN ANTICIPATED

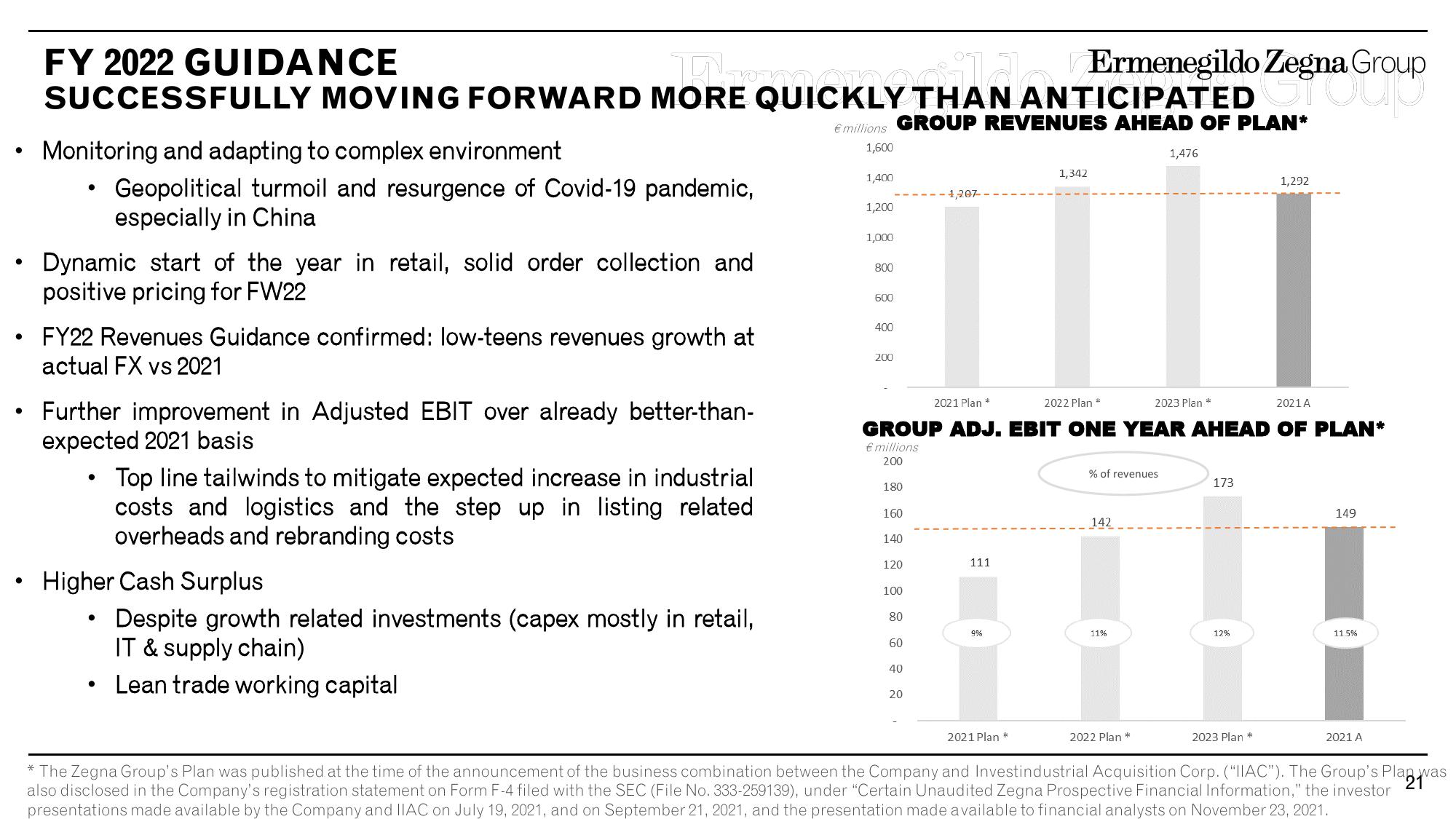

€ millions GROUP REVENUES AHEAD OF PLAN*

1,600

Dynamic start of the year in retail, solid order collection and

positive pricing for FW22

22 Revenues Guidance confirmed: low-teens revenues growth at

actual FX vs 2021

●

Geopolitical turmoil and resurgence of Covid-19 pandemic,

especially in China

Further improvement in Adjusted EBIT over already better-than-

expected 2021 basis

●

Higher Cash Surplus

●

Top line tailwinds to mitigate expected increase in industrial

costs and logistics and the step up in listing related

overheads and rebranding costs

Despite growth related investments (capex mostly in retail,

IT & supply chain)

Lean trade working capital

1,400

1,200

1,000

800

600

400

200

180

160

140

120

100

2021 Plan *

2022 Plan *

2023 Plan *

2021 A

GROUP ADJ. EBIT ONE YEAR AHEAD OF PLAN*

€ millions

200

80

60

40

-4,207 --

20

111

9%

1,342

2021 Plan *

% of revenues

142

11%

1,476

2022 Plan *

173

12%

1,292

2023 Plan *

149

11.5%

2021 A

* The Zegna Group's Plan was published at the time of the announcement of the business combination between the Company and Investindustrial Acquisition Corp. ("IIAC"). The Group's Plan was

21

also disclosed in the Company's registration statement on Form F-4 filed with the SEC (File No. 333-259139), under "Certain Unaudited Zegna Prospective Financial Information," the investor

presentations made available by the Company and IIAC on July 19, 2021, and on September 21, 2021, and the presentation made available to financial analysts on November 23, 2021.View entire presentation