Hyperfine SPAC Presentation Deck

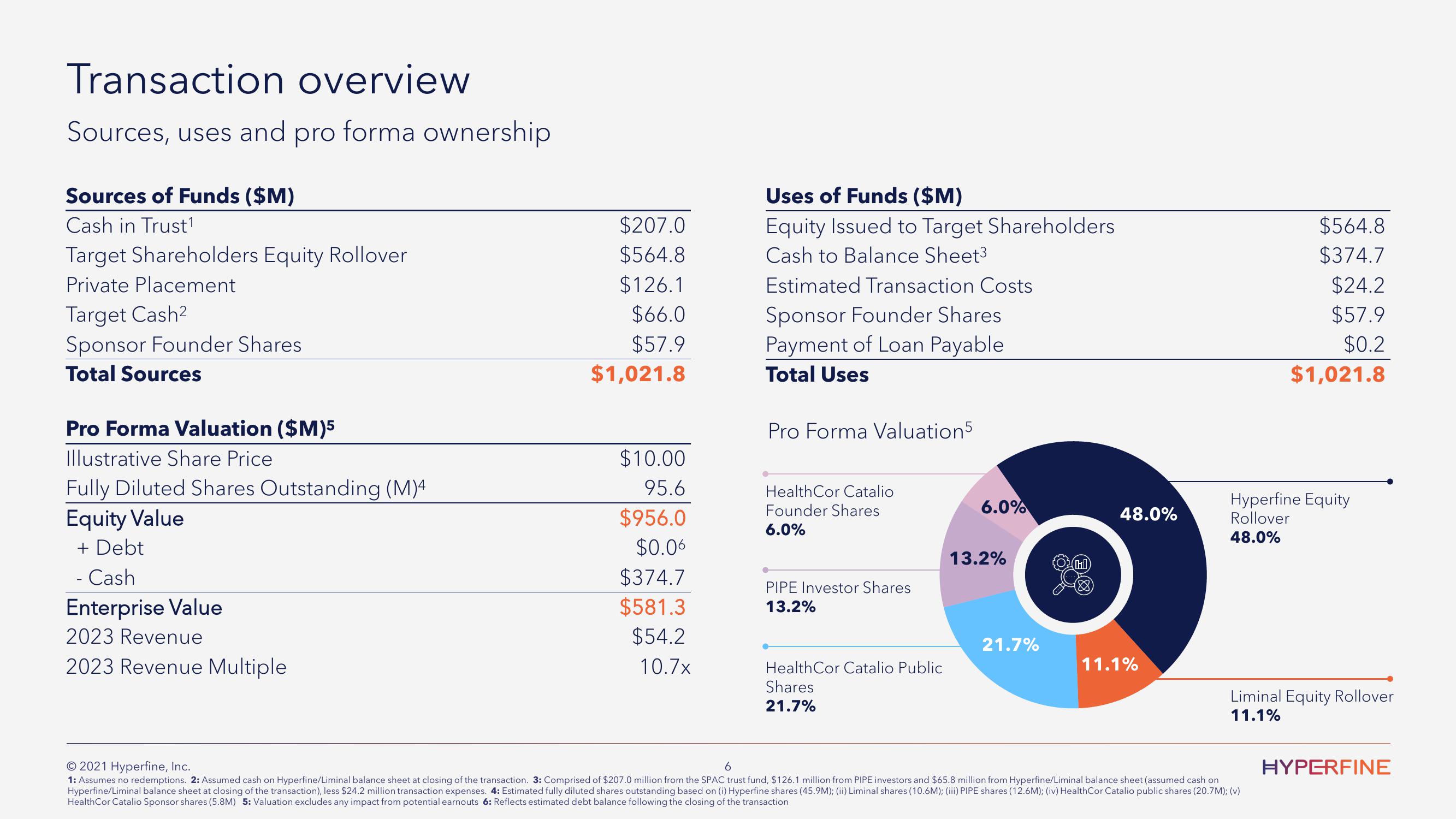

Transaction overview

Sources, uses and pro forma ownership

Sources of Funds ($M)

Cash in Trust¹

Target Shareholders Equity Rollover

Private Placement

Target Cash²

Sponsor Founder Shares

Total Sources

Pro Forma Valuation ($M)5

Illustrative Share Price

Fully Diluted Shares Outstanding (M)4

Equity Value

+ Debt

- Cash

Enterprise Value

2023 Revenue

2023 Revenue Multiple

$207.0

$564.8

$126.1

$66.0

$57.9

$1,021.8

$10.00

95.6

$956.0

$0.06

$374.7

$581.3

$54.2

10.7x

Uses of Funds ($M)

Equity Issued to Target Shareholders

Cash to Balance Sheet³

Estimated Transaction Costs

Sponsor Founder Shares

Payment of Loan Payable

Total Uses

Pro Forma Valuation5

HealthCor Catalio

Founder Shares

6.0%

PIPE Investor Shares

13.2%

Health Cor Catalio Public

Shares

21.7%

6.0%

13.2%

21.7%

48.0%

11.1%

$564.8

$374.7

$24.2

$57.9

$0.2

$1,021.8

Hyperfine Equity

Rollover

48.0%

Liminal Equity Rollover

11.1%

6

© 2021 Hyperfine, Inc.

1: Assumes no redemptions. 2: Assumed cash on Hyperfine/Liminal balance sheet at closing of the transaction. 3: Comprised of $207.0 million from the SPAC trust fund, $126.1 million from PIPE investors and $65.8 million from Hyperfine/Liminal balance sheet (assumed cash on

Hyperfine/Liminal balance sheet at closing of the transaction), less $24.2 million transaction expenses. 4: Estimated fully diluted shares outstanding based on (i) Hyperfine shares (45.9M); (ii) Liminal shares (10.6M); (iii) PIPE shares (12.6M); (iv) Health Cor Catalio public shares (20.7M); (v)

Health Cor Catalio Sponsor shares (5.8M) 5: Valuation excludes any impact from potential earnouts 6: Reflects estimated debt balance following the closing of the transaction

HYPERFINEView entire presentation