Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

MAERSK GROUP

PERFORMANCE

For the first six months of 2015

Contents

Following a good start to 2015 in 01 the Maersk Group deliv-

ered a profit in Q2 of USD 1.1bn (USD 2.3bn) giving a profit for

the first six months of USD 2.7bn (USD 3.5bn). The profit last

year was positively impacted by a USD 2.8bn gain from the

sale of the majority share of Dansk Supermarked Group partly

offset by the impairment of USD 1.7bn on Brazilian oil assets.

The Group's ROIC was 12.0% (14.3%).The underlying profit was

USD 2.4bn (USD 2.3bn).

Revenue decreased to USD 21.1bn (USD 23.7bn), predominantly

due to lower oil price and lower average container freight rates.

The operating expenses decreased by USD 1.7bn mainly due to

lower bunker prices and the decrease in tax by USD 1.2bn was

primarily a result of the lower oil price.

Cash flow from continuing operating activities was USD 3.7bn

(USD 3.6bn) while cash flow used for capital expenditure was

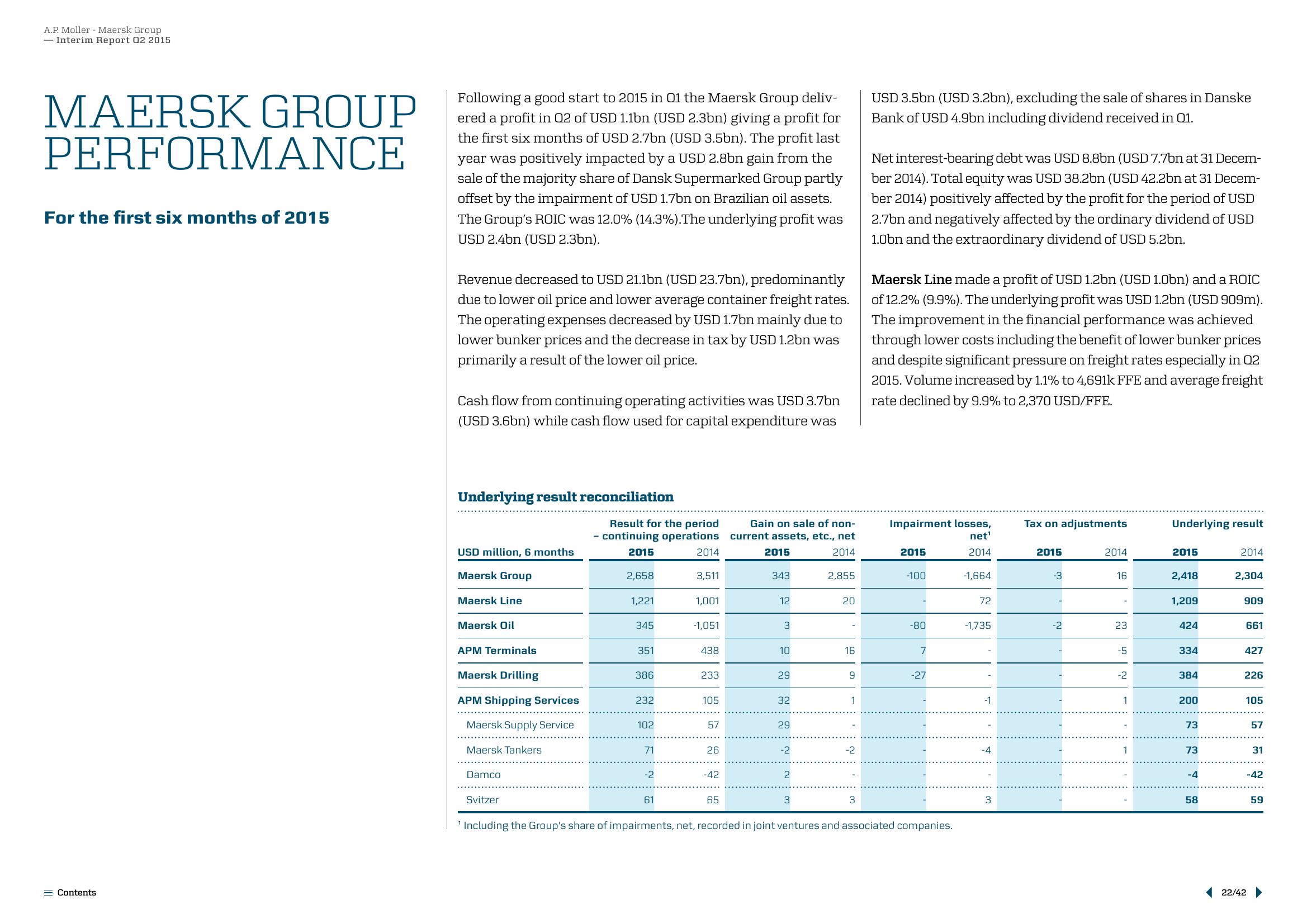

Underlying result reconciliation

USD million, 6 months

Maersk Group

Maersk Line

Maersk Oil

APM Terminals

Maersk Drilling

APM Shipping Services

Maersk Supply Service

Maersk Tankers

Damco

Svitzer

Result for the period

- continuing operations

2015

2,658

1,221

345

351

386

232

102

71

-2

61

2014

3,511

1,001

-1,051

438

233

105

57

26

-42

65

Gain on sale of non-

current assets, etc., net

2015

2014

343

12

3

10

29

32

29

-2

2

3

2,855

20

16

1

-2

3

USD 3.5bn (USD 3.2bn), excluding the sale of shares in Danske

Bank of USD 4.9bn including dividend received in 01.

Net interest-bearing debt was USD 8.8bn (USD 7.7bn at 31 Decem-

ber 2014). Total equity was USD 38.2bn (USD 42.2bn at 31 Decem-

ber 2014) positively affected by the profit for the period of USD

2.7bn and negatively affected by the ordinary dividend of USD

1.0bn and the extraordinary dividend of USD 5.2bn.

Maersk Line made a profit of USD 1.2bn (USD 1.0bn) and a ROIC

of 12.2% (9.9%). The underlying profit was USD 1.2bn (USD 909m).

The improvement in the financial performance was achieved

through lower costs including the benefit of lower bunker prices

and despite significant pressure on freight rates especially in 02

2015. Volume increased by 1.1% to 4,691k FFE and average freight

rate declined by 9.9% to 2,370 USD/FFE.

Impairment losses,

net¹

2014

2015

-100

-80

7

-27

'Including the Group's share of impairments, net, recorded in joint ventures and associated companies.

-1,664

72

-1,735

-1

-4

3

Tax on adjustments

2015

-3

-2

2014

16

23

-5

-2

1

1

Underlying result

2015

2,418

1,209

424

334

384

200

73

73

-4

58

2014

2,304

909

661

427

226

105

57

22/42

31

-42

59View entire presentation