Trian Partners Activist Presentation Deck

Why Adding a Shareholder Voice to the Boardroom is Critical

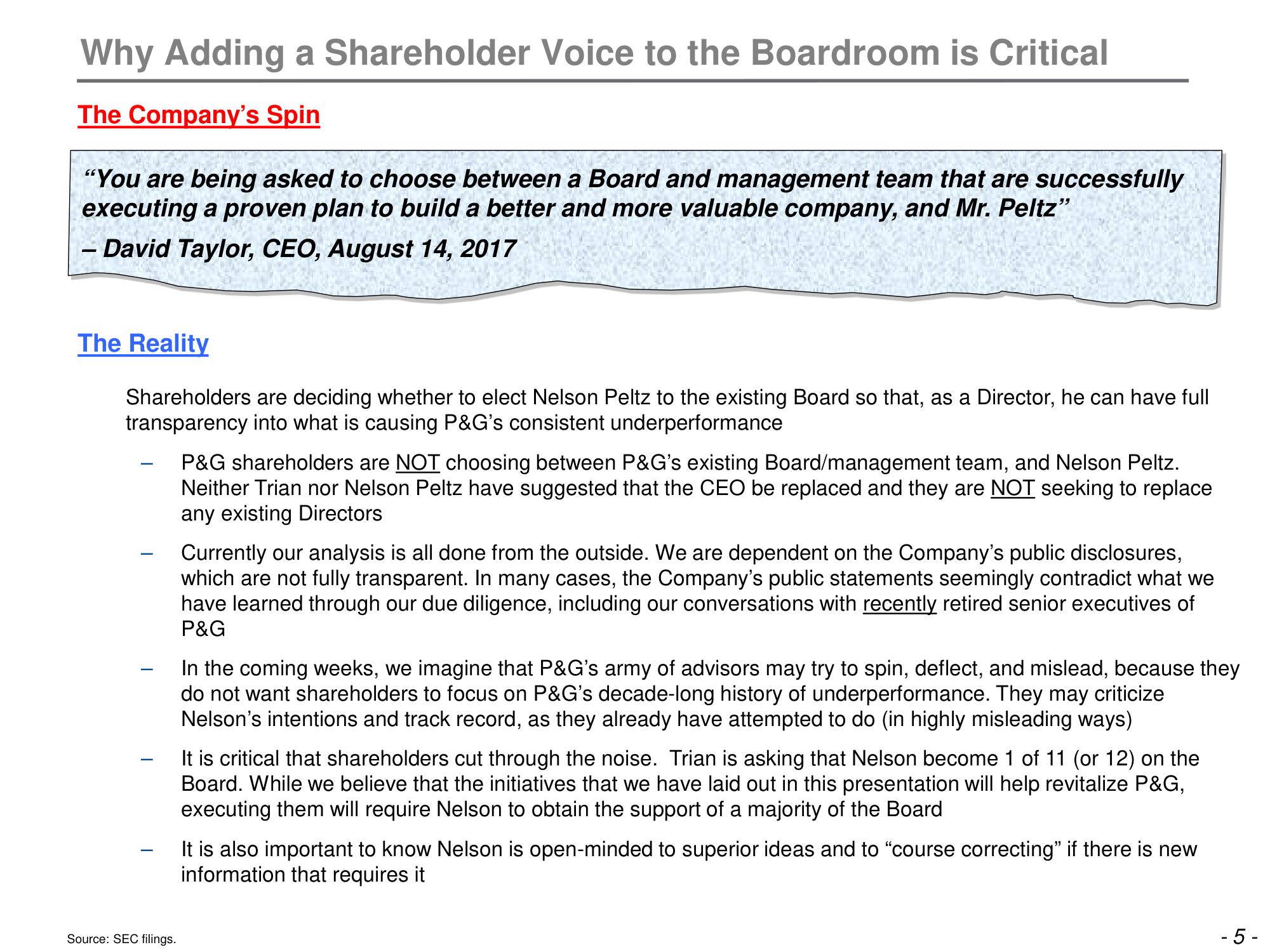

The Company's Spin

"You are being asked to choose between a Board and management team that are successfully

executing a proven plan to build a better and more valuable company, and Mr. Peltz"

- David Taylor, CEO, August 14, 2017

The Reality

Shareholders are deciding whether to elect Nelson Peltz to the existing Board so that, as a Director, he can have full

transparency into what is causing P&G's consistent underperformance

-

Source: SEC filings.

P&G shareholders are NOT choosing between P&G's existing Board/management team, and Nelson Peltz.

Neither Trian nor Nelson Peltz have suggested that the CEO be replaced and they are NOT seeking to replace

any existing Directors

Currently our analysis is all done from the outside. We are dependent on the Company's public disclosures,

which are not fully transparent. In many cases, the Company's public statements seemingly contradict what we

have learned through our due diligence, including our conversations with recently retired senior executives of

P&G

In the coming weeks, we imagine that P&G's army of advisors may try to spin, deflect, and mislead, because they

do not want shareholders to focus on P&G's decade-long history of underperformance. They may criticize

Nelson's intentions and track record, as they already have attempted to do (in highly misleading ways)

It is critical that shareholders cut through the noise. Trian is asking that Nelson become 1 of 11 (or 12) on the

Board. While we believe that the initiatives that we have laid out in this presentation will help revitalize P&G,

executing them will require Nelson to obtain the support of a majority of the Board

It is also important to know Nelson is open-minded to superior ideas and to "course correcting" if there is new

information that requires it

-5-View entire presentation