Blackwells Capital Activist Presentation Deck

CASE STUDY- SUPERVALU

●

●

Overview

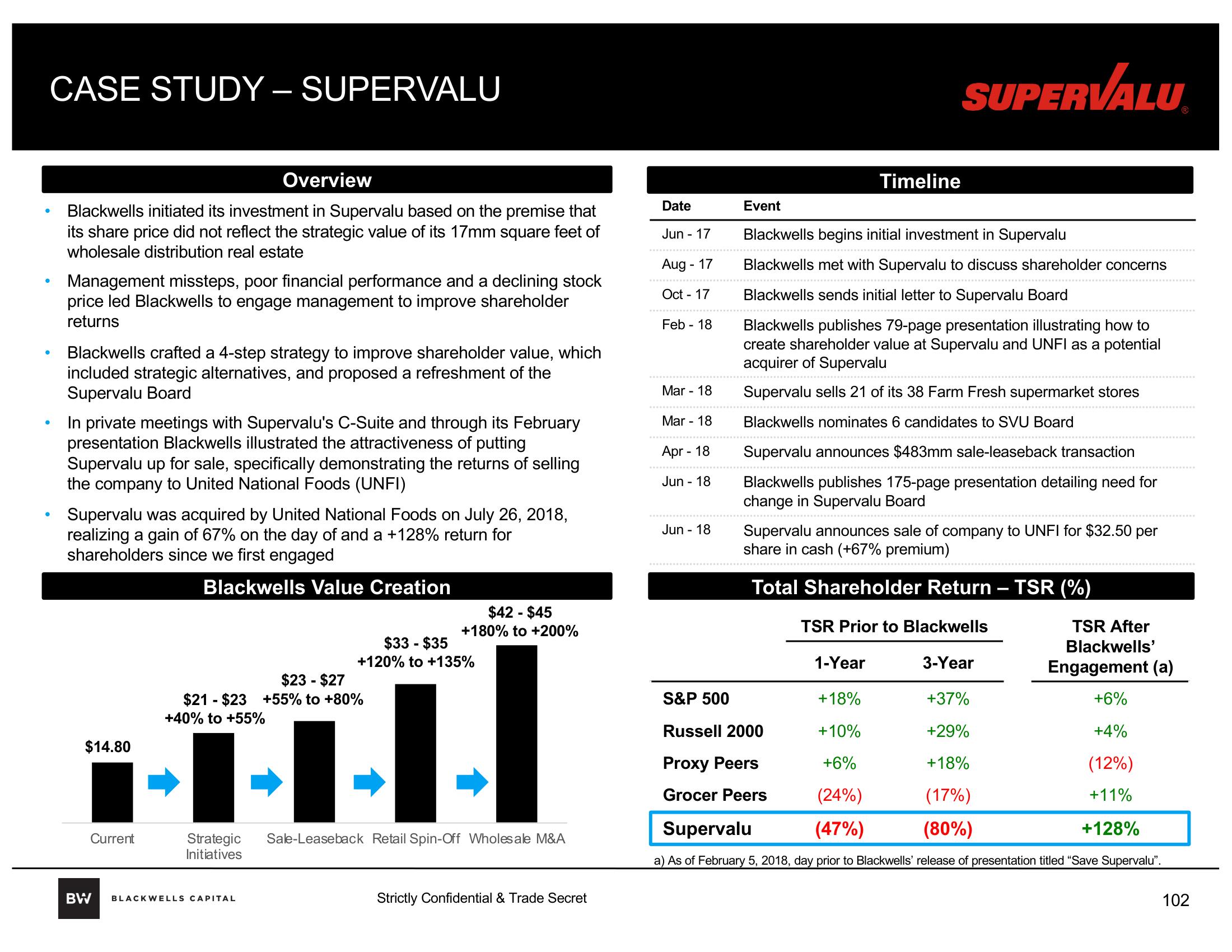

Blackwells initiated its investment in Supervalu based on the premise that

its share price did not reflect the strategic value of its 17mm square feet of

wholesale distribution real estate

Management missteps, poor financial performance and a declining stock

price led Blackwells to engage management to improve shareholder

returns

Blackwells crafted a 4-step strategy to improve shareholder value, which

included strategic alternatives, and proposed a refreshment of the

Supervalu Board

In private meetings with Supervalu's C-Suite and through its February

presentation Blackwells illustrated the attractiveness of putting

Supervalu up for sale, specifically demonstrating the returns of selling

the company to United National Foods (UNFI)

Supervalu was acquired by United National Foods on July 26, 2018,

realizing a gain of 67% on the day of and a +128% return for

shareholders since we first engaged

Blackwells Value Creation

$14.80

Current

BW

$23 - $27

$21 $23 +55% to +80%

+40% to +55%

$42 - $45

+180% to +200%

$33- $35

+120% to +135%

BLACKWELLS CAPITAL

1

Strategic Sale-Leaseback Retail Spin-Off Wholesale M&A

Initiatives

Strictly Confidential & Trade Secret

Date

Jun - 17

Aug - 17

Oct - 17

Feb 18

Mar - 18

Mar - 18

Apr - 18

Jun - 18

Event

Jun - 18

SUPERVALU

Timeline

Blackwells begins initial investment in Supervalu

Blackwells met with Supervalu to discuss shareholder concerns

Blackwells sends initial letter to Supervalu Board

Blackwells publishes 79-page presentation illustrating how to

create shareholder value at Supervalu and UNFI as a potential

acquirer of Supervalu

Supervalu sells 21 of its 38 Farm Fresh supermarket stores

Blackwells nominates 6 candidates to SVU Board

Supervalu announces $483mm sale-leaseback transaction

Blackwells publishes 175-page presentation detailing need for

change in Supervalu Board

Supervalu announces sale of company to UNFI for $32.50 per

share in cash (+67% premium)

Total Shareholder Return - TSR (%)

TSR Prior to Blackwells

1-Year

3-Year

+18%

+37%

+10%

+29%

+6%

+18%

(24%)

(17%)

Supervalu

(47%)

(80%)

a) As of February 5, 2018, day prior to Blackwells' release of presentation titled "Save Supervalu".

S&P 500

Russell 2000

Proxy Peers

Grocer Peers

TSR After

Blackwells'

Engagement (a)

+6%

+4%

(12%)

+11%

+128%

102View entire presentation