Q4 2020 Investor Presentation

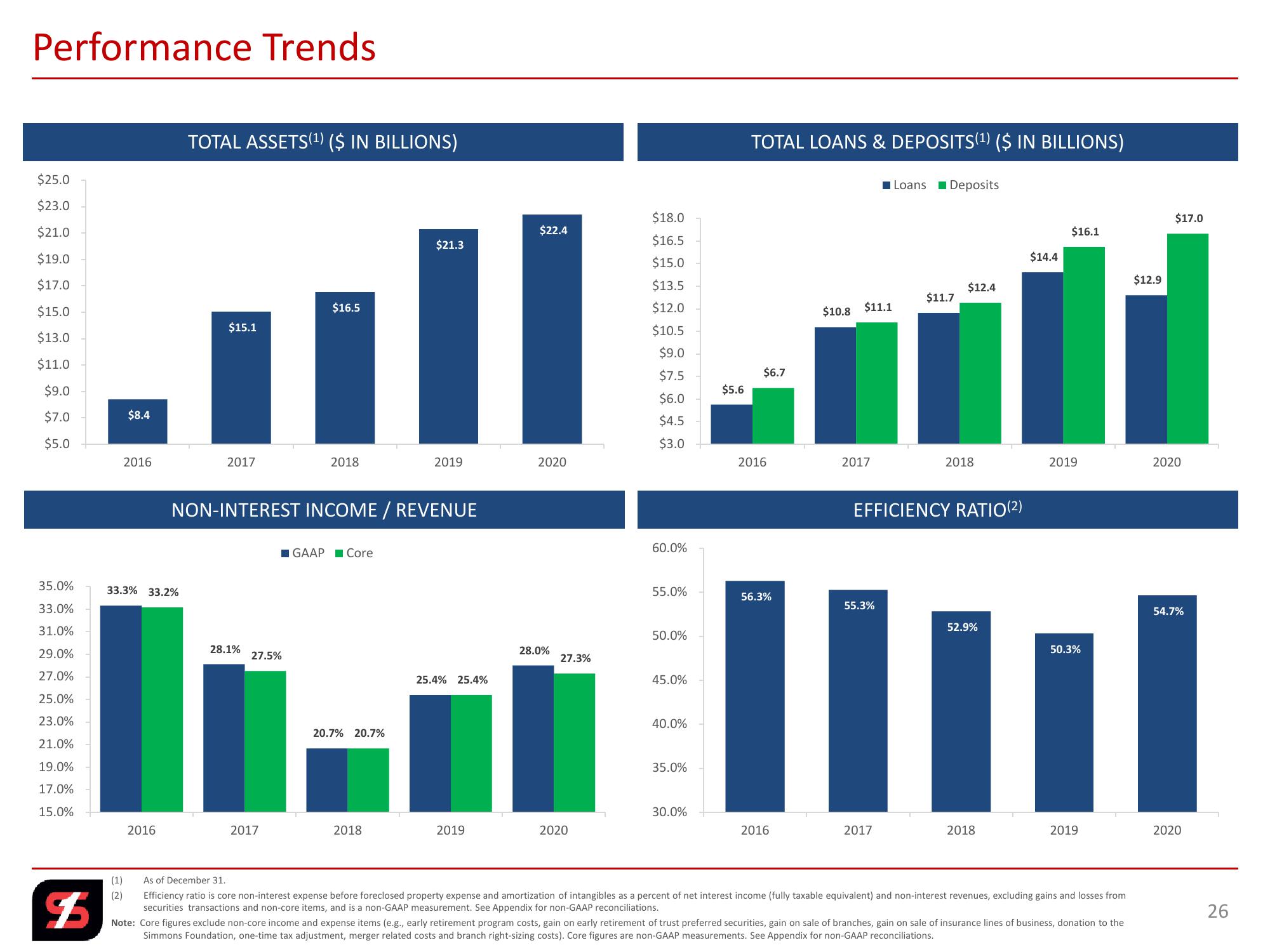

Performance Trends

TOTAL ASSETS (1) ($ IN BILLIONS)

$25.0

$23.0

$21.0

$19.0

$17.0

$15.0

$16.5

$15.1

$13.0

$11.0

$9.0

$7.0

$8.4

$5.0

2016

2017

2018

TOTAL LOANS & DEPOSITS(1) ($ IN BILLIONS)

Loans Deposits

$17.0

$16.1

$14.4

$12.9

$12.4

$11.7

$10.8

$11.1

$18.0

$22.4

$21.3

$16.5

$15.0

$13.5

$12.0

$10.5

$9.0

$7.5

$6.7

$5.6

$6.0

$4.5

$3.0

2019

2020

2016

2017

NON-INTEREST INCOME / REVENUE

35.0%

33.3% 33.2%

33.0%

31.0%

29.0%

27.0%

25.0%

23.0%

21.0%

19.0%

17.0%

15.0%

2016

28.1%

27.5%

GAAP Core

20.7% 20.7%

60.0%

2018

EFFICIENCY RATIO(2)

2019

2020

55.0%

56.3%

55.3%

52.9%

50.3%

50.0%

28.0%

27.3%

25.4% 25.4%

45.0%

40.0%

35.0%

54.7%

30.0%

2017

2018

2019

2020

2016

2017

2018

2019

2020

Efficiency ratio is core non-interest expense before foreclosed property expense and amortization of intangibles as a percent of net interest income (fully taxable equivalent) and non-interest revenues, excluding gains and losses from

securities transactions and non-core items, and is a non-GAAP measurement. See Appendix for non-GAAP reconciliations.

(1)

As of December 31.

F

(2)

Note: Core figures exclude non-core income and expense items (e.g., early retirement program costs, gain on early retirement of trust preferred securities, gain on sale of branches, gain on sale of insurance lines of business, donation to the

Simmons Foundation, one-time tax adjustment, merger related costs and branch right-sizing costs). Core figures are non-GAAP measurements. See Appendix for non-GAAP reconciliations.

26View entire presentation