Carlyle Investor Conference Presentation Deck

Focus on Fee Related Earnings Growth Building Upon Recent Momentum

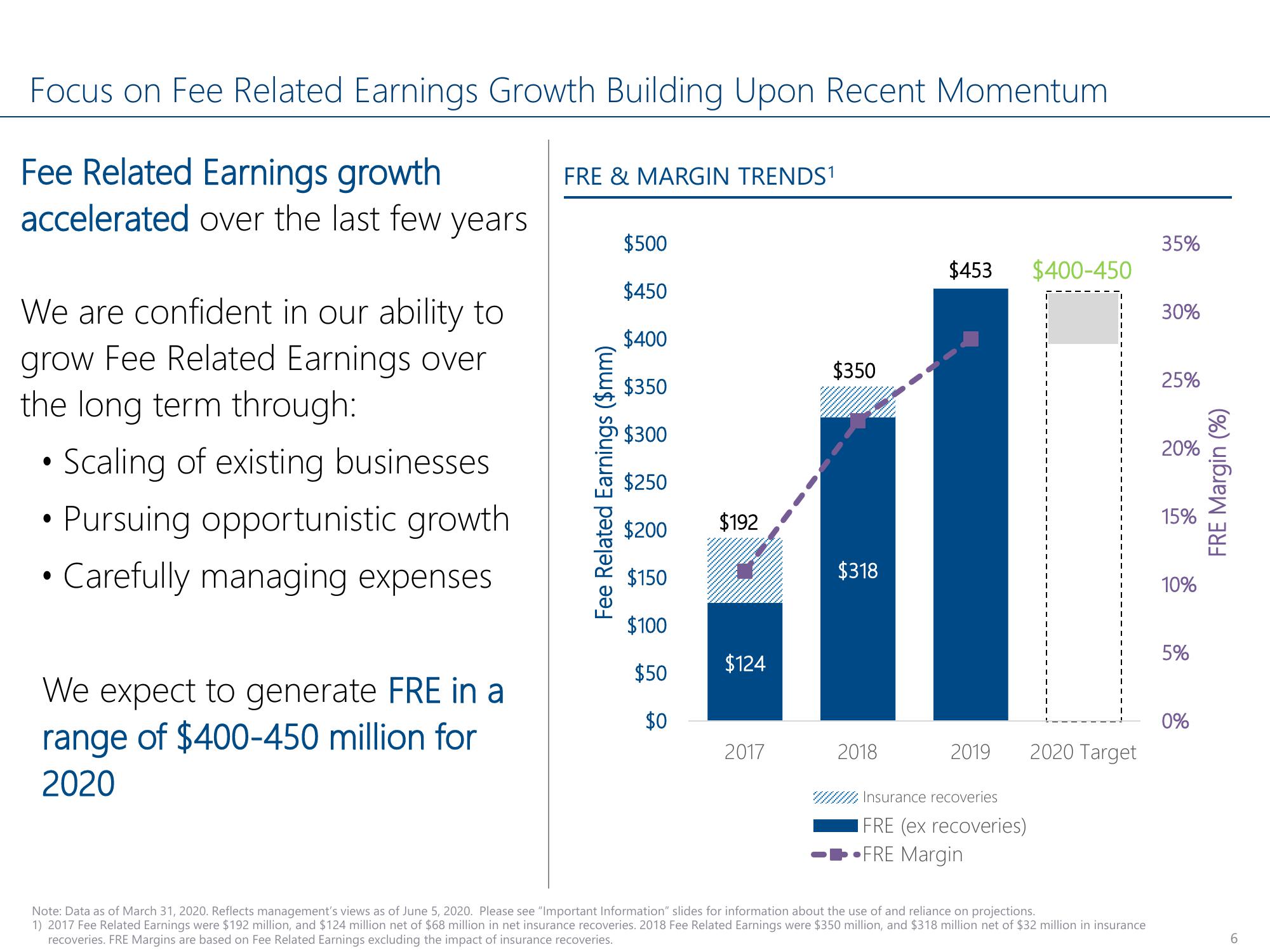

Fee Related Earnings growth

accelerated over the last few years

We are confident in our ability to

grow Fee Related Earnings over

the long term through:

• Scaling of existing businesses

●

• Pursuing opportunistic growth

Carefully managing expenses

●

We expect to generate FRE in a

range of $400-450 million for

2020

FRE & MARGIN TRENDS¹1

Fee Related Earnings ($mm)

$500

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

$192

$124

2017

$350

$318

2018

$453

2019

Insurance recoveries

IFRE (ex recoveries)

•FRE Margin

$400-450

2020 Target

Note: Data as of March 31, 2020. Reflects management's views as of June 5, 2020. Please see "Important Information" slides for information about the use of and reliance on projections.

1) 2017 Fee Related Earnings were $192 million, and $124 million net of $68 million in net insurance recoveries. 2018 Fee Related Earnings were $350 million, and $318 million net of $32 million in insurance

recoveries. FRE Margins are based on Fee Related Earnings excluding the impact of insurance recoveries.

35%

30%

25%

20%

15%

10%

5%

0%

FRE Margin (%)

6View entire presentation