Telia Company Results Presentation Deck

FINLAND

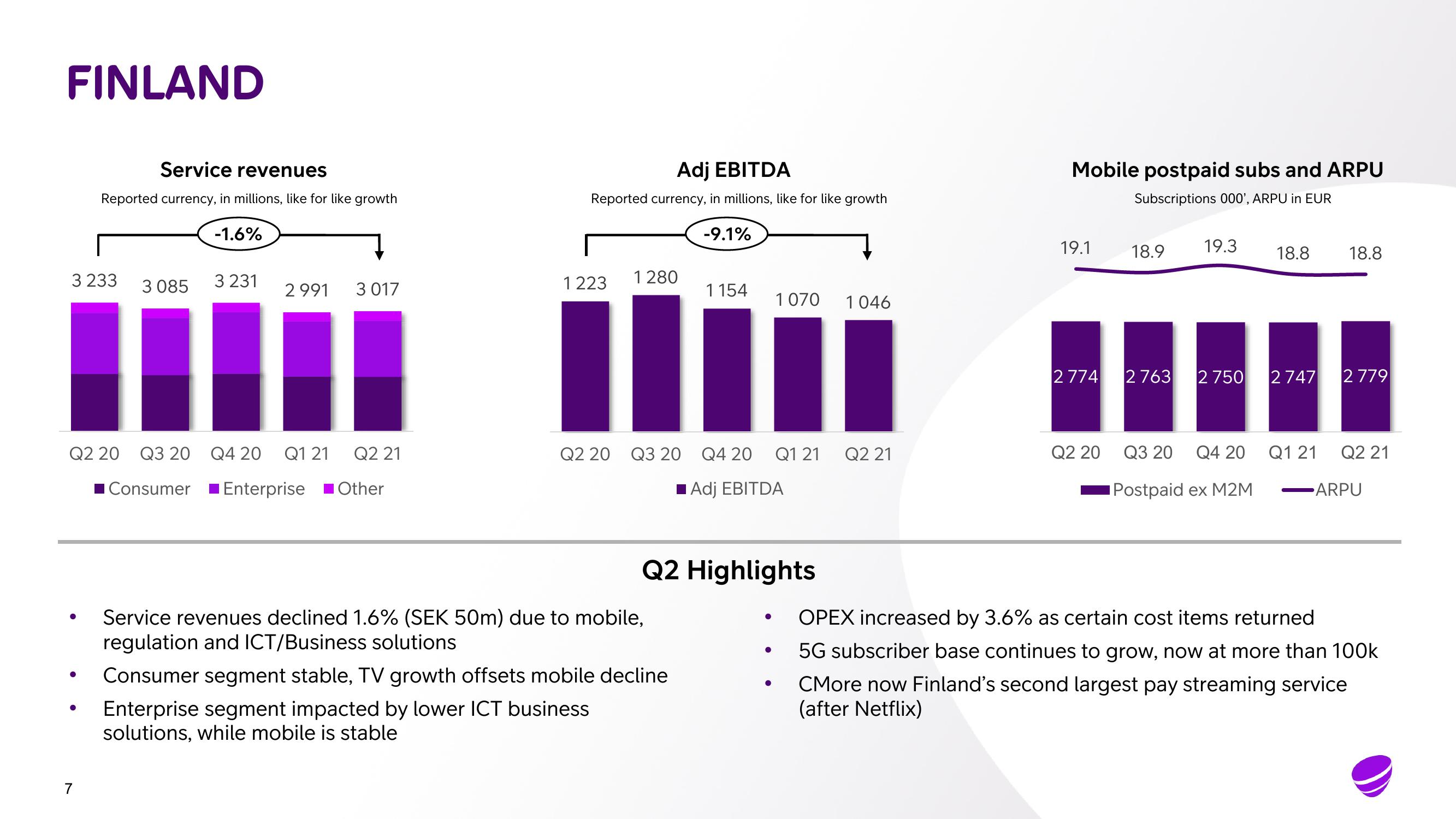

3 233

●

Service revenues

Reported currency, in millions, like for like growth

-1.6%

Q2 20 Q3 20

■ Consumer

●

N

3 085

3 231

2 991 3 017

Q4 20 Q1 21

Enterprise

Q2 21

Other

Adj EBITDA

Reported currency, in millions, like for like growth

-9.1%

1 280

1 223

1

1154

Q2 20 Q3 20 Q4 20

Service revenues declined 1.6% (SEK 50m) due to mobile,

regulation and ICT/Business solutions

Consumer segment stable, TV growth offsets mobile decline

Enterprise segment impacted by lower ICT business

solutions, while mobile is stable

Adj EBITDA

Q2 Highlights

●

1 070

●

Q1 21

●

1 046

Q2 21

Mobile postpaid subs and ARPU

Subscriptions 000', ARPU in EUR

19.1

18.9

2774 2763

Q2 20

Q3 20

19.3 18.8 18.8

2 750 2 747 2779

Q4 20

Postpaid ex M2M

Q1 21

Q2 21

ARPU

OPEX increased by 3.6% as certain cost items returned

5G subscriber base continues to grow, now at more than 100k

CMore now Finland's second largest pay streaming service

(after Netflix)View entire presentation