Grab Results Presentation Deck

Business Update

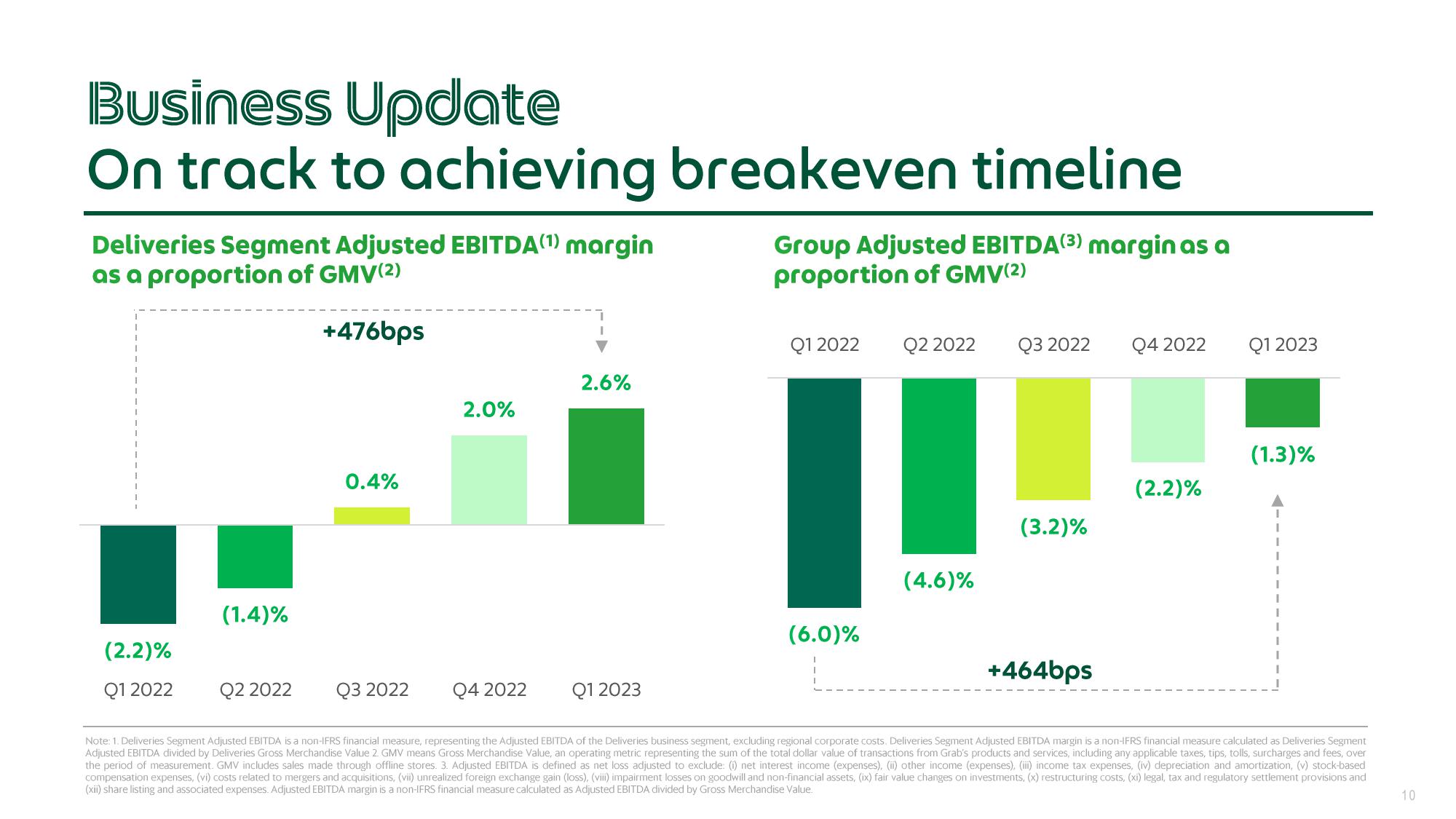

On track to achieving breakeven timeline

Deliveries Segment Adjusted EBITDA(¹) margin

as a proportion of GMV(2)

+476bps

(2.2)%

Q1 2022

(1.4)%

Q2 2022

0.4%

Q3 2022

2.0%

Q4 2022

I

2.6%

Q1 2023

Group Adjusted EBITDA (3) margin as a

proportion of GMV(2)

Q1 2022

(6.0)%

Q2 2022 Q3 2022 Q4 2022

(4.6)%

(3.2)%

+464bps

(2.2)%

Q1 2023

(1.3)%

Note: 1. Deliveries Segment Adjusted EBITDA is a non-IFRS financial measure, representing the Adjusted EBITDA of the Deliveries business segment, excluding regional corporate costs. Deliveries Segment Adjusted EBITDA margin is a non-IFRS financial measure calculated as Deliveries Segment

Adjusted EBITDA divided by Deliveries Gross Merchandise Value 2. GMV means Gross Merchandise Value, an operating metric representing the sum of the total dollar value of transactions from Grab's products and services, including any applicable taxes, tips, tolls, surcharges and fees, over

the period of measurement. GMV includes sales made through offline stores. 3. Adjusted EBITDA is defined as net loss adjusted to exclude: (i) net interest income (expenses), (ii) other income (expenses), (iii) income tax expenses, (iv) depreciation and amortization, (v) stock-based

compensation expenses, (vi) costs related to mergers and acquisitions, (vii) unrealized foreign exchange gain (loss), (viii) impairment losses on goodwill and non-financial assets, (ix) fair value changes on investments, (x) restructuring costs, (xi) legal, tax and regulatory settlement provisions and

(xii) share listing and associated expenses. Adjusted EBITDA margin is a non-IFRS financial measure calculated as Adjusted EBITDA divided by Gross Merchandise Value.

10View entire presentation