Azerion SPAC Presentation Deck

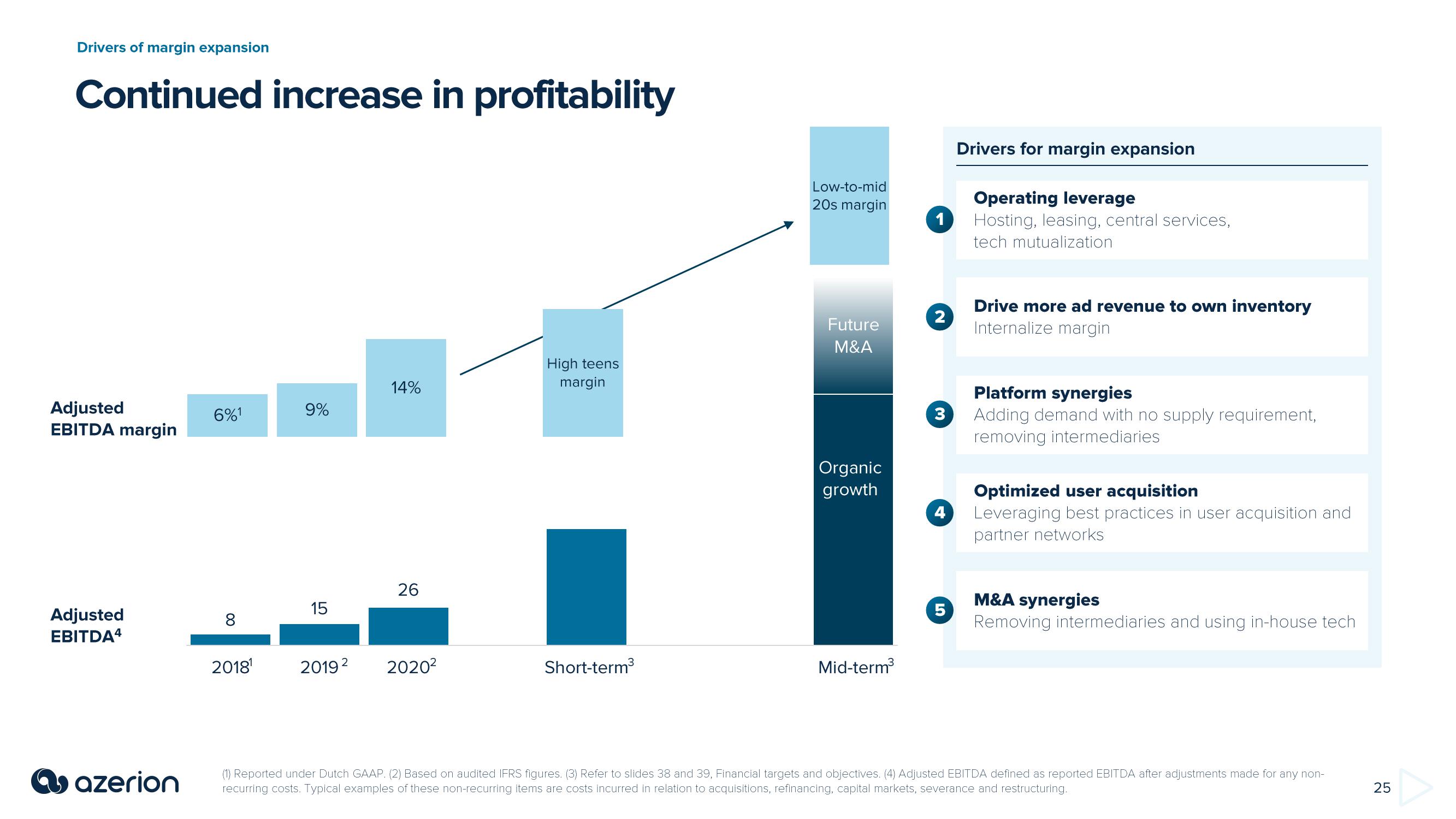

Drivers of margin expansion

Continued increase in profitability

Adjusted

EBITDA margin

Adjusted

EBITDA4

azerion

6%1

8

2018¹

9%

15

14%

26

2019² 2020²

High teens

margin

Short-term³

Low-to-mid

20s margin

Future

M&A

Organic

growth

Mid-term³

1

2

3

4

5

Drivers for margin expansion

Operating leverage

Hosting, leasing, central services,

tech mutualization

Drive more ad revenue to own inventory

Internalize margin

Platform synergies

Adding demand with no supply requirement,

removing intermediaries

Optimized user acquisition

Leveraging best practices in user acquisition and

partner networks

M&A synergies

Removing intermediaries and using in-house tech

(1) Reported under Dutch GAAP. (2) Based on audited IFRS figures. (3) Refer to slides 38 and 39, Financial targets and objectives. (4) Adjusted EBITDA defined as reported EBITDA after adjustments made for any non-

recurring costs. Typical examples of these non-recurring items are costs incurred in relation to acquisitions, refinancing, capital markets, severance and restructuring.

25View entire presentation