AgroFresh SPAC Presentation Deck

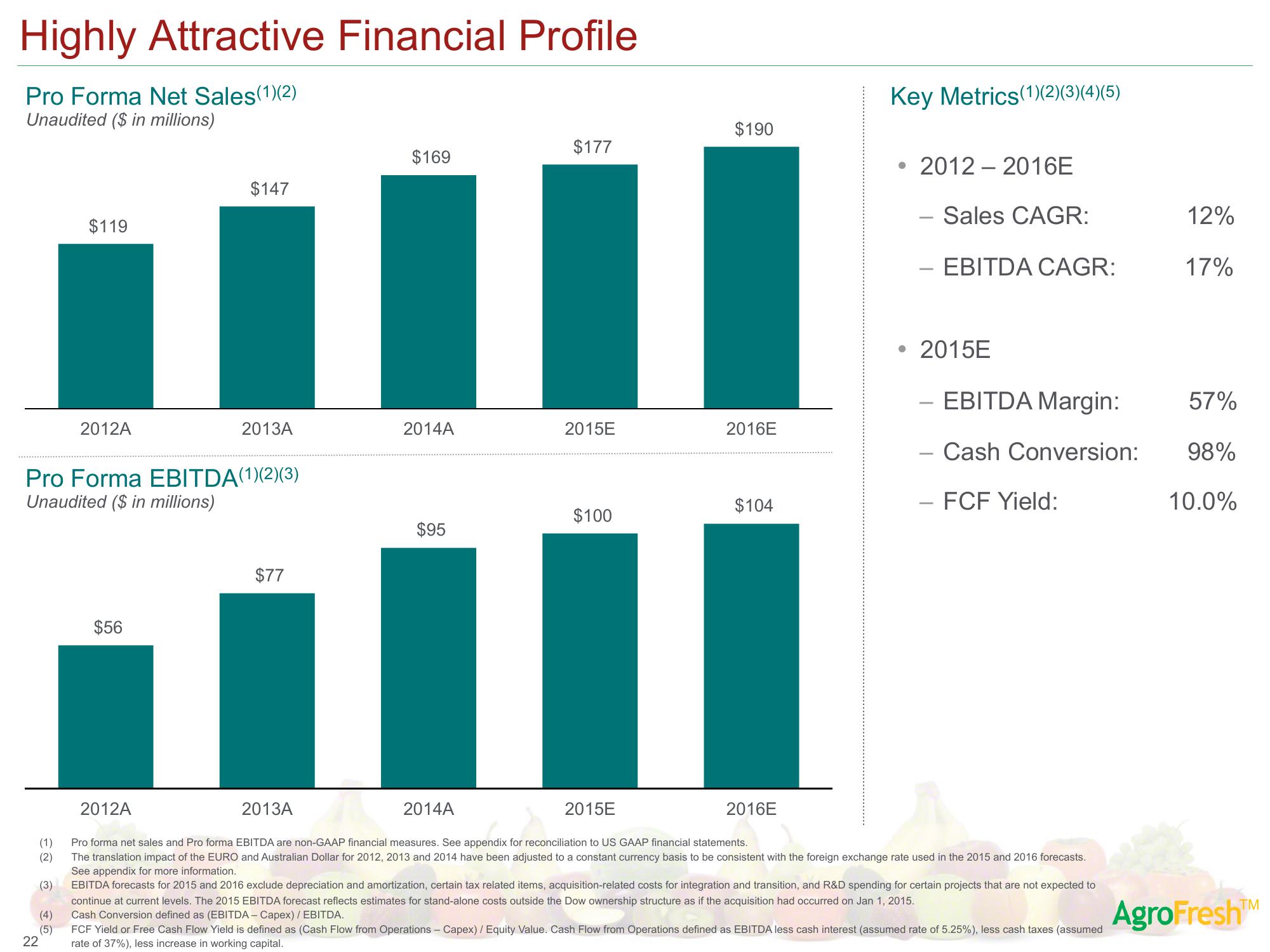

Highly Attractive Financial Profile

Pro Forma Net Sales(1)(2)

Unaudited ($ in millions)

22

(1)

(2)

(3)

$119

(4)

(5)

2012A

Pro Forma EBITDA(1)(2)(3)

Unaudited ($ in millions)

$56

$147

2012A

2013A

$77

2013A

$169

2014A

$95

2014A

$177

2015E

$100

2015E

$190

2016E

$104

2016E

Key Metrics (1)(2)(3)(4)(5)

2012-2016E

Sales CAGR:

EBITDA CAGR:

• 2015E

- EBITDA Margin:

Cash Conversion:

FCF Yield:

Pro forma net sales and Pro forma EBITDA are non-GAAP financial measures. See appendix for reconciliation to US GAAP financial statements.

The translation impact of the EURO and Australian Dollar for 2012, 2013 and 2014 have been adjusted to a constant currency basis to be consistent with the foreign exchange rate used in the 2015 and 2016 forecasts.

See appendix for more information.

EBITDA forecasts for 2015 and 2016 exclude depreciation and amortization, certain tax related items, acquisition-related costs for integration and transition, and R&D spending for certain projects that are not expected to

continue at current levels. The 2015 EBITDA forecast reflects estimates for stand-alone costs outside the Dow ownership structure as if the acquisition had occurred on Jan 1, 2015.

Cash Conversion defined as (EBITDA - Capex) / EBITDA.

FCF Yield or Free Cash Flow Yield is defined as (Cash Flow from Operations - Capex) / Equity Value. Cash Flow from Operations defined as EBITDA less cash interest (assumed rate of 5.25%), less cash taxes (assumed

rate of 37%), less increase in working capital.

12%

17%

57%

98%

10.0%

AgroFresh™View entire presentation