Bank of America Investment Banking Pitch Book

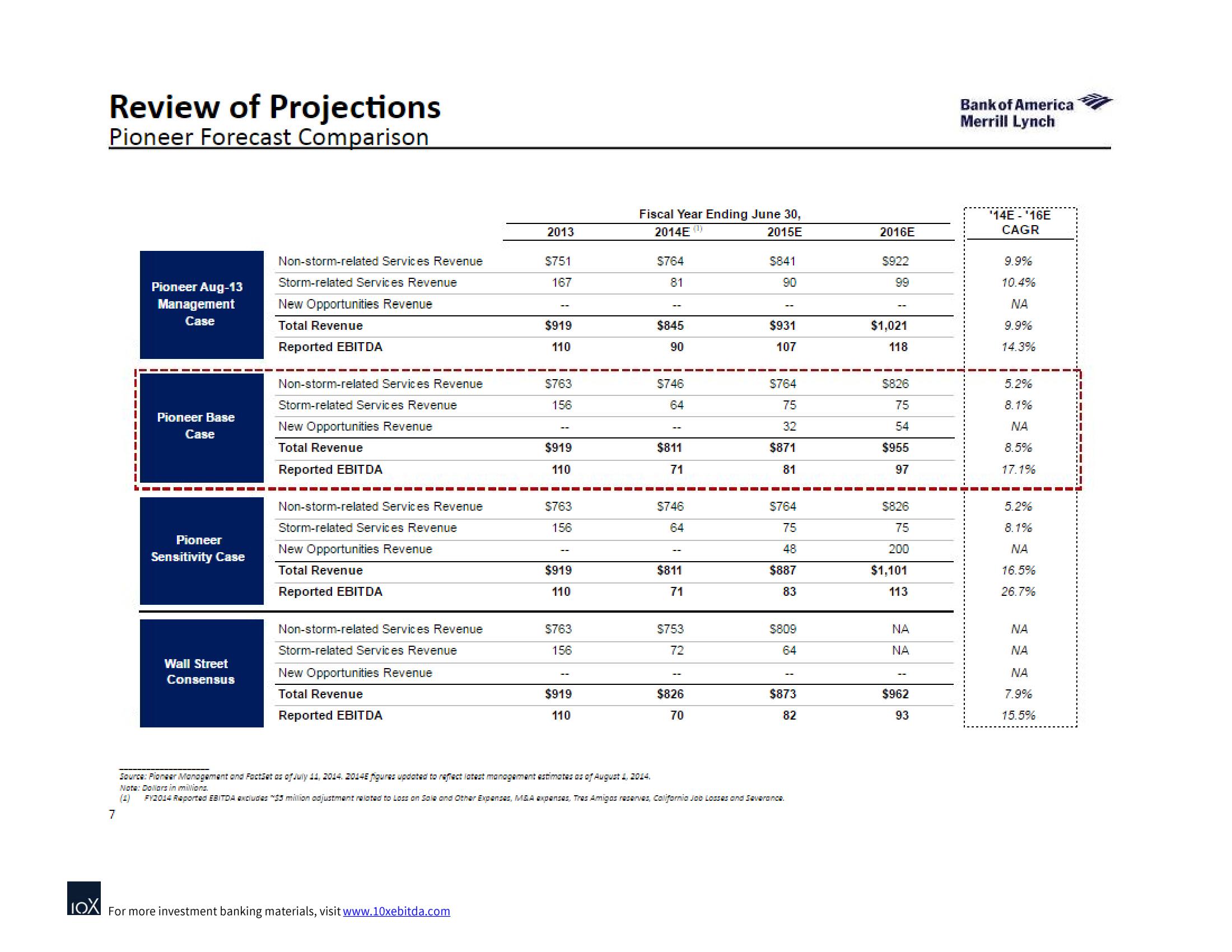

Review of Projections

Pioneer Forecast Comparison

7

Pioneer Aug-13

Management

Case

Pioneer Base

Case

Pioneer

Sensitivity Case

Wall Street

Consensus

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

Reported EBITDA

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

Reported EBITDA

▬▬▬▬▬▬▬▬▬▬▬▬

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

Reported EBITDA

Non-storm-related Services Revenue

Storm-related Services Revenue

New Opportunities Revenue

Total Revenue

Reported EBITDA

2013

IOX For more investment banking materials, visit www.10xebitda.com

$751

167

$919

110

$763

156

$919

110

$763

156

$919

110

$763

156

$919

110

Fiscal Year Ending June 30,

2014E (¹)

2015E

$764

81

$845

90

$746

64

$811

71

$746

64

$811

71

$753

72

$826

70

$841

90

$931

107

$764

75

32

$871

81

$764

75

48

$887

83

$809

64

-

$873

82

Source: Pioneer Management and FactSet as of July 11, 2014. 2014E figures updated to reflect latest management estimates as of August 1, 2014.

Note: Dollars in milions.

FY2014 Raported EBITDA excludes $3 million adjustment related to Loss on Sale and Other Expanses, M&A expansas. Tras Amigos reserves, California Job Losses and Severance.

2016E

$922

9.9

$1,021

118

$826

75

54

$955

97

$8.26

75

200

$1,101

113

NA

NA

$962

93

Bank of America

Merrill Lynch

'14E - '16E

CAGR

9.9%

10.4%

NA

14.3%

5.2%

8.1%

NA

8.5%

17.1%

5.2%

8.1%

ΝΑ

16.5%

26.7%

NA

NA

ΝΑ

7.9%

15.5%View entire presentation