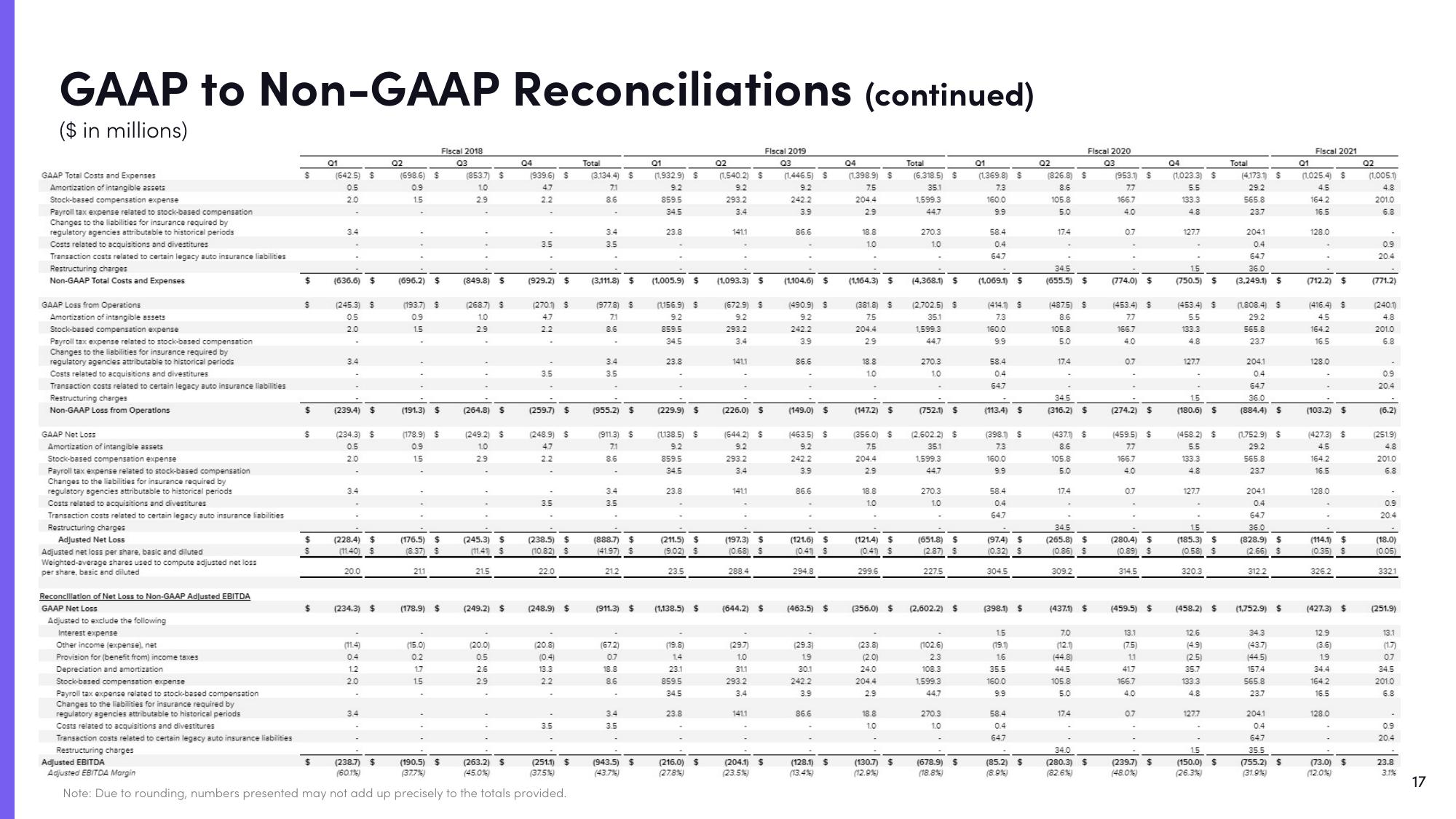

Lyft Results Presentation Deck

GAAP to Non-GAAP Reconciliations

($ in millions)

GAAP Total Costs and Expenses

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods

Costs related to acquisitions and divestitures

Transaction costs related to certain legacy auto insurance liabilities

Restructuring charges

Non-GAAP Total Costs and Expenses

GAAP Loss from Operations

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods

Costs related to acquisitions and divestitures

Transaction costs related to certain legacy auto insurance liabilities

Restructuring charges

Non-GAAP Loss from Operations

GAAP Net Loss

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods

Costs related to acquisitions and divestitures

Transaction costs related to certain legacy auto insurance liabilities

Restructuring charges

Adjusted Net Loss

Adjusted net loss per share, basic and diluted

Weighted-average shares used to compute adjusted net loss

per share, basic and diluted

Reconciliation of Net Loss to Non-GAAP Adjusted EBITDA

GAAP Net Loss

Adjusted to exclude the following

Interest expense

Other income (expense), net

Provision for (benefit from) income taxes

Depreciation and amortization

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Changes to the liabilities for insurance required by

regulatory agencies attributable to historical periods

Costs related to acquisitions and divestitures

Transaction costs related to certain legacy auto insurance liabilities

Restructuring charges

$

$

$

$

$

$

$

$

$

01

(642.5) S

0.5

2.0

.

3.4

(636.6) $

(245.3) $

0.5

2.0

3.4

(239.4) $

(234.3) S

0.5

20

3.4

(228.4) $

(1140) S

20.0

(234.3) $

(11.4)

0.4

12

20

-

3.4

(238.7) $

(60.1%)

Q2

(698.6) $

0.9

1.5

.

(696.2) $

(193.7) $

0.9

1.5

(191.3) $

(178.9) $

0.9

1.5

(176.5) $

(8.37) S

21,1

(178.9) $

(15.0)

0.2

17

1.5

(190.5) $

(37.7%)

Fiscal 2018

Q3

(853.7) $

1.0

2.9

.

(849.8) $

(2687) $

1.0

2.9

(264.8) $

(249.2) $

1.0

29

(245.3) $

(1141) S

21.5

(249.2) $

(20.0)

0.5

2.6

2.9

Reconciliations (continued)

(263.2) $

(45.0%)

04

(939.6) $

47

2.2

3.5

(929.2) $

(2701) $

47

2.2

(259.7) $

(248.9) $

47

2.2

3.5

(238.5)

$

(10.82) S

22.0

(248.9) $

Adjusted EBITDA

Adjusted EBITDA Margin

(251.1) $

(37.5%)

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

(20.8)

(0.4)

13.3

2.2

3.5

Total

(3.134.4) S

71

8.6

3.4

3.5

(3,111.8) $

(977.8) S

71

8.6

3.4

3.5

(955.2) $

(911.3) $

71

8.6

3.4

3.5

(888.7) $

(41.97) $

21.2

(911.3) $

(67.2)

0.7

18.8

8.6

-

3.4

3.5

(943.5) $

(43.7%)

01

(1,932.9) S

9.2

859.5

34.5

23.8

(1.005.9) $

(1156.9) S

9.2

859.5

34.5

23.8

(229.9) $

(1138.5) S

9.2

859.5

34.5

23.8

(211.5)

(9.02)

23.5

(1.138.5) $

(19.8)

1.4

23.1

859.5

34.5

$

23.8

(216.0) $

(27.8%)

Q2

(1.540.2) $

9.2

293.2

3.4

1411

(1,093.3) $

(672.9) S

9.2

293.2

3.4

1411

(226.0) $

(644.2) S

9.2

293.2

3.4

1411

(197.3) $

(0.68) $

288.4

(644.2) $

(29.7)

1.0

31.1

293.2

3.4

Fiscal 2019

1411

(204.1) $

(23.5%)

Q3

(1.446.5) S

9.2

242.2

3.9

86.6

(1.104.6) $

(490.9) S

9.2

242.2

3.9

86.6

(149.0) $

(463.5) $

9.2

242.2

3.9

86.6

(121.6)

$

(0.41) S

294.8

(463.5) $

(29.3)

1.9

30.1

242.2

3.9

86.6

(128.1) S

(13.4%)

04

(1,398.9) $

7.5

204.4

2.9

18.8

1.0

(1,164.3) $

(381.8) S

7.5

204.4

29

18.8

1.0

(147.2) S

(356.0) $

7.5

204.4

2.9

18.8

1.0

(121.4) $

(041) S

299.6

(356.0) $

(23.8)

(2.0)

24.0

204.4

2.9

18.8

1.0

(130.7) $

(12.9%)

Total

(6,318.5) $

35.1

1,599.3

447

270.3

1.0

(4,368.1) $

(2.702.5) S

35.1

1,599.3

447

270.3

10

(752.1) S

(2.602.2) S

35.1

1,599.3

447

270.3

1.0

(651.8) $

(2.87) S

227.5

(2,602.2) $

(102.6)

2.3

108.3

1,599.3

447

270.3

1.0

(678.9) $

(18.8%)

01

(1,369.8) $

7.3

160.0

58.4

0.4

64.7

(1,069.1) $

(414) S

7.3

160.0

9.9

58.4

0.4

64.7

(113.4) S

(398.1) S

7.3

160.0

9.9

58.4

10.4

64.7

(97.4) $

(0.32) S

304.5

(398.1) $

15

(19.1)

16

35.5

160.0

9.9

58.4

10.4

64.7

(85.2) $

(8.9%)

Q2

(826.8) S

8.6

105.8

5.0

17.4

34.5

(655.5) $

(487.5) $

8.6

105.8

5.0

17.4

34.5

(316.2) $

(437.1) $

8.6

105.8

5.0

17.4

Fiscal 2020

Q3

34.5

(265.8) $

(0.86) $

309.2

(437.1) $

7.0

(12.1)

(44.8)

44.5

105.8

5.0

17.4

34.0

(280.3) $

(82.6%)

(953.1) S

77

166.7

4.0

0.7

(774.0) $

(453.4) S

7.7

166.7

4.0

0.7

(274.2) $

(459.5) $

7.7

166.7

4.0

0.7

(280.4) $

(0.89) $

314.5

(459.5) $

13.1

(7.5)

11

417

166.7

4.0

0.7

(239.7) $

(48.0%)

04

(1,023.3) S

5.5

133.3

4.8

1277

1.5

(750.5)

(453.4) S

5.5

133.3

4.8

127.7

1.5

(180.6) $

$

(458.2) $

5.5

133.3

4.8

127.7

1.5

(185.3) $

(0.58) $

320.3

(458.2) $

12.6

(4.9)

(2.5)

35.7

133.3

4.8

127.7

1.5

(150.0) $

(26.3%)

Total

(4,173.1) S

29.2

565.8

23.7

204.1

0.4

647

36.0

(3,249.1) $

(1808.4) S

29.2

565.8

23.7

2041

0.4

647

36.0

(884.4) $

(1,7529) S

29.2

565.8

23.7

204.1

0.4

647

36.0

(828.9) $

(2.66) $

312.2

(1,752.9) $

34.3

(43.7)

(44.5)

157.4

565.8

23.7

204.1

0.4

647

35.5

(755.2) $

(31.9%)

Fiscal 2021

Q1

(1,025.4) $

45

164.2

16.5

128.0

(712.2) S

(416.4) $

45

164.2

16.5

128.0

(103.2) $

(427.3) $

45

164.2

16.5

128.0

(114.1) $

(0.35)

326.2

(427.3)

12.9

(3.6)

19

34.4

164.2

16.5

128.0

$

(73.0) $

(12.0%)

Q2

(1,005.1)

4.8

201.0

6.8

0.9

20.4

(771.2)

(2401)

4.8

201.0

6.8

0.9

20.4

(6.2)

(251.9)

4.8

201.0

6.8

0.9

20.4

(18.0)

(0.05)

332.1

(251.9)

13.1

(17)

07

34.5

201.0

6.8

09

20.4

23.8

3.1%

17View entire presentation