LSE Mergers and Acquisitions Presentation Deck

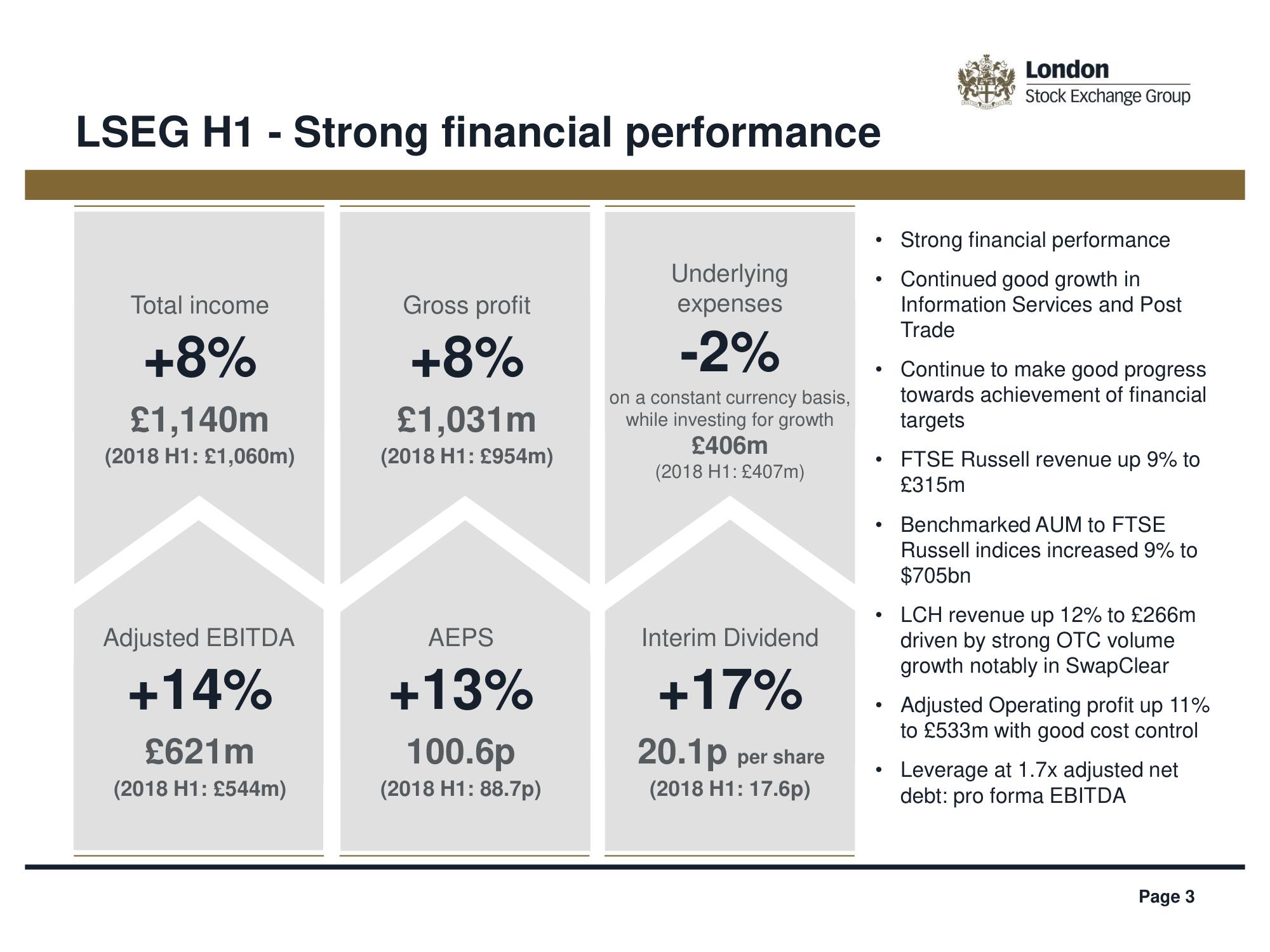

LSEG H1 - Strong financial performance

Total income

+8%

£1,140m

(2018 H1: £1,060m)

Adjusted EBITDA

+14%

£621m

(2018 H1: £544m)

Gross profit

+8%

£1,031m

(2018 H1: £954m)

AEPS

+13%

100.6p

(2018 H1: 88.7p)

Underlying

expenses

-2%

on a constant currency basis,

while investing for growth

£406m

(2018 H1: £407m)

Interim Dividend

+17%

20.1p per share

(2018 H1: 17.6p)

●

●

●

●

●

Duke action

London

Stock Exchange Group

Strong financial performance

Continued good growth in

Information Services and Post

Trade

Continue to make good progress

towards achievement of financial

targets

FTSE Russell revenue up 9% to

£315m

Benchmarked AUM to FTSE

Russell indices increased 9% to

$705bn

LCH revenue up 12% to £266m

driven by strong OTC volume

growth notably in SwapClear

Adjusted Operating profit up 11%

to £533m with good cost control

Leverage at 1.7x adjusted net

debt: pro forma EBITDA

Page 3View entire presentation