Nuvei Results Presentation Deck

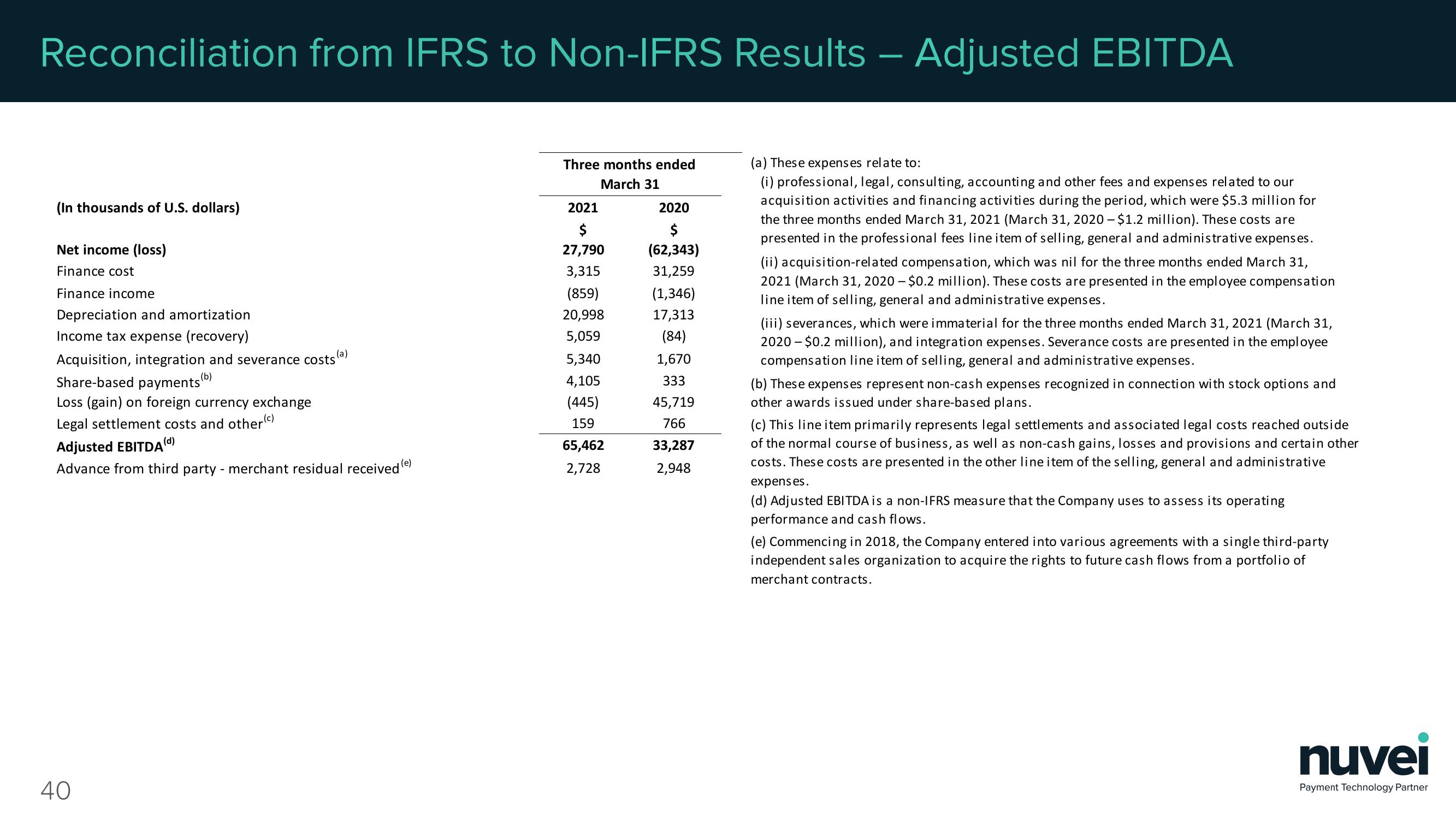

Reconciliation from IFRS to Non-IFRS Results – Adjusted EBITDA

-

(In thousands of U.S. dollars)

Net income (loss)

Finance cost

Finance income

Depreciation and amortization

Income tax expense (recovery)

(a)

Acquisition, integration and severance costs

(b)

Share-based payments

Loss (gain) on foreign currency exchange

Legal settlement costs and other(c)

(d)

Adjusted EBITDA

Advance from third party - merchant residual received (e)

40

Three months ended

March 31

2021

$

27,790

3,315

(859)

20,998

5,059

5,340

4,105

(445)

159

65,462

2,728

2020

$

(62,343)

31,259

(1,346)

17,313

(84)

1,670

333

45,719

766

33,287

2,948

(a) These expenses relate to:

(i) professional, legal, consulting, accounting and other fees and expenses related to our

acquisition activities and financing activities during the period, which were $5.3 million for

the three months ended March 31, 2021 (March 31, 2020 - $1.2 million). These costs are

presented in the professional fees line item of selling, general and administrative expenses.

(ii) acquisition-related compensation, which was nil for the three months ended March 31,

2021 (March 31, 2020 - $0.2 million). These costs are presented in the employee compensation

line item of selling, general and administrative expenses.

(iii) severances, which were immaterial for the three months ended March 31, 2021 (March 31,

2020 - $0.2 million), and integration expenses. Severance costs are presented in the employee

compensation line item of selling, general and administrative expenses.

(b) These expenses represent non-cash expenses recognized in connection with stock options and

other awards issued under share-based plans.

(c) This line item primarily represents legal settlements and associated legal costs reached outside

of the normal course of business, as well as non-cash gains, losses and provisions and certain other

costs. These costs are presented in the other line item of the selling, general and administrative

expenses.

(d) Adjusted EBITDA is a non-IFRS measure that the Company uses to assess its operating

performance and cash flows.

(e) Commencing in 2018, the Company entered into various agreements with a single third-party

independent sales organization to acquire the rights to future cash flows from a portfolio of

merchant contracts.

nuvei

Payment Technology PartnerView entire presentation