Bank of America Investment Banking Pitch Book

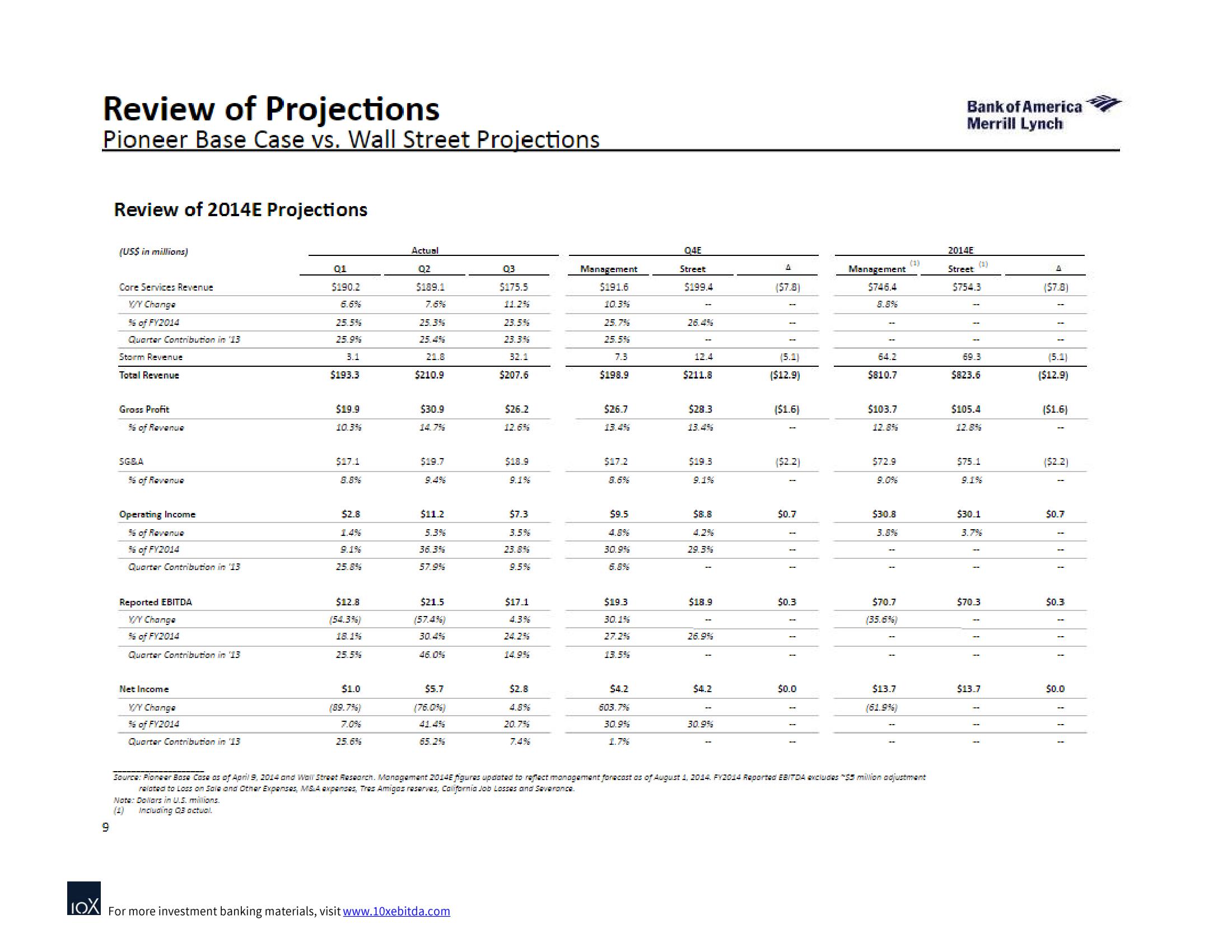

Review of Projections

Pioneer Base Case vs. Wall Street Projections

9

Review of 2014E Projections

(US$ in millions)

Core Services Revenue

X/Y Change

% of FY2014

Quarter Contribution in 13

Storm Revenue

Total Revenue

Gross Profit

56 of Revenue

SGBA

35 of Revenue

Operating Income

56 of Revenue

% of FY2014

Quarter Contribution in 13

Reported EBITDA

X/Y Change

% of FY2014

Quarter Contribution in 13

Net Income

X/Y Change

% of FY2014

Quarter Contribution in 13

01

$190.2

25.5%

25.9%

3.1

$193.3

$19.9

10.3%

$17.1

8.8%

$2.8

9.1%

25.8%

$12.8

(54.3%)

18.1%

25.5%

$1.0

7.0%

25.6%

Actual

02

$189.1

25.3%

21.8

$210.9

$30.9

14.7%

$19.7

$11.2

5.3%

36.3%

57.9%

$21.5

(57.4%)

30.4%

$5.7

03

$175.5

11.2%

IOX For more investment banking materials, visit www.10xebitda.com

23.5%

23.3%

32.1

$207.6

$26.2

12.6%

9.1%

$7.3

3.5%

23.8%

9.5%

$17.1

$2.8

20.7%

Management

$191.6

10.3%

25.7%

25.5%

7.3

$198.9

$26.7

13.4%

$17.2

$9.5

30.9%

$19.3

30.1%

27.2%

13.5%

$4.2

603.7%

30.9%

1.7%

04E

Street

$199.4

12.4

$211.8

$28.3

13.4%

$19.3

$8.8

29.3%

$18.9

$4.2

30.9%

($7.8)

(5.1)

($12.9)

($1.6)

($2.2)

$0.7

$0.3

$0.0

Management

$746.4

64.2

$810.7

$103.7

$7.2.9

$30.8

$70.7

(35.6%)

$13.7

(61.9%)

(4)

Source: Pioneer Bose Cosa as of April 9, 2014 and Wall Street Research. Management 2014E figures updated to reflect management forecast as of August 1, 2014 FY2014 Reported EBITDA excludes $5 million adjustment

related to Loss on Sale and Other Expenses, M&A expenses, Tres Amigos reserves, California Job Losses and Severance.

Note: Dollars in U.S. millions.

Including QB actual.

Bank of America

Merrill Lynch

2014E

(1)

Street

5754.3

69.3

$823.6

$105.4

12.8%

$75.1

9.1%

$30.1

3.7%

$70.3

$13.7

($7.8)

(5.1)

($12.9)

($1.6)

($2.2)

$0.7

$0.3

T

$0.0View entire presentation