WeWork SPAC Presentation Deck

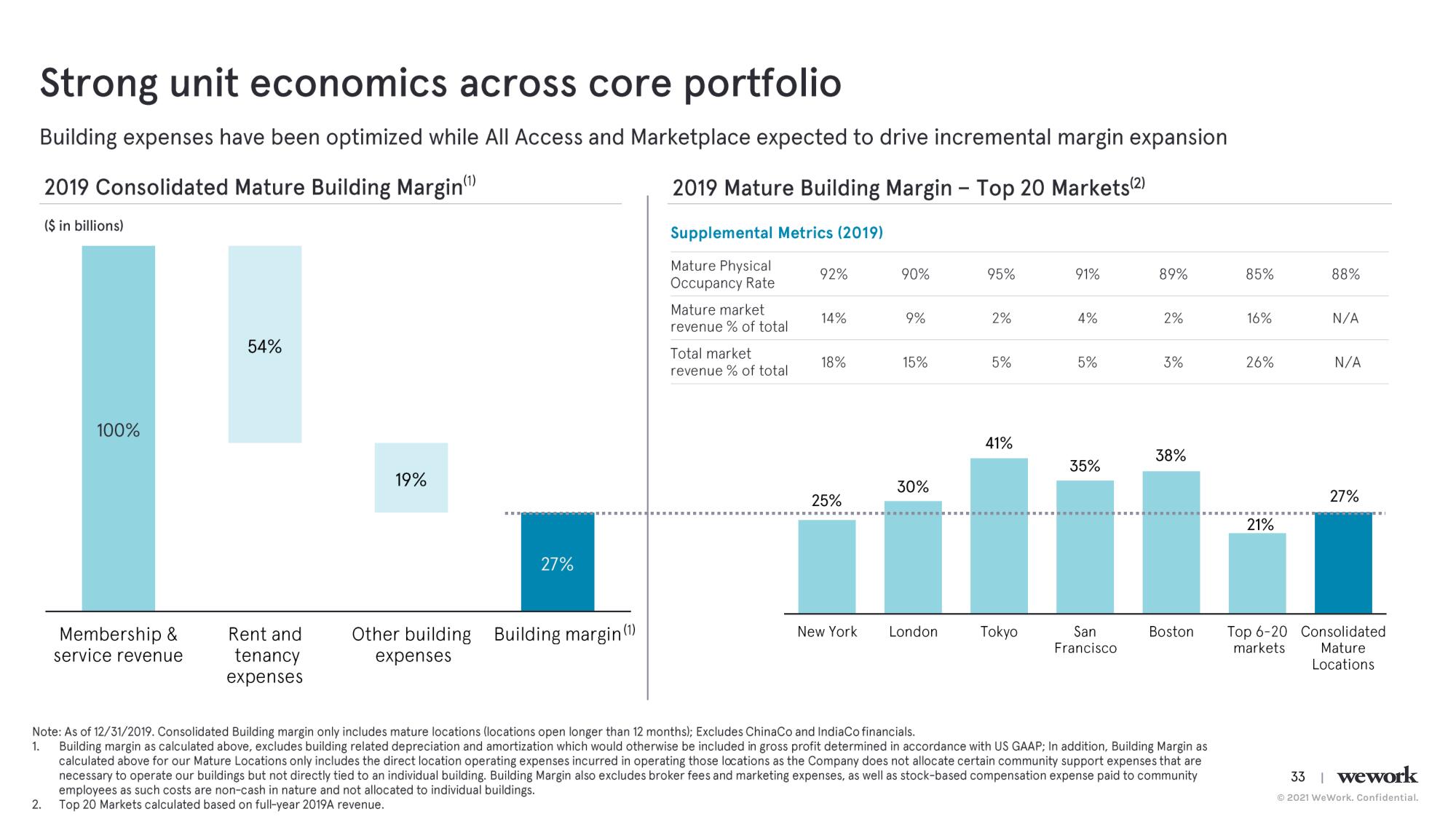

Strong unit economics across core portfolio

Building expenses have been optimized while All Access and Marketplace expected to drive incremental margin expansion

2019 Consolidated Mature Building Margin(¹)

2019 Mature Building Margin- Top 20 Markets(2)

($ in billions)

Supplemental Metrics (2019)

Mature Physical

Occupancy Rate

100%

2.

Membership &

service revenue

54%

Rent and

tenancy

expenses

19%

27%

Other building Building margin (1)

expenses

Mature market

revenue % of total

Total market

revenue % of total.

92%

14%

18%

25%

New York

90%

9%

15%

30%

London

95%

2%

5%

41%

Tokyo

91%

4%

5%

35%

San

Francisco

89%

2%

3%

38%

Boston

Note: As of 12/31/2019. Consolidated Building margin only includes mature locations (locations open longer than 12 months); Excludes ChinaCo and IndiaCo financials.

1. Building margin as calculated above, excludes building related depreciation and amortization which would otherwise be included in gross profit determined in accordance with US GAAP; In addition, Building Margin as

calculated above for our Mature Locations only includes the direct location operating expenses incurred in operating those locations as the Company does not allocate certain community support expenses that are

necessary to operate our buildings but not directly tied to an individual building. Building Margin also excludes broker fees and marketing expenses, as well as stock-based compensation expense paid to community

employees as such costs are non-cash in nature and not allocated to individual buildings.

Top 20 Markets calculated based on full-year 2019A revenue.

85%

16%

26%

21%

88%

N/A

N/A

27%

Top 6-20 Consolidated

Mature

Locations

markets

33 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation