Affirm Results Presentation Deck

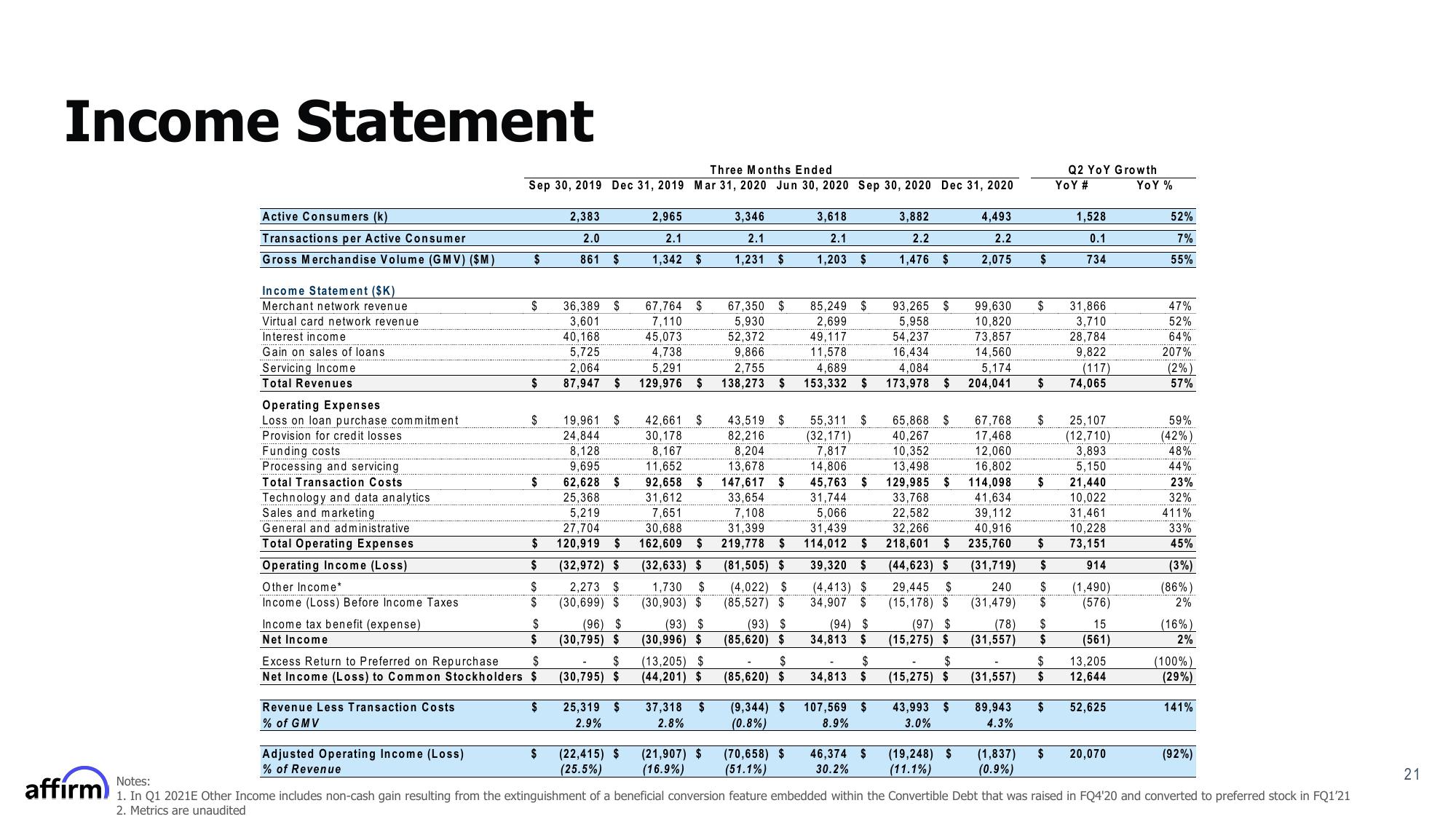

Income Statement

Active Consumers (k)

Transactions per Active Consumer

Gross Merchandise Volume (GMV) ($M)

Income Statement ($K)

Merchant network revenue

Virtual card network revenue

Interest in come

Gain on sales of loans

Servicing Income

Total Revenues

Operating Expenses

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Total Operating Expenses

Operating Income (Loss)

Other Income*

Income (Loss) Before Income Taxes

Income tax benefit (expense)

Net Income

Three Months Ended

Sep 30, 2019 Dec 31, 2019 Mar 31, 2020 Jun 30, 2020 Sep 30, 2020 Dec 31, 2020

Revenue Less Transaction Costs

% of GMV

$

Adjusted Operating Income (Loss)

% of Revenue

$

$

$

$

$

$

$

$

$

Excess Return to Preferred on Repurchase

S

Net Income (Loss) to Common Stockholders $

$

$

2,383

2.0

861 $

$

36,389 $

3,601

40,168

5,725

2,064

87,947

$

19,961 $

24,844

8,128

9,695

62,628 $

25,368

5,219

27,704

120,919 $

(32,972) $

2,273 $

(30,699) $

(96) $

(30,795) $

$

(30,795) $

25,319 $

2.9%

2,965

2.1

1,342 $

(22,415) $

(25.5%)

67,764 $

7,110

4,738

5,291

129,976 $

42,661 $

30,178

8,167

11,652

92,658 $

31,612

7,651

30,688

162,609 $

(32,633) $

1,730 $

(30,903) $

(93) $

(30,996) $

(13,205) $

(44,201) $

37,318 $

2.8%

3,346

2.1

1,231 $

(21,907) $

(16.9%)

67,350 $

5,930

52,3

9,866

2,755

138,273 $

3,618

2.1

1,203 $

85,249 $

2,699

43,519 $

82,216

8,204

13,678

147,617 $

33,654

7,108

31,399

219,778 $

(81,505) $

(4,022) $

(85,527) $

(93) $

(85,620) $

$

(85,620) $

(9,344) $

(0.8%)

(70,658) $

(51.1%)

(1,837)

$

(92%)

(19,248) $

(11.1%)

(0.9%)

Notes:

affirm) Q1 2021E Other Income includes non-cash gain resulting from the extinguishment of a beneficial conversion feature embedded within the Convertible Debt that was raised in FQ4'20 and converted to preferred stock in FQ1'21

2. Metrics are unaudited

49,1

11,578

16,434

4,084

4,689

153,332 $ 173,978 $

55,311 $

(32,171)

7,817

14,806

45,763

3,882

2.2

1,476 $

31,744

5,066

31,439

114,012 $

39,320 $

(4,413) $

34,907 $

(94) $

34,813 $

$

34,813 $

93,265 $

5,958

107,569 $

8.9%

46,374 $

30.2%

4,493

2.2

2,075

65,868 $

40,267

10,352

13,498

$

99,630 $

10,820

73,85

14,560

5,174

204,041

$

$ 129,985 $ 114,098 $

33,768

41,634

39,112

22,582

32,266

218,601 $

(44,623) $

29,445 $

(15,178) $

(97) $

(15,275) $

$

(15,275) $

43,993 $

3.0%

40,916

235,760 $

(31,719) $

240 $

(31,479) $

(78) $

(31,557) $

$

$

67,768 $

17,468

12,060

16,802

Q2 YoY Growth

(31,557)

89,943 $

4.3%

YOY #

1,528

0.1

734

31,866

3,710

28,7

9,822

(117)

74,065

25,107

(12,710)

3,893

5,150

21,440

10,022

31,461

10,228

73,151

914

(1,490)

(576)

15

(561)

13,205

12,644

52,625

YOY %

20,070

52%

7%

55%

47%

52%

64%

207%

(2%)

57%

59%

(42%)

48%

44%

23%

32%

411%

33%

45%

(3%)

(86%)

2%

(16%)

2%

(100%)

(29%)

141%

21View entire presentation