UBS Results Presentation Deck

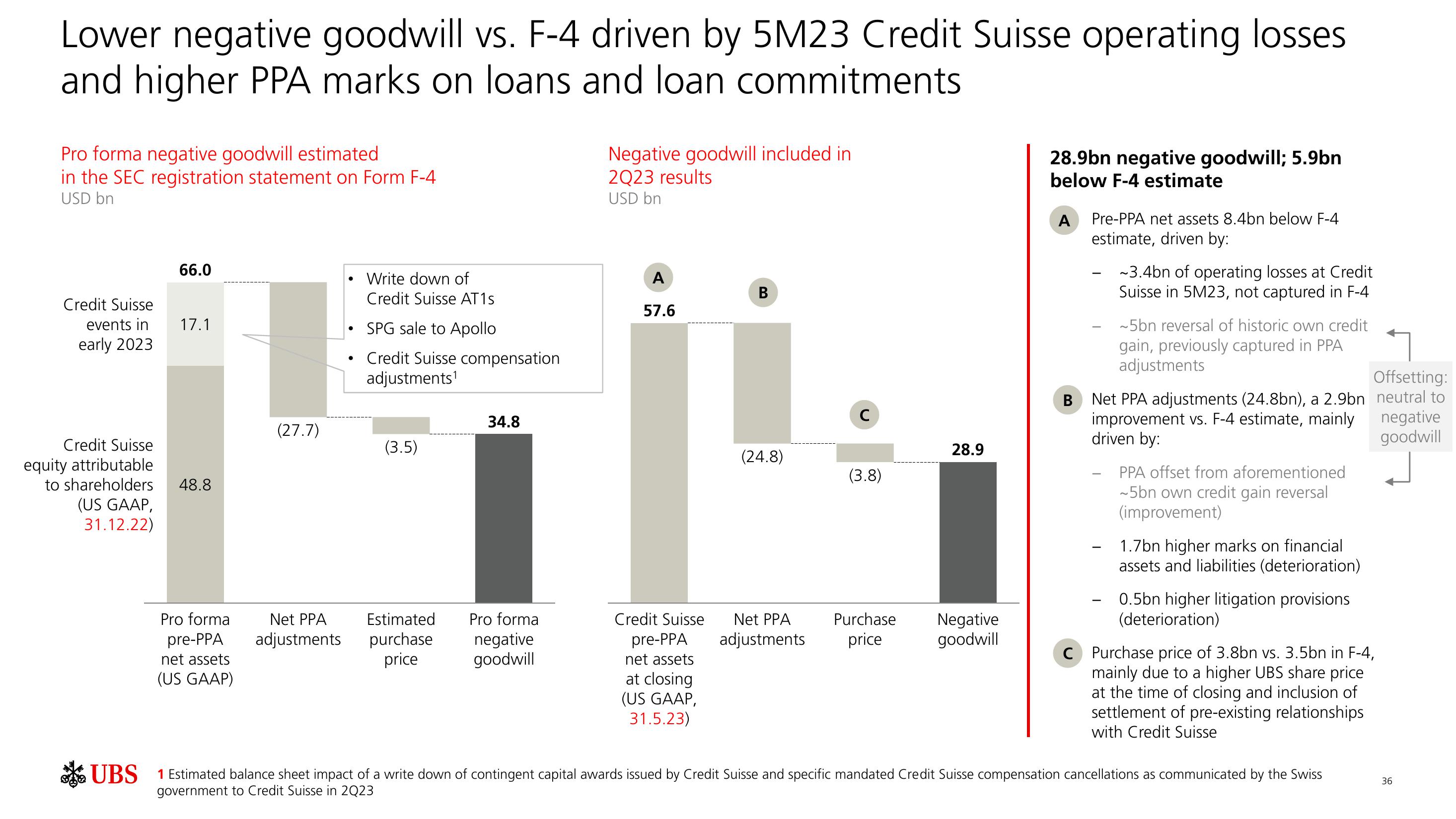

Lower negative goodwill vs. F-4 driven by 5M23 Credit Suisse operating losses

and higher PPA marks on loans and loan commitments

Pro forma negative goodwill estimated

in the SEC registration statement on Form F-4

USD bn

Credit Suisse

events in

early 2023

Credit Suisse

equity attributable

66.0

(US GAAP,

31.12.22)

17.1

to shareholders 48.8

Pro forma

pre-PPA

net assets

(US GAAP)

(27.7)

Net PPA

adjustments

●

Write down of

Credit Suisse AT1s

SPG sale to Apollo

Credit Suisse compensation

adjustments¹

(3.5)

Estimated

purchase

price

34.8

Pro forma

negative

goodwill

Negative goodwill included in

2Q23 results

USD bn

A

57.6

Credit Suisse

pre-PPA

net assets

at closing

(US GAAP,

31.5.23)

B

(24.8)

Net PPA

adjustments

C

(3.8)

Purchase

price

28.9

Negative

goodwill

28.9bn negative goodwill; 5.9bn

below F-4 estimate

A

B

Pre-PPA net assets 8.4bn below F-4

estimate, driven by:

-3.4bn of operating losses at Credit

Suisse in 5M23, not captured in F-4

-

~5bn reversal of historic own credit

gain, previously captured in PPA

adjustments

Net PPA adjustments (24.8bn), a 2.9bn

improvement vs. F-4 estimate, mainly

driven by:

PPA offset from aforementioned

~5bn own credit gain reversal

(improvement)

1.7bn higher marks on financial

assets and liabilities (deterioration)

0.5bn higher litigation provisions

(deterioration)

Offsetting:

neutral to

negative

goodwill

C Purchase price of 3.8bn vs. 3.5bn in F-4,

mainly due to a higher UBS share price

at the time of closing and inclusion of

settlement of pre-existing relationships

with Credit Suisse

UBS 1 Estimated balance sheet impact of a write down of contingent capital awards issued by Credit Suisse and specific mandated Credit Suisse compensation cancellations as communicated by the Swiss

government to Credit Suisse in 2Q23

36View entire presentation