Kin SPAC Presentation Deck

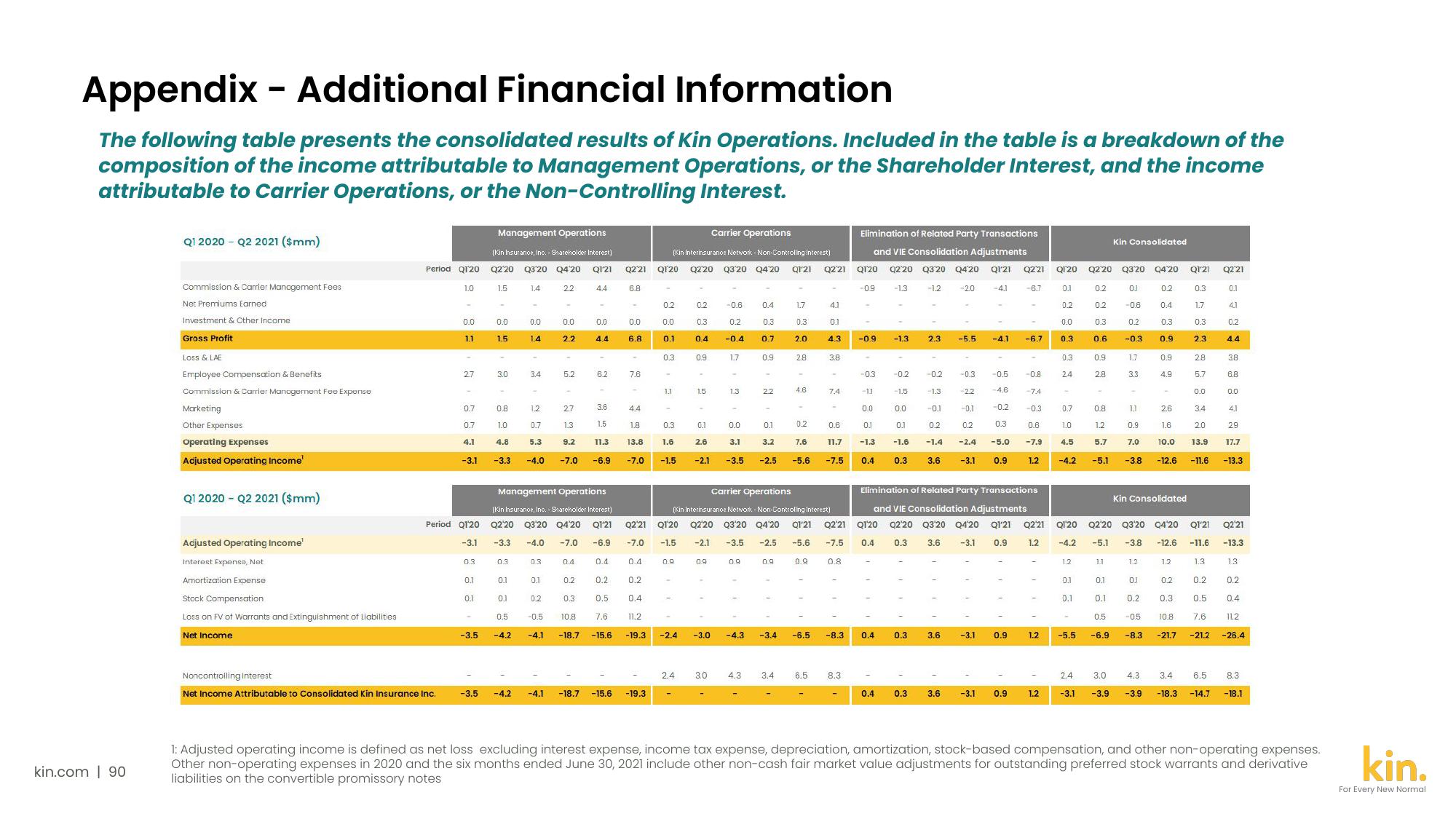

Appendix - Additional Financial Information

The following table presents the consolidated results of Kin Operations. Included in the table is a breakdown of the

composition of the income attributable to Management Operations, or the Shareholder Interest, and the income

attributable to Carrier Operations, or the Non-Controlling Interest.

kin.com | 90

Q1 2020 - Q2 2021 ($mm)

Commission & Carrier Management Fees

Net Premiums Earned

Investment & Other Income

Gross Profit

Loss & LAE

Employee Compensation & Benefits

Commission & Carrier Management Fee Expense

Marketing

Other Expenses

Operating Expenses

Adjusted Operating Income'

Q1 2020 - Q2 2021 ($mm)

Adjusted Operating Income'

Interest Expense, Net

Amortization Expense

Stock Compensation

Loss on FV of Warrants and Extinguishment of Liabilities

Net Income

Period Q120

1.0

0.0

1.1

Noncontrolling Interest

Net Income Attributable to Consolidated Kin Insurance Inc.

27

0.7

0.7

4.1

-3.1

Period Q120

0.3

0.1

0.1

-3.5

Management Operations

(Kin Insurance, Inc. - Shareholder Interest)

Q2 20

Q320 Q4'20 Q121

1.4

22

-3.5

1.5

0.0

1.5

3.0

0.8

1.0

4.8

-3.3

0.3

-

0.1

0.0

1.4

-3.1 -3.3 -4.0 -7.0

0.1

3.4

0.5

1.2

0.7

5.3

0.0

2.2

5.2

-4.0 -7.0

Management Operations

(Kin Insurance, Inc. - Shareholder Interest)

Q2'20 Q3'20 Q4'20 Q1'21

-6.9

0.3

27

1.3

9.2

0.1

04

0.0

4.4

0.2

0.2

0.3

0.5

-0.5 10.8

7.6

-4.2 -4.1 -18.7 -15.6

6.2

0.2

3.6

1.5

11.3

-6.9

0.4

-4.2 -4.1 -18.7 -15.6

Q2'21 Q120

6.8

0.0

6.8

7.6

44

1.8

13.8

-7.0

0.4

Carrier Operations

(Kin Interinsurance Network - Non-Controlling Interest)

Q2'20 Q3'20 Q4 20

0.2

0.0

0.1

-19.3

0.3

1.1

0.3

1.6

-1.5

0.9

0.2

0.4

11.2

-19.3 -2.4

0.2

0.3

-0.6

0.2

0.4 -0.4

0.9

1.5

0.1

2.6

-2.1

0.9

17

-

1.3

0.0

3.1

0.4

0.9

0.3

0.7

-3.0 -4.3

0.9

-

22

0.9

Q1'21

-3.4

1.7

0.1

3.2

-3.5 -2.5 -5.6

2.4 3.0 4.3 3.4

0.3

2.0

28

Carrier Operations

Q1'20

Q2'21

-7.0 -1.5

(Kin Interinsurance Network - Non-Controlling Interest)

Q220 Q3'20 Q4'20 Q1'21 Q2'21

-2.1 -3.5 -2.5 -5.6 -7.5

-

4.6

0.2

7.6

0.9

-6.5

Q2'21

6.5

3.8

4.1

0.1

4.3 -0.9

7.4

0.6

11.7

-7.5

0.8

-8.3

Elimination of Related Party Transactions

and VIE Consolidation Adjustments

Q2 20 Q3 20

Q420 Q1'21 Q2'21

-4.1

8.3

Q120

-0.9

-0.3

-11

0.0

01

-1.3

0.4

Q1'20

0.4

0.4

-1.3

0.4

-1.3

-0.2

-1.5

0.0

0.1

-1.6

0.3

0.3

-1.2

0.3

-

2.3

-0.2

-1.3

-0.1

0.2

-1.4

3.6

-20

3.6

-5.5

-0.3

2.2

-4.1

-0.5

-3.1

-4.6

-0.1

-0.2

0.2

0.3

-2.4 -5.0

-3.1 0.9

Elimination of Related Party Transactions

and VIE Consolidation Adjustments

Q2'20 Q3'20 Q4'20 Q1'21 Q2'21

3.6 -3.1 0.9 1.2

1

0.9

-6.7

0.3 3.6 -3.1 0.9

-6.7

-0.8

-7.4

-0.3

0.6

-7.9

1.2

1.2

1.2

Q120

0.1

0.2

0.0

0.3

0.3

24

0.7

1.0

4.5

-4.2

Q120

-4.2

12

0.1

0.1

-5.5

0.2

0.2

0.3

0.6

Q2'20 Q3'20 Q4 20

0.1

0.2

-0.6

0.4

0.2

0.3

-0.3 0.9

0.9

2.8

0.8

1.2

5.7

-5.1

Kin Consolidated

1.1

1.7

3.3

1.1

0.9

7.0

0.9

4.9

Kin Consolidated

1.2

Q1'21

0.3

1.7

0.3

2.3

1.2

2.8

5.7

0.0

26

1.6

20

10.0 13.9

-3.8 -12.6 -11.6 -13.3

34

Q2'21

0.1

4.1

0.2

4.4

3.8

6.8

0.0

4.1

Q2'20 Q3'20 Q4'20 Q1'21 Q2'21

-5.1 -3.8 -12.6 -11.6 -13.3

1.3.

13

0.1

0.1

0.2

0.2

0.2

0.1

0.2 0.3

0.5

0,4

0.5

-0.5

10.8

7.6

11.2

-6.9 -8.3 -21.7 -21.2

-26.4

29

17.7

2.4 3.0 4.3 3.4 6.5 8.3

-3.1 -3.9 -3.9 -18.3 -14.7 -18.1

1: Adjusted operating income is defined as net loss excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, and other non-operating expenses.

Other non-operating expenses in 2020 and the six months ended June 30, 2021 include other non-cash fair market value adjustments for outstanding preferred stock warrants and derivative

liabilities on the convertible promissory notes

kin.

For Every New NormalView entire presentation