Verint SPAC Presentation Deck

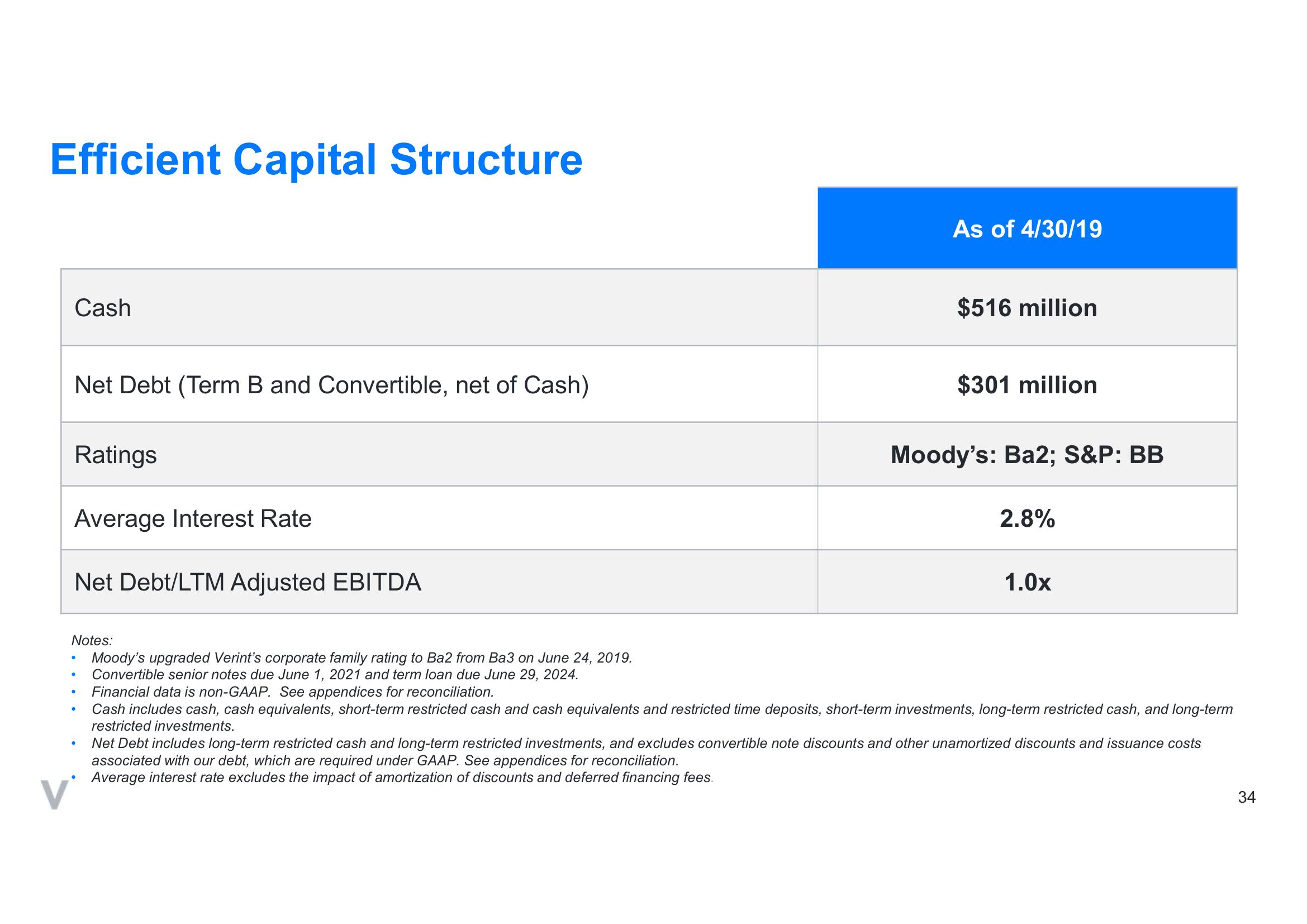

Efficient Capital Structure

Cash

Net Debt (Term B and Convertible, net of Cash)

Ratings

Average Interest Rate

Net Debt/LTM Adjusted EBITDA

Notes:

Moody's upgraded Verint's corporate family rating to Ba2 from Ba3 on June 24, 2019.

Convertible senior notes due June 1, 2021 and term loan due June 29, 2024.

●

●

●

●

●

As of 4/30/19

$516 million

$301 million

Moody's: Ba2; S&P: BB

2.8%

1.0x

Financial data is non-GAAP. See appendices for reconciliation.

Cash includes cash, cash equivalents, short-term restricted cash and cash equivalents and restricted time deposits, short-term investments, long-term restricted cash, and long-term

restricted investments.

Net Debt includes long-term restricted cash and long-term restricted investments, and excludes convertible note discounts and other unamortized discounts and issuance costs

associated with our debt, which are required under GAAP. See appendices for reconciliation.

Average interest rate excludes the impact of amortization of discounts and deferred financing fees.

34View entire presentation