Bird SPAC Presentation Deck

Quarterly financial performance update

●

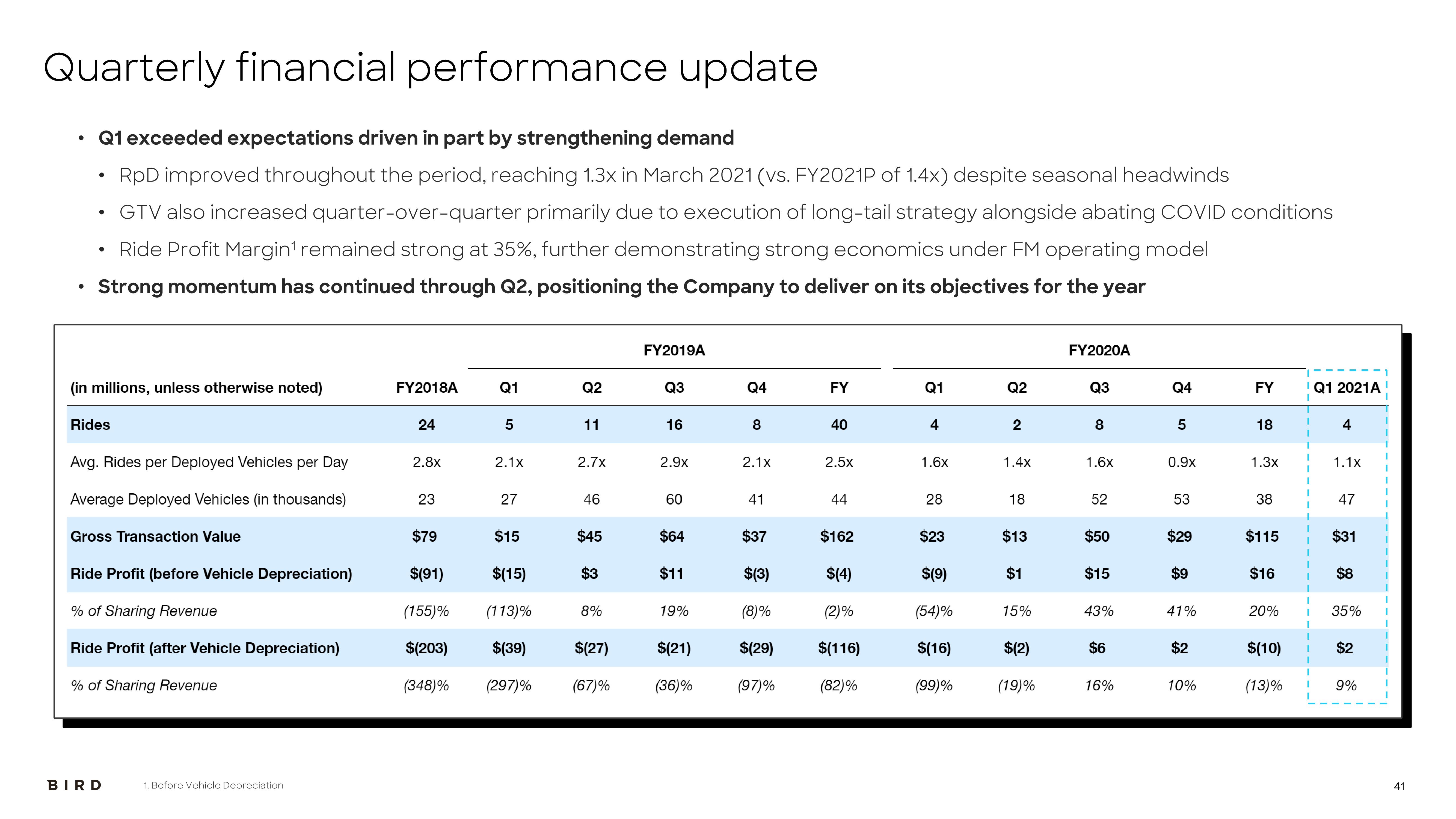

Q1 exceeded expectations driven in part by strengthening demand

RpD improved throughout the period, reaching 1.3x in March 2021 (vs. FY2021P of 1.4x) despite seasonal headwinds

GTV also increased quarter-over-quarter primarily due to execution of long-tail strategy alongside abating COVID conditions

Ride Profit Margin¹ remained strong at 35%, further demonstrating strong economics under FM operating model

Strong momentum has continued through Q2, positioning the Company to deliver on its objectives for the year

●

●

●

(in millions, unless otherwise noted)

Rides

Avg. Rides per Deployed Vehicles per Day

Average Deployed Vehicles (in thousands)

Gross Transaction Value

Ride Profit (before Vehicle Depreciation)

% of Sharing Revenue

Ride Profit (after Vehicle Depreciation)

% of Sharing Revenue

BIRD

1. Before Vehicle Depreciation

FY2018A

24

2.8x

23

Q1

5

2.1x

27

$79

$(91)

$(15)

(155)% (113)%

$(203) $(39)

(348)% (297)%

$15

Q2

11

2.7x

46

$45

$3

8%

$(27)

(67)%

FY2019A

Q3

16

2.9x

60

$64

$11

19%

$(21)

(36)%

Q4

8

2.1x

41

$37

$(3)

(8)%

$(29)

(97)%

FY

40

2.5x

44

$162

$(4)

(2)%

$(116)

(82)%

Q1

4

1.6x

28

$23

$(9)

(54)%

$(16)

(99)%

Q2

2

1.4x

18

$13

$1

15%

$(2)

(19)%

FY2020A

Q3

8

1.6x

52

$50

$15

43%

$6

16%

Q4

5

0.9x

53

$29

$9

41%

$2

10%

FY

18

1.3x

38

$115

$16

20%

$(10)

(13)%

1

Q1 2021A

4

1.1x

47

$31

$8

35%

$2

9%

I

41View entire presentation