DraftKings SPAC Presentation Deck

5 PROPOSED TRANSACTION SUMMARY

DRAFT

KINGS

GAWNE

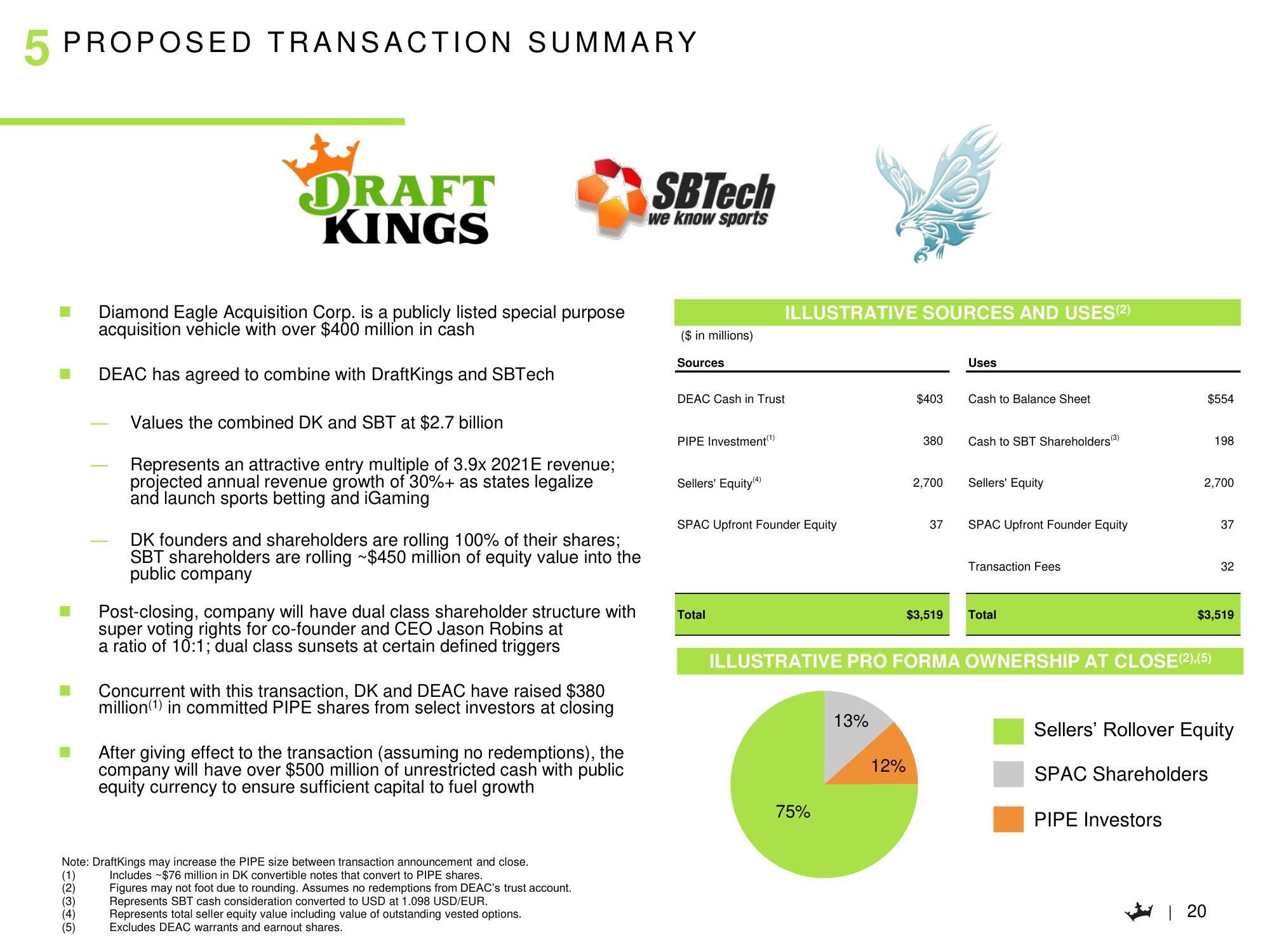

Diamond Eagle Acquisition Corp. is a publicly listed special purpose

acquisition vehicle with over $400 million in cash

DEAC has agreed to combine with DraftKings and SBTech

Values the combined DK and SBT at $2.7 billion

Represents an attractive entry multiple of 3.9x 2021E revenue;

projected annual revenue growth of 30%+ as states legalize

and launch sports betting and iGaming

DK founders and shareholders are rolling 100% of their shares;

SBT shareholders are rolling ~$450 million of equity value into the

public company

Post-closing, company will have dual class shareholder structure with

super voting rights for co-founder and CEO Jason Robins at

a ratio of 10:1; dual class sunsets at certain defined triggers

Concurrent with this transaction, DK and DEAC have raised $380

million (1) in committed PIPE shares from select investors at closing

After giving effect to the transaction (assuming no redemptions), the

company will have over $500 million of unrestricted cash with public

equity currency to ensure sufficient capital to fuel growth

Note: DraftKings may increase the PIPE size between transaction announcement and close.

Includes $76 million in DK convertible notes that convert to PIPE shares.

Figures may not foot due to rounding. Assumes no redemptions from DEAC's trust account.

Represents SBT cash consideration converted to USD at 1.098 USD/EUR.

Represents total seller equity value including value of outstanding vested options.

Excludes DEAC warrants and earnout shares.

SBTech

we know sports

($ in millions)

Sources

DEAC Cash in Trust

PIPE Investment(¹)

Sellers' Equity (4)

ILLUSTRATIVE SOURCES AND USES(2)

SPAC Upfront Founder Equity

Total

75%

13%

$403

12%

380

2,700

37

$3,519

Uses

Cash to Balance Sheet

Cash to SBT Shareholders(³)

Sellers' Equity

SPAC Upfront Founder Equity

Transaction Fees

Total

ILLUSTRATIVE PRO FORMA OWNERSHIP AT CLOSE (2).(5)

$554

PIPE Investors

2,700

198

37

$3,519

| 20

32

Sellers' Rollover Equity

SPAC ShareholdersView entire presentation