jetBlue Mergers and Acquisitions Presentation Deck

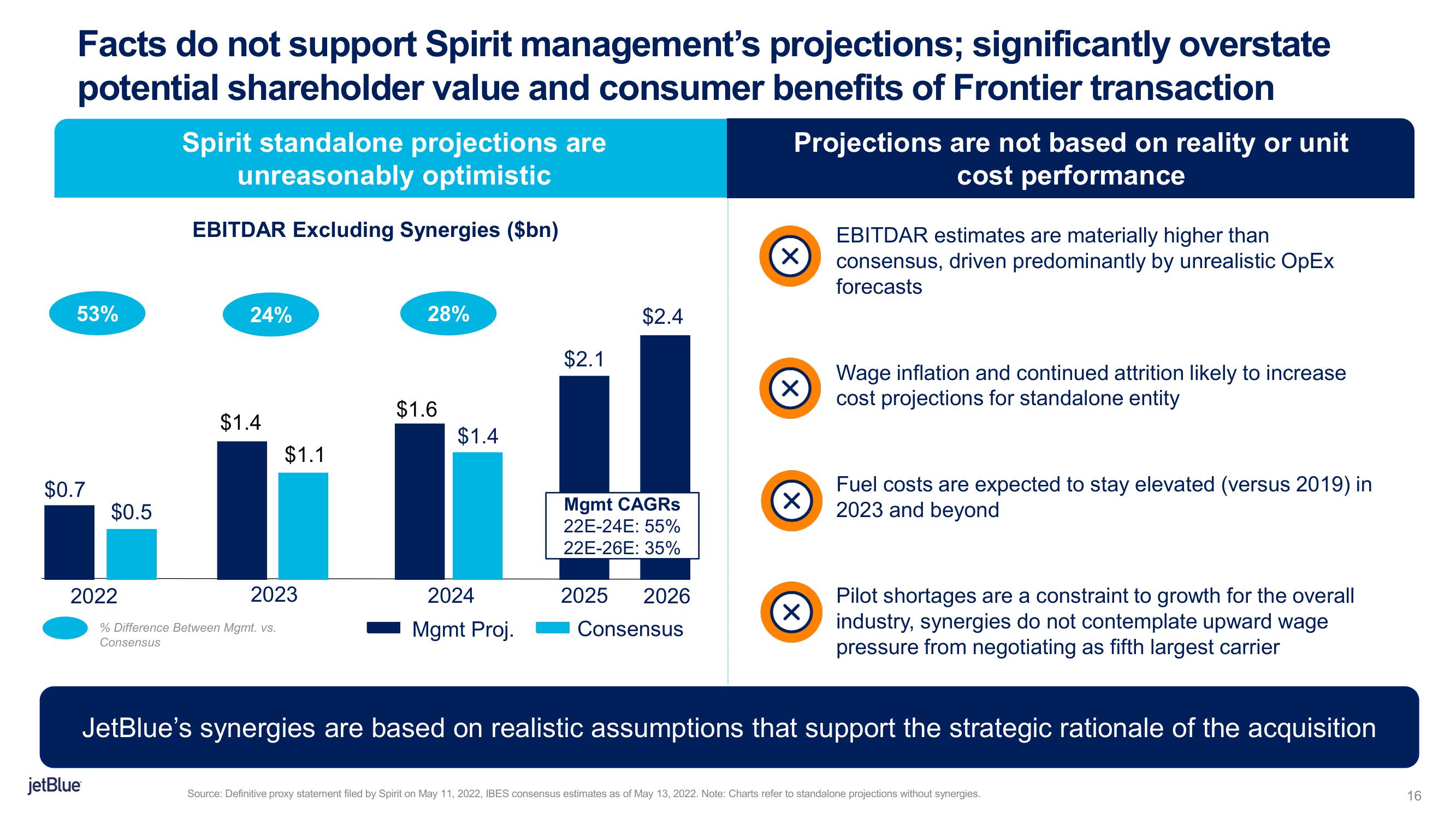

Facts do not support Spirit management's projections; significantly overstate

potential shareholder value and consumer benefits of Frontier transaction

53%

$0.7

$0.5

2022

jetBlue

Spirit standalone projections are

unreasonably optimistic

EBITDAR Excluding Synergies ($bn)

24%

$1.4

$1.1

2023

% Difference Between Mgmt. vs.

Consensus

28%

$1.6

$1.4

2024

Mgmt Proj.

$2.1

$2.4

Mgmt CAGRs

22E-24E: 55%

22E-26E: 35%

2025 2026

Consensus

Projections are not based on reality or unit

cost performance

X

X

X

X

EBITDAR estimates are materially higher than

consensus, driven predominantly by unrealistic OpEx

forecasts

Wage inflation and continued attrition likely to increase

cost projections for standalone entity

Fuel costs are expected to stay elevated (versus 2019) in

2023 and beyond

Pilot shortages are a constraint to growth for the overall

industry, synergies do not contemplate upward wage

pressure from negotiating as fifth largest carrier

JetBlue's synergies are based on realistic assumptions that support the strategic rationale of the acquisition

Source: Definitive proxy statement filed by Spirit on May 11, 2022, IBES consensus estimates as of May 13, 2022. Note: Charts refer to standalone projections without synergies.

16View entire presentation