Origin SPAC Presentation Deck

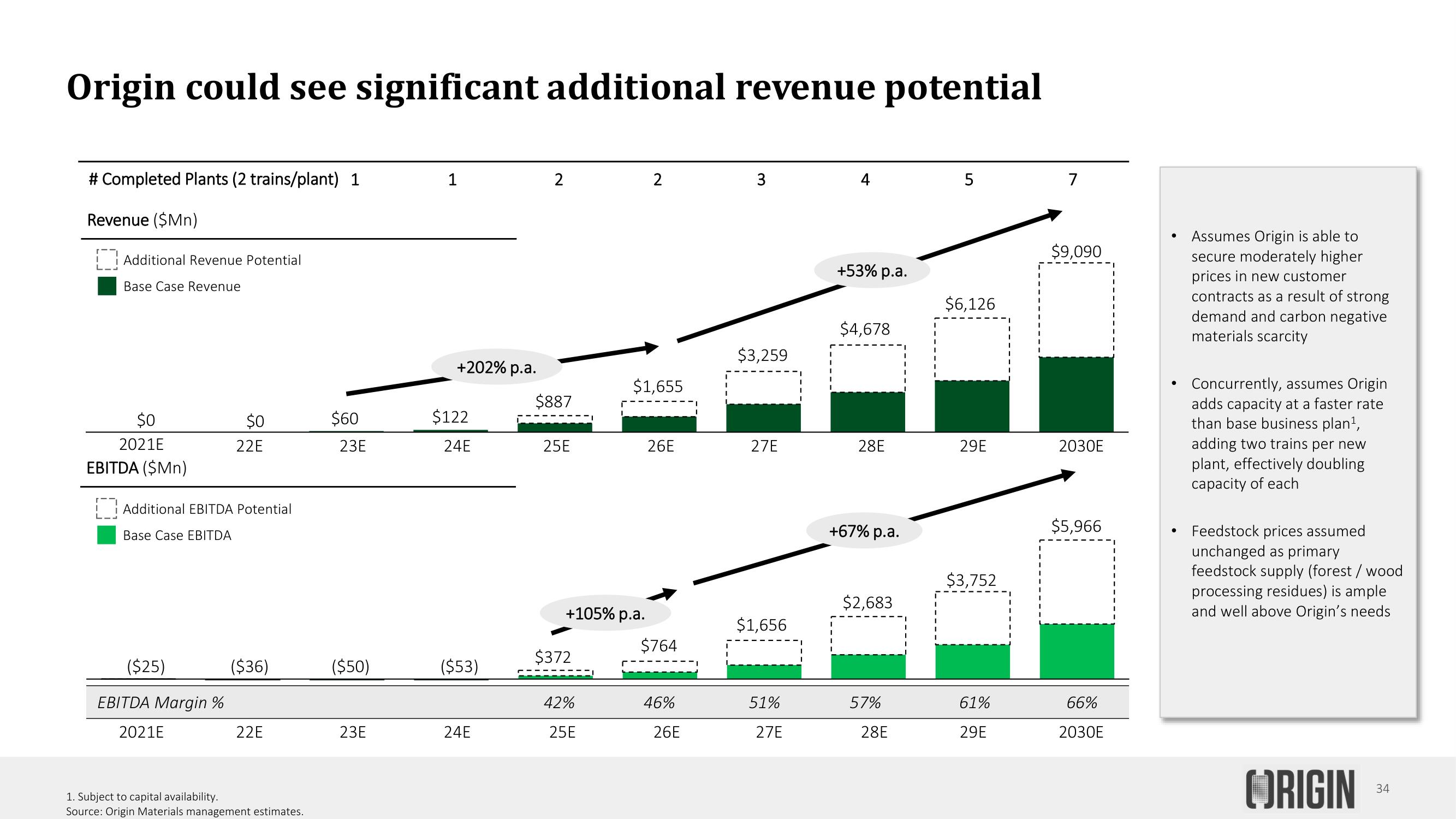

Origin could see significant additional revenue potential

# Completed Plants (2 trains/plant) 1

Revenue ($Mn)

Additional Revenue Potential

Base Case Revenue

$0

2021E

EBITDA ($Mn)

$0

22E

Additional EBITDA Potential

Base Case EBITDA

($25)

EB DA Margin

2021E

($36)

22E

1. Subject to capital availability.

Source: Origin Materials management estimates.

$60

23E

($50)

23E

1

+202% p.a.

$122

24E

($53)

24E

2

$887

25E

+105% p.a.

$372

2%

25E

2

$1,655

26E

$764

26E

3

$3,259

27E

$1,656

51%

27E

+53% p.a.

$4,678

28E

+67% p.a.

$2,683

28E

5

$6,126

29E

$3,752

61%

29E

7

$9,090

2030E

$5,966

66%

2030E

Assumes Origin is able to

secure moderately higher

prices in new customer

contracts as a result of strong

demand and carbon negative

materials scarcity

Concurrently, assumes Origin

adds capacity at a faster rate

than base business plan¹,

adding two trains per new

plant, effectively doubling

capacity of each

Feedstock prices assumed

unchanged as primary

feedstock supply (forest / wood

processing residues) is ample

and well above Origin's needs

ORIGIN

34View entire presentation