HSBC Results Presentation Deck

Wealth and Personal Banking

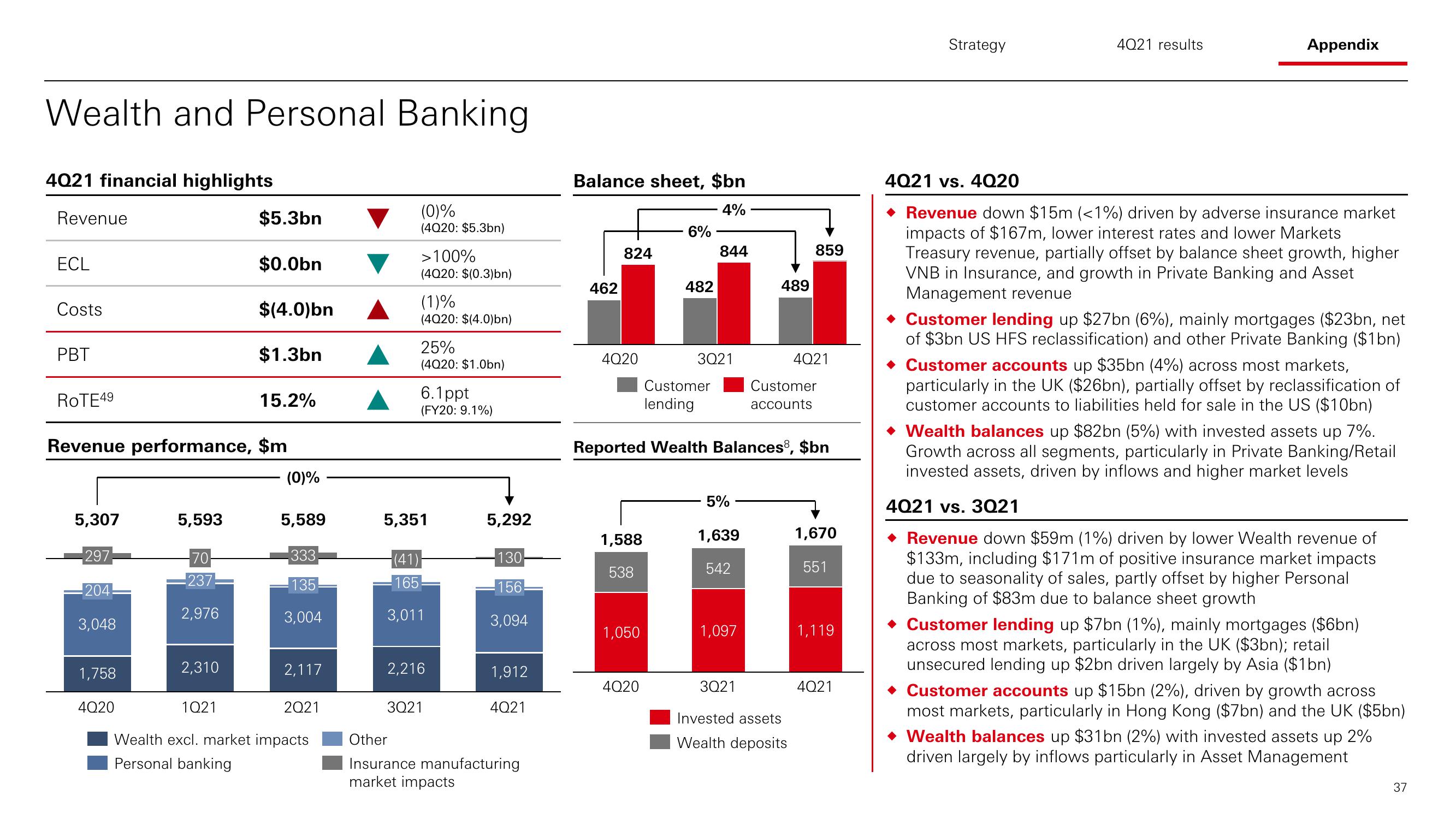

4021 financial highlights

Revenue

ECL

Costs

PBT

ROTE 49

5,307

297

Revenue performance, $m

-204

3,048

1,758

4020

5,593

-70-

-237!

2,976

2,310

$5.3bn

$0.0bn

$(4.0)bn

$1.3bn

1Q21

15.2%

(0)%

5,589

333

135

3,004

2,117

2021

Wealth excl. market impacts

Personal banking

(0)%

(4020: $5.3bn)

>100%

(4020: $(0.3)bn)

(1)%

(4020: $(4.0)bn)

25%

(4020: $1.0bn)

6.1ppt

(FY20: 9.1%)

5,351

(41) -

165

3,011

2,216

3Q21

5,292

130

-156!

3,094

1,912

4Q21

Other

Insurance manufacturing

market impacts

Balance sheet, $bn

4%

462

824

4Q20

1,588

538

1,050

6%

4Q20

482

844

3Q21

Customer

lending

Reported Wealth Balances8, $bn

5%

1,639

542

489

1,097

859

4Q21

Customer

accounts

3Q21

Invested assets

Wealth deposits

1,670

551

1,119

4Q21

Strategy

4021 results

Appendix

4021 vs. 4Q20

Revenue down $15m (<1%) driven by adverse insurance market

impacts of $167m, lower interest rates and lower Markets

Treasury revenue, partially offset by balance sheet growth, higher

VNB in Insurance, and growth in Private Banking and Asset

Management revenue

◆ Customer lending up $27bn (6%), mainly mortgages ($23bn, net

of $3bn US HFS reclassification) and other Private Banking ($1bn)

◆ Customer accounts up $35bn (4%) across most markets,

particularly in the UK ($26bn), partially offset by reclassification of

customer accounts to liabilities held for sale in the US ($10bn)

Wealth balances up $82bn (5%) with invested assets up 7%.

Growth across all segments, particularly in Private Banking/Retail

invested assets, driven by inflows and higher market levels

4021 vs. 3Q21

◆ Revenue down $59m (1%) driven by lower Wealth revenue of

$133m, including $171m of positive insurance market impacts

due to seasonality of sales, partly offset by higher Personal

Banking of $83m due to balance sheet growth

◆ Customer lending up $7bn (1%), mainly mortgages ($6bn)

across most markets, particularly in the UK ($3bn); retail

unsecured lending up $2bn driven largely by Asia ($1bn)

◆ Customer accounts up $15bn (2%), driven by growth across

most markets, particularly in Hong Kong ($7bn) and the UK ($5bn)

◆ Wealth balances up $31bn (2%) with invested assets up 2%

driven largely by inflows particularly in Asset Management

37View entire presentation