Melrose Investor Day Presentation Deck

Melrose

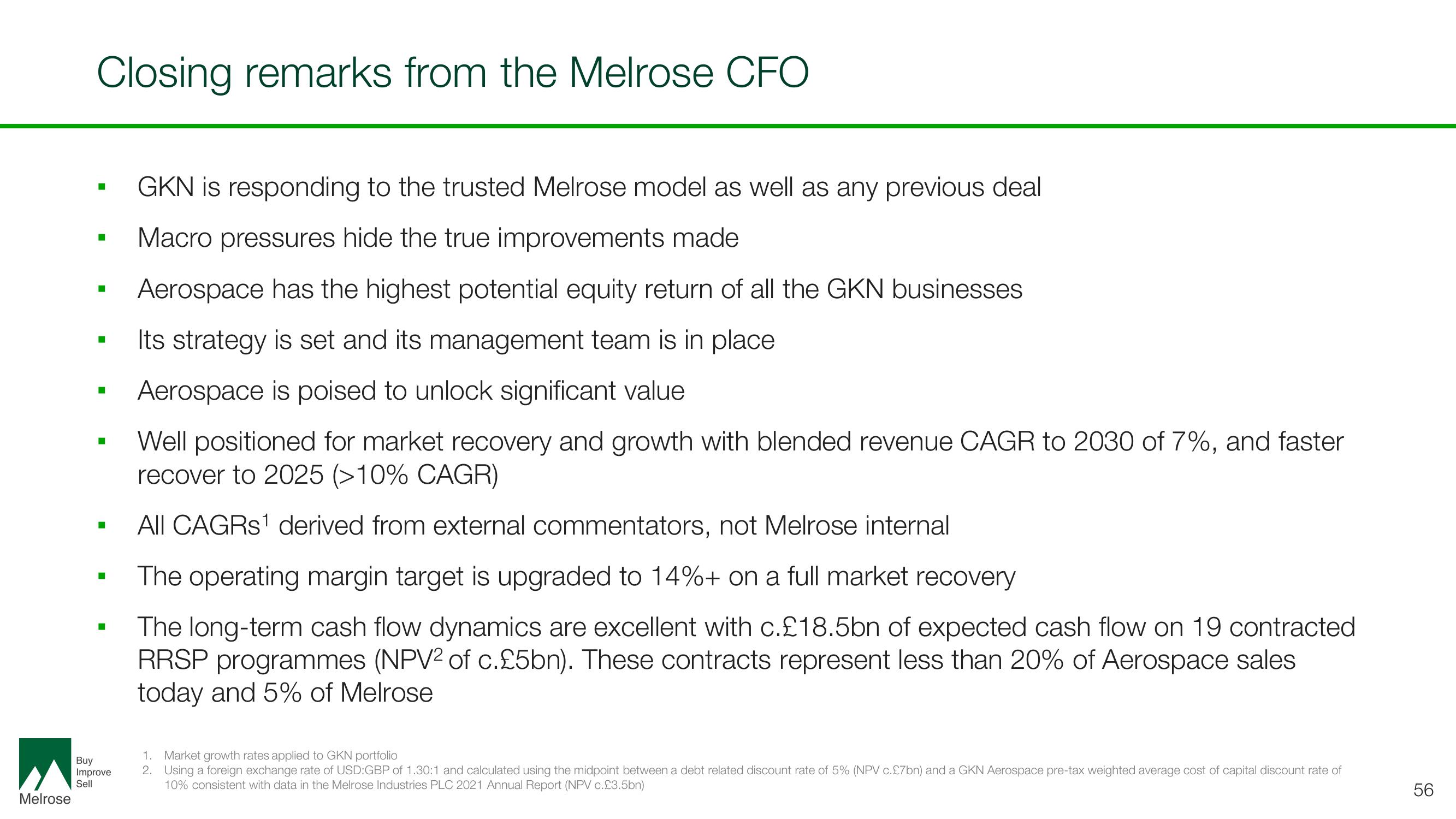

Closing remarks from the Melrose CFO

■

■

■

■

■

■

■

■

■

Buy

Improve

Sell

GKN is responding to the trusted Melrose model as well as any previous deal

Macro pressures hide the true improvements made

Aerospace has the highest potential equity return of all the GKN businesses

Its strategy is set and its management team is in place

Aerospace is poised to unlock significant value

Well positioned for market recovery and growth with blended revenue CAGR to 2030 of 7%, and faster

recover to 2025 (>10% CAGR)

All CAGRs¹ derived from external commentators, not Melrose internal

The operating margin target is upgraded to 14%+ on a full market recovery

The long-term cash flow dynamics are excellent with c.£18.5bn of expected cash flow on 19 contracted

RRSP programmes (NPV2 of c.£5bn). These contracts represent less than 20% of Aerospace sales

today and 5% of Melrose

1. Market growth rates applied to GKN portfolio

2.

Using a foreign exchange rate of USD:GBP of 1.30:1 and calculated using the midpoint between a debt related discount rate of 5% (NPV c.£7bn) and a GKN Aerospace pre-tax weighted average cost of capital discount rate of

10% consistent with data in the Melrose Industries PLC 2021 Annual Report (NPV c.£3.5bn)

56View entire presentation