Liberty Global Results Presentation Deck

RECONCILIATIONS - VODAFONEZIGGO JV

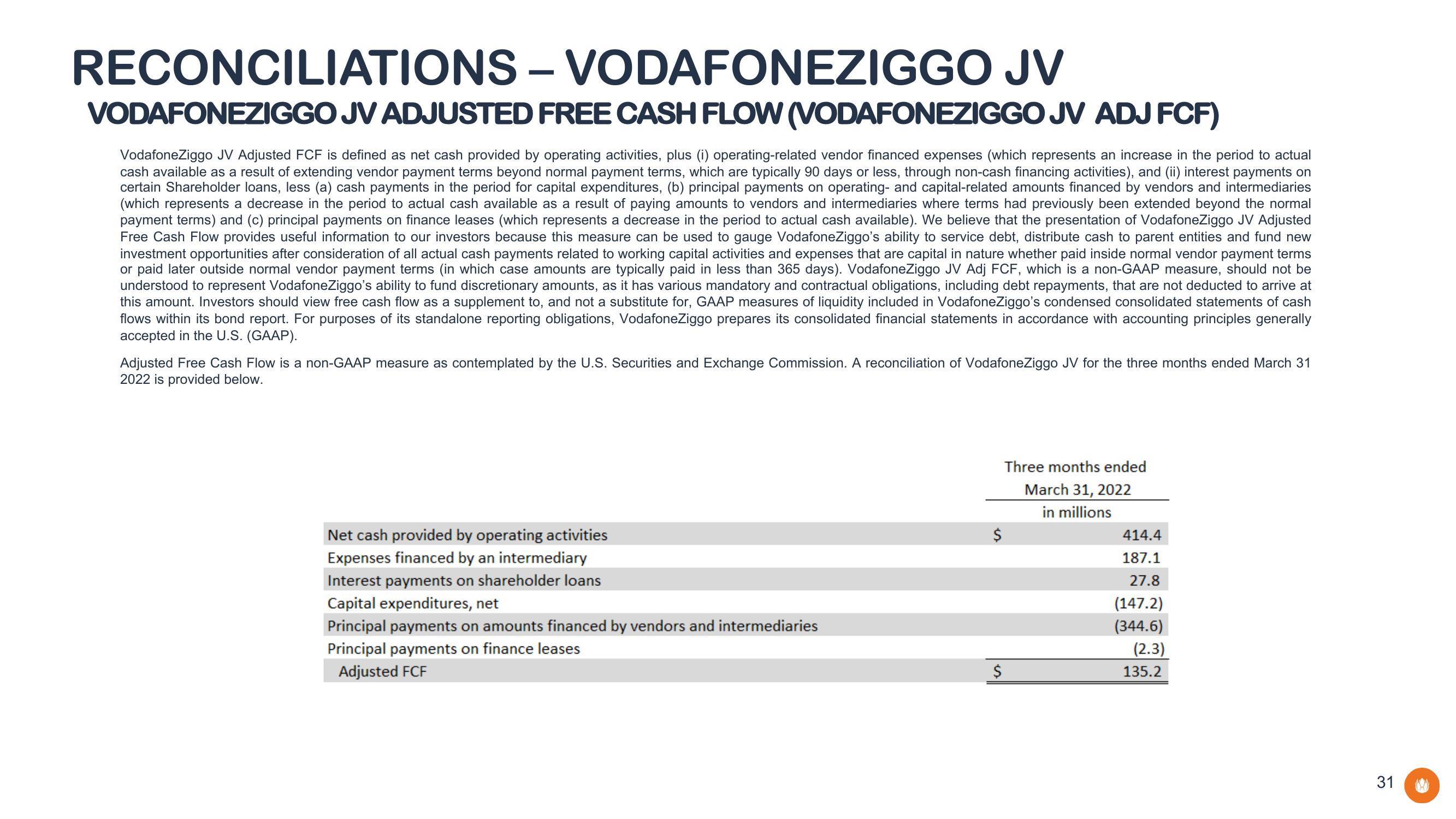

VODAFONEZIGGO JV ADJUSTED FREE CASH FLOW (VODAFONEZIGGO JV ADJ FCF)

VodafoneZiggo JV Adjusted FCF is defined as net cash provided by operating activities, plus (i) operating-related vendor financed expenses (which represents an increase in the period to actual

cash available as a result of extending vendor payment terms beyond normal payment terms, which are typically 90 days or less, through non-cash financing activities), and (ii) interest payments on

certain Shareholder loans, less (a) cash payments in the period for capital expenditures, (b) principal payments on operating- and capital-related amounts financed by vendors and intermediaries

(which represents a decrease in the period to actual cash available as a result of paying amounts to vendors and intermediaries where terms had previously been extended beyond the normal

payment terms) and (c) principal payments on finance leases (which represents a decrease in the period to actual cash available). We believe that the presentation of VodafoneZiggo JV Adjusted

Free Cash Flow provides useful information to our investors because this measure can be used to gauge VodafoneZiggo's ability to service debt, distribute cash to parent entities and fund new

investment opportunities after consideration of all actual cash payments related to working capital activities and expenses that are capital in nature whether paid inside normal vendor payment terms

or paid later outside normal vendor payment terms (in which case amounts are typically paid in less than 365 days). VodafoneZiggo JV Adj FCF, which is a non-GAAP measure, should not be

understood to represent VodafoneZiggo's ability to fund discretionary amounts, as it has various mandatory and contractual obligations, including debt repayments, that are not deducted to arrive at

this amount. Investors should view free cash flow as a supplement to, and not a substitute for, GAAP measures of liquidity included in VodafoneZiggo's condensed consolidated statements of cash

flows within its bond report. For purposes of its standalone reporting obligations, VodafoneZiggo prepares its consolidated financial statements in accordance with accounting principles generally

accepted in the U.S. (GAAP).

Adjusted Free Cash Flow is a non-GAAP measure as contemplated by the U.S. Securities and Exchange Commission. A reconciliation of VodafoneZiggo JV for the three months ended March 31

2022 is provided below.

Net cash provided by operating activities

Expenses financed by an intermediary

Interest payments on shareholder loans

Capital expenditures, net

Principal payments on amounts financed by vendors and intermediaries

Principal payments on finance leases

Adjusted FCF

$

$

Three months ended

March 31, 2022

in millions

414.4

187.1

27.8

(147.2)

(344.6)

(2.3)

135.2

31View entire presentation