Lyft Results Presentation Deck

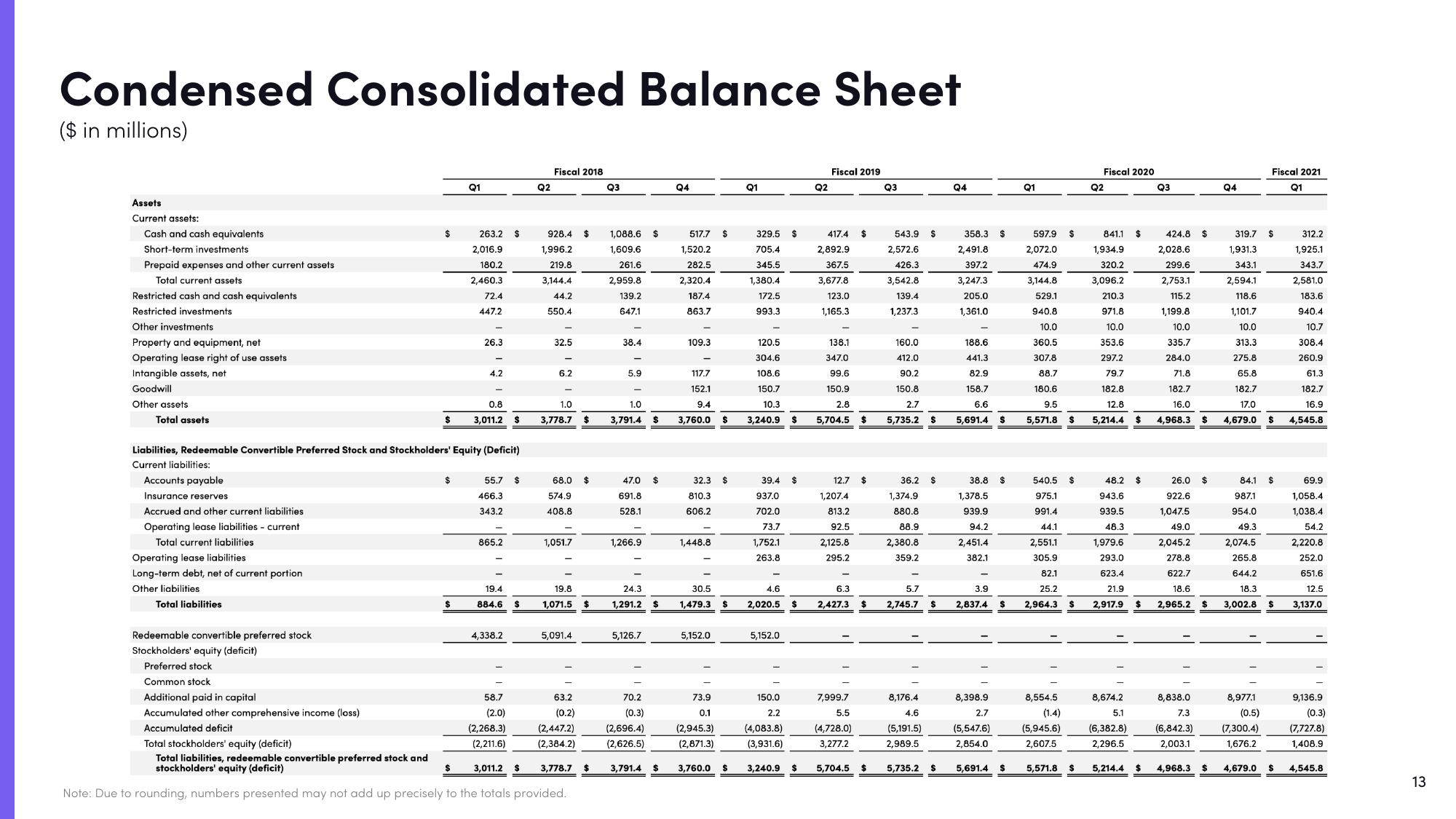

Condensed Consolidated Balance Sheet

($ in millions)

Assets

Current assets:

Cash and cash equivalents

Short-term investments

Prepaid expenses and other current assets

Total current assets

Restricted cash and cash equivalents

Restricted investments

Other investments

Property and equipment, net

Operating lease right of use assets

Intangible assets, net

Goodwill

Other assets

Total assets

Accounts payable

Insurance reserves

Accrued and other current liabilities

Operating lease liabilities - current

Total current liabilities

Operating lease liabilities

Long-term debt, net of current portion

Other liabilities

Total liabilities

$

Redeemable convertible preferred stock

Stockholders' equity (deficit)

Preferred stock

Common stock

Additional paid in capital

Accumulated other comprehensive income (loss)

Accumulated deficit

$

Liabilities, Redeemable Convertible Preferred Stock and Stockholders' Equity (Deficit)

Current liabilities:

$

Q1

263.2

2,016.9

180.2

2,460.3

72.4

447.2

$

26.3

4.2

0.8

3,011.2

55.7 $

466.3

343.2

865.2

$

19.4

884.6 $

4,338.2

58.7

(2.0)

(2,268.3)

(2,211.6)

Q2

Fiscal 2018

928.4 $

1,996.2

219.8

3,144.4

44.2

550.4

32.5

6.2

1.0

3,778.7

68.0 $

574.9

408.8

1,051.7

19.8

1,071.5 $

5,091.4

63.2

(0.2)

(2,447.2)

(2,384.2)

Total stockholders' equity (deficit)

Total liabilities, redeemable convertible preferred stock and

stockholders' equity (deficit)

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

3,011.2 $ 3,778.7

Q3

1,088.6

1,609.6

261.6

2,959.8

139.2

647.1

38.4

5.9

1.0

3,791.4 $

47.0 $

691.8

528.1

1,266.9

$

24.3

1,291.2 $

5,126.7

70.2

(0.3)

(2,696.4)

(2,626.5)

3,791.4

Q4

517.7 $

1,520.2

282.5

2,320.4

187.4

863.7

109.3

117.7

152.1

9.4

3,760.0

32.3 $

810.3

606.2

1,448.8

$

30.5

1,479.3 $

5,152.0

73.9

0.1

(2,945.3)

(2,871.3)

$ 3,760.0

Q1

329.5

705.4

345.5

1,380.4

172.5

993.3

120.5

304.6

108.6

150.7

10.3

3,240.9

1,752.1

263.8

39.4 $

937.0

702.0

73.7

$

5,152.0

$

4.6

2,020.5 $

150.0

2.2

(4,083.8)

(3,931.6)

3,240.9

Q2

Fiscal 2019

417.4

2,892.9

367.5

3,677.8

123.0

1,165.3

138.1

347.0

99.6

150.9

2.8

5,704.5

12.7

1,207,4

813.2

92.5

2,125.8

295.2

6.3

2,427.3

I

7,999.7

5.5

(4,728.0)

3,277.2

$ 5,704.5

$

$

$

Q3

543.9 $

2,572.6

426.3

3,542.8

139.4

1,237.3

160.0

412.0

90.2

150.8

2.7

5,735.2 $

36.2 $

1,374.9

880.8

88.9

2,380.8

359.2

5.7

2,745.7 $

8,176.4

4.6

(5,191.5)

2,989.5

5,735.2

Q4

358.3

2,491.8

397.2

3,247.3

205.0

1,361.0

188.6

441.3

82.9

158.7

6.6

5,691.4 $

38.8

1,378.5

939.9

94.2

2,451.4

382.1

3.9

$

8,398.9

2.7

(5,547.6)

2,854.0

2,837.4 S

5,691.4

$

$

Q1

597.9

2,072.0

474.9

3,144.8

529.1

940.8

10.0

360.5

307.8

88.7

180.6

9.5

5,571.8

$

540.5 $

975.1

991.4

44.1

2,551.1

305.9

82.1

25.2

2,964.3 $

8,554.5

(1.4)

(5,945.6)

2,607.5

5,571.8

$

Fiscal 2020

Q2

841.1 $

1,934.9

320.2

3,096.2

210.3

971.8

10.0

353.6

297.2

79.7

182.8

12.8

5,214.4 $

48.2

943.6

939.5

48.3

1,979.6

293.0

623.4

21.9

2,917.9

8,674.2

5.1

(6,382.8)

2,296.5

$

5,214.4 $

Q3

424.8

2,028.6

299.6

2,753.1

115.2

1,199.8

10.0

335.7

284.0

71.8

182.7

16.0

4,968.3

$

$

26.0 $

922.6

1,047.5

49.0

2,045.2

278.8

622.7

18.6

2,965.2 $

Q4

Fiscal 2021

Q1

319.7 $

1,931.3

343.1

2,594.1

118.6

1,101.7

10.0

313.3

275.8

65.8

182.7

17.0

4,679.0

8,838.0

7.3

(6,842.3)

2,003.1

8,977.1

(0.5)

(7,300.4)

1,676.2

4,968.3 $ 4,679.0

$

84.1 $

987.1

954.0

49.3

2,074.5

265.8

644.2

18.3

3,002.8 $

312.2

1,925.1

343.7

2,581.0

183.6

940.4

10.7

308.4

260.9

61.3

182.7

16.9

4,545.8

69.9

1,058.4

1,038.4

54.2

2,220.8

252.0

651.6

12.5

3,137.0

9,136.9

(0.3)

(7,727.8)

1,408.9

$ 4,545.8

13View entire presentation