First Quarter 2017 Financial Review

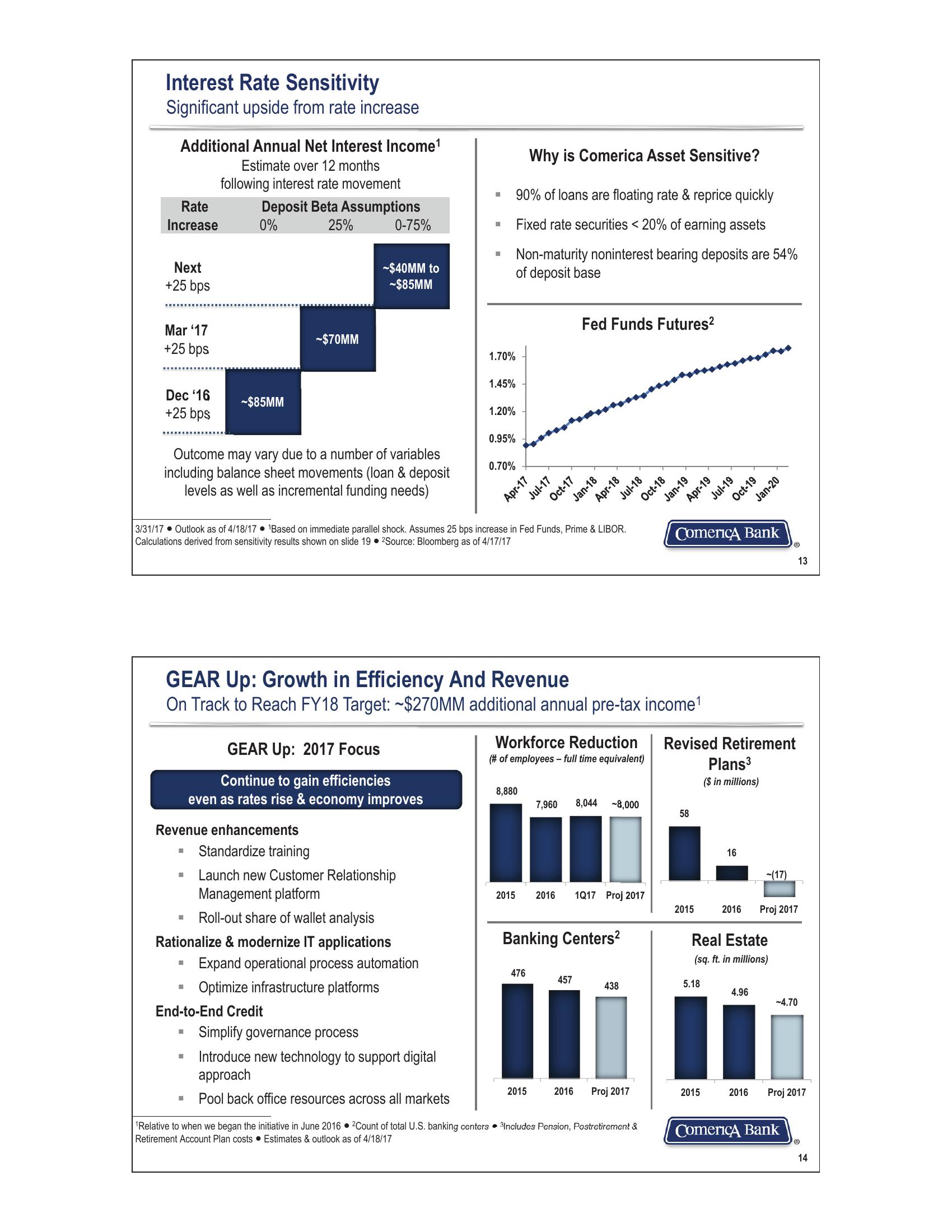

Interest Rate Sensitivity

Significant upside from rate increase

Additional Annual Net Interest Income¹

Estimate over 12 months

following interest rate movement

Deposit Beta Assumptions

Rate

Increase

0%

Next

+25 bps

Mar '17

+25 bps

Dec '16

~$85MM

+25 bps

25%

~$70MM

0-75%

~$40MM to

~$85MM

Why is Comerica Asset Sensitive?

90% of loans are floating rate & reprice quickly

Fixed rate securities < 20% of earning assets

Non-maturity noninterest bearing deposits are 54%

of deposit base

1.70%

1.45%

1.20%

0.95%

0.70%

Fed Funds Futures²

Jul-19

Oct-19

Jan-20

Outcome may vary due to a number of variables

including balance sheet movements (loan & deposit

levels as well as incremental funding needs)

Apr-17

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

3/31/17 Outlook as of 4/18/17 Based on immediate parallel shock. Assumes 25 bps increase in Fed Funds, Prime & LIBOR.

Calculations derived from sensitivity results shown on slide 19 ⚫2Source: Bloomberg as of 4/17/17

Comerica Bank

Ⓡ

13

GEAR Up: Growth in Efficiency And Revenue

On Track to Reach FY18 Target: ~$270MM additional annual pre-tax income¹

GEAR Up: 2017 Focus

Continue to gain efficiencies

even as rates rise & economy improves

Revenue enhancements

Standardize training

Launch new Customer Relationship

Management platform

Roll-out share of wallet analysis

Rationalize & modernize IT applications

Expand operational process automation

Optimize infrastructure platforms

End-to-End Credit

Workforce Reduction

(# of employees - full time equivalent)

Revised Retirement

Plans³

8,880

7,960 8,044 -8,000

58

($ in millions)

16

(17)

2015

2016

1Q17 Proj 2017

2015

2016

Proj 2017

Banking Centers²

Real Estate

(sq. ft. in millions)

476

457

438

5.18

4.96

-4.70

Simplify governance process

Introduce new technology to support digital

approach

2015

2016

Proj 2017

2015

2016

Pool back office resources across all markets

Proj 2017

Relative to when we began the initiative in June 2016 ⚫2Count of total U.S. banking centers Includes Pension, Postretirement &

Retirement Account Plan costs Estimates & outlook as of 4/18/17

Comerica Bank

Ⓡ

14View entire presentation