Hydrofarm IPO Presentation Deck

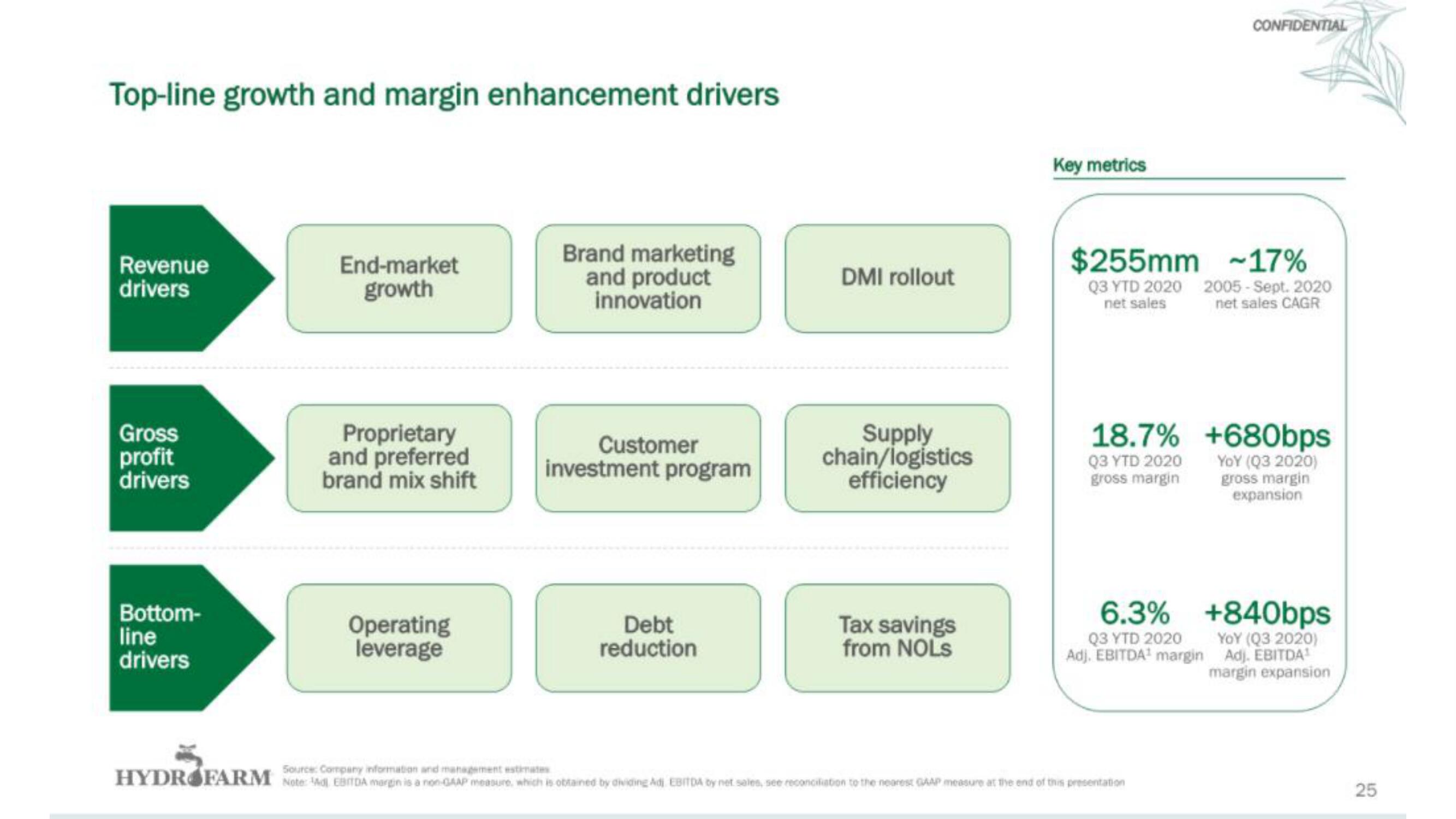

Top-line growth and margin enhancement drivers

Revenue

drivers

Gross

profit

drivers

Bottom-

line

drivers

End-market

growth

Proprietary

and preferred

brand mix shift

Operating

leverage

Brand marketing

and product

innovation

Customer

investment program

Debt

reduction

DMI rollout

Supply

chain/logistics

efficiency

Tax savings

from NOLS

Key metrics

$255mm -17%

Q3 YTD 2020

net sales

Q3 YTD 2020

gross margin

CONFIDENTIAL

18.7% +680bps

YOY (Q3 2020)

gross margin

expansion

2005-Sept. 2020

net sales CAGR

6.3% +840bps

YOY (Q3 2020)

Adj. EBITDA¹

margin expansion

Q3 YTD 2020

Adj. EBITDA¹ margin

Source: Company information and management estimates

HYDROFARM Note: Ad EBITDA margin is a non-GAAP measure, which is obtained by dividing Adi EBITDA by net sales, see reconciliation to the nearest GAAP measure at the end of this presentation

25View entire presentation