HyperloopTT Investor Presentation Deck

H

Confidential and Proprietary

7

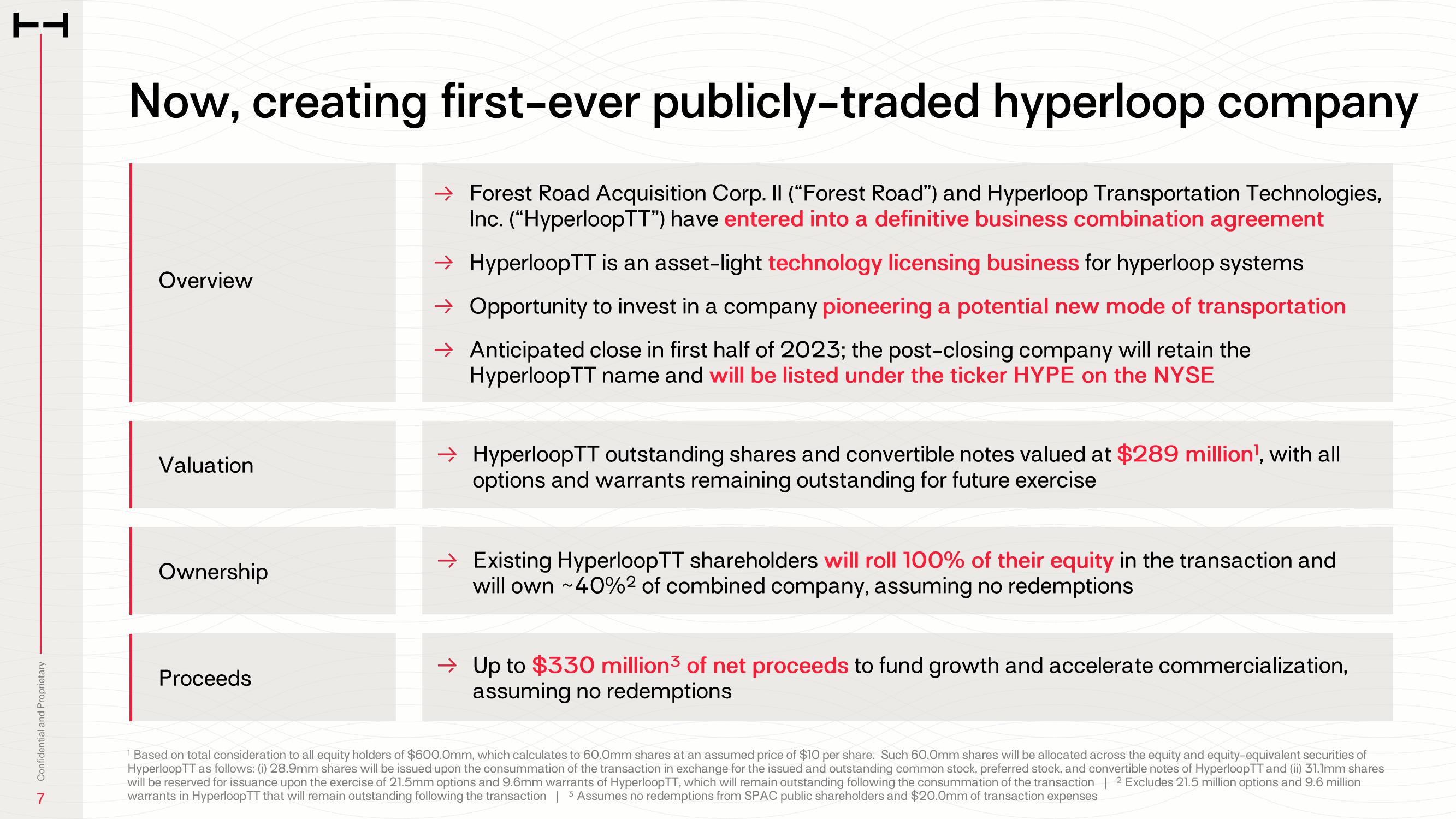

Now, creating first-ever publicly-traded hyperloop company

→ Forest Road Acquisition Corp. Il ("Forest Road") and Hyperloop Transportation Technologies,

Inc. ("HyperloopTT") have entered into a definitive business combination agreement

→ HyperloopTT is an asset-light technology licensing business for hyperloop systems

→ Opportunity to invest in a company pioneering a potential new mode of transportation

→Anticipated close in first half of 2023; the post-closing company will retain the

HyperloopTT name and will be listed under the ticker HYPE on the NYSE

Overview

Valuation

Ownership

Proceeds

→ HyperloopTT outstanding shares and convertible notes valued at $289 million¹, with all

options and warrants remaining outstanding for future exercise

→ Existing HyperloopTT shareholders will roll 100% of their equity in the transaction and

will own ~40%2 of combined company, assuming no redemptions

→ Up to $330 million3 of net proceeds to fund growth and accelerate commercialization,

assuming no redemptions

¹ Based on total consideration to all equity holders of $600.0mm, which calculates to 60.0mm shares at an assumed price of $10 per share. Such 60.0mm shares will be allocated across the equity and equity-equivalent securities of

HyperloopTT as follows: (i) 28.9mm shares will be issued upon the consummation of the transaction in exchange for the issued and outstanding common stock, preferred stock, and convertible notes of HyperloopTT and (ii) 31.1mm shares

will be reserved for issuance upon the exercise of 21.5mm options and 9.6mm warrants of HyperloopTT, which will remain outstanding following the consummation of the transaction | 2 Excludes 21.5 million options and 9.6 million

warrants in HyperloopTT that will remain outstanding following the transaction | 3 Assumes no redemptions from SPAC public shareholders and $20.0mm of transaction expensesView entire presentation