Investor Presentation

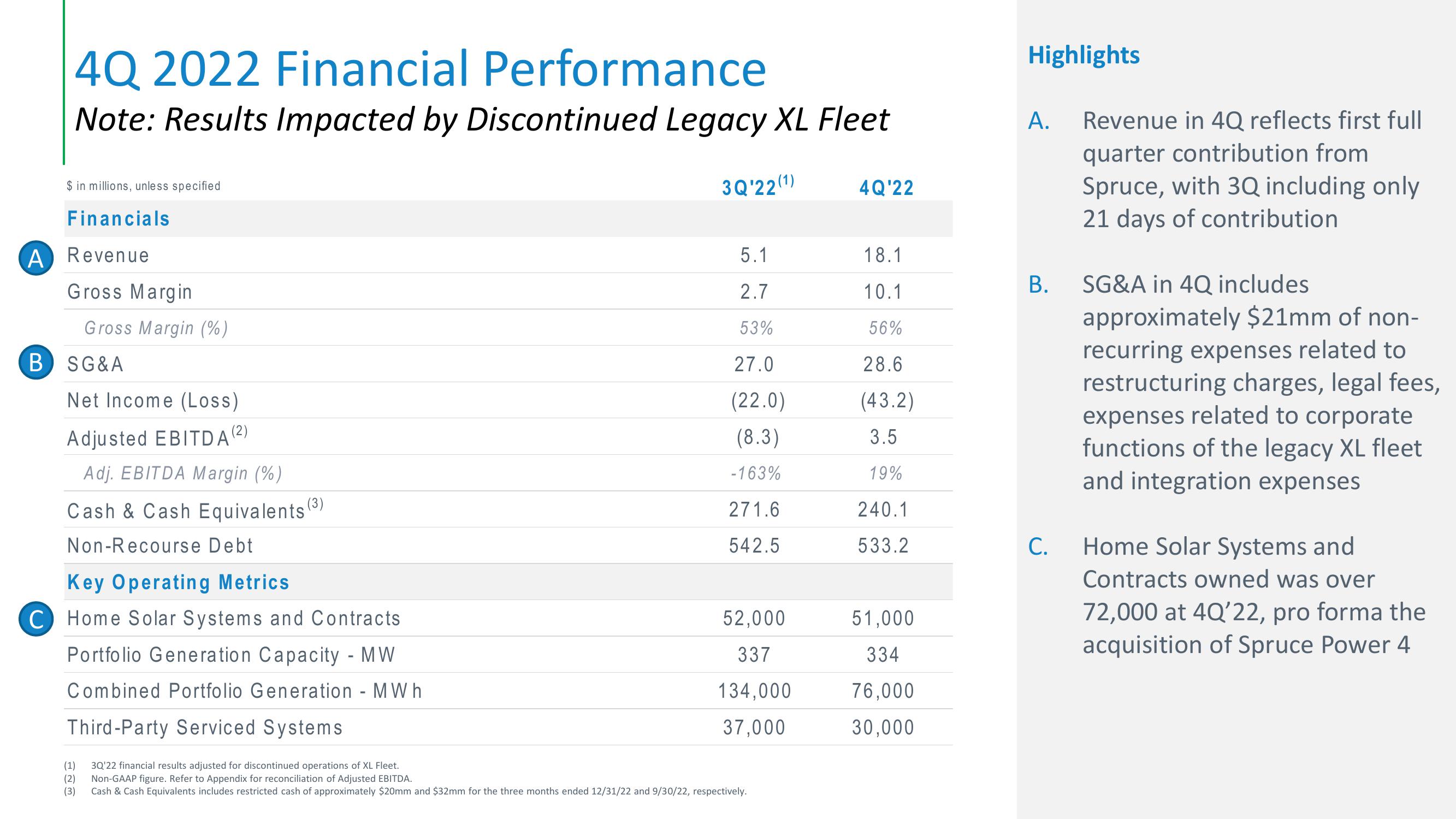

4Q 2022 Financial Performance

Note: Results Impacted by Discontinued Legacy XL Fleet

$ in millions, unless specified

A

B

Financials

Revenue

Gross Margin

Gross Margin (%)

SG&A

Net Income (Loss)

Adjusted EBITDA (2)

Adj. EBITDA Margin (%)

Cash & Cash Equivalents.

Non-Recourse Debt

Key Operating Metrics

C Home Solar Systems and Contracts

Portfolio Generation Capacity - MW

Combined Portfolio Generation - MWh

Third-Party Serviced Systems

3Q'22(1)

4Q'22

Highlights

A.

Revenue in 4Q reflects first full

quarter contribution from

Spruce, with 3Q including only

5.1

18.1

2.7

10.1

B.

53%

56%

27.0

28.6

(22.0)

(43.2)

(8.3)

3.5

-163%

19%

271.6

240.1

542.5

533.2

C.

52,000

51,000

337

334

134,000

76,000

37,000

30,000

(1)

3Q'22 financial results adjusted for discontinued operations of XL Fleet.

(2)

Non-GAAP figure. Refer to Appendix for reconciliation of Adjusted EBITDA.

(3)

Cash & Cash Equivalents includes restricted cash of approximately $20mm and $32mm for the three months ended 12/31/22 and 9/30/22, respectively.

21 days of contribution

SG&A in 4Q includes

approximately $21mm of non-

recurring expenses related to

restructuring charges, legal fees,

expenses related to corporate

functions of the legacy XL fleet

and integration expenses

Home Solar Systems and

Contracts owned was over

72,000 at 4Q'22, pro forma the

acquisition of Spruce Power 4View entire presentation