BlackRock Investor Day Presentation Deck

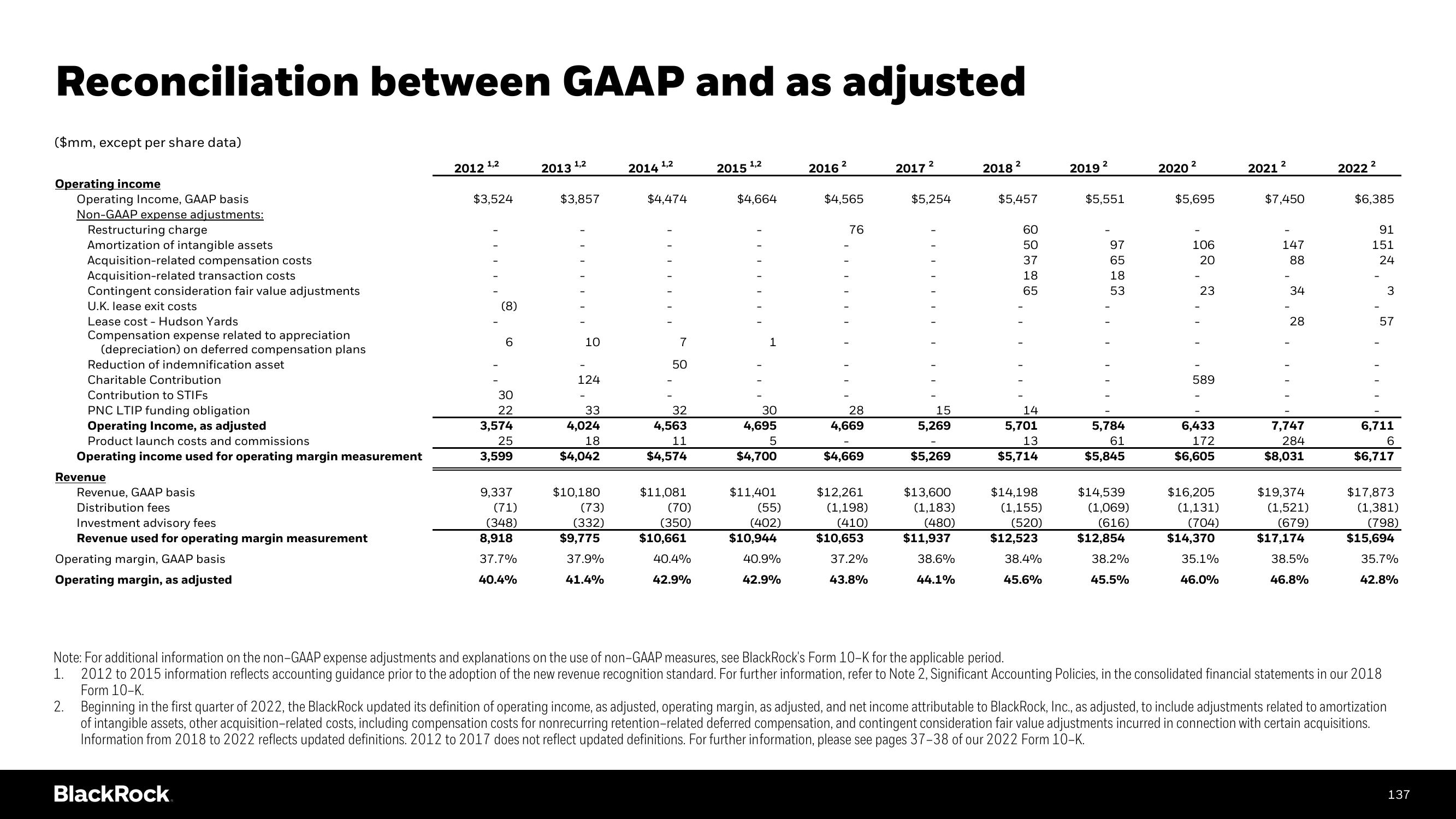

Reconciliation between GAAP and as adjusted

($mm, except per share data)

Operating income

Operating Income, GAAP basis

Non-GAAP expense adjustments:

Restructuring charge

Amortization of intangible assets

Acquisition-related compensation costs

Acquisition-related transaction costs

Contingent consideration fair value adjustments

U.K. lease exit costs

Lease cost - Hudson Yards

Compensation expense related to appreciation

(depreciation) on deferred compensation plans

Reduction of indemnification asset

Charitable Contribution

Contribution to STIFs

PNC LTIP funding obligation

Operating Income, as adjusted

Product launch costs and commissions

Operating income used for operating margin measurement

Revenue

Revenue, GAAP basis

Distribution fees

Investment advisory fees

Revenue used for operating margin measurement

Operating margin, GAAP basis

Operating margin, as adjusted

2012 ¹,2

$3,524

BlackRock

(8)

6

30

22

3,574

25

3,599

9,337

(71)

(348)

8,918

37.7%

40.4%

2013 ¹,2

$3,857

10

124

33

4,024

18

$4,042

$10,180

(73)

(332)

$9,775

37.9%

41.4%

2014 ¹,2

$4,474

7

50

32

4,563

11

$4,574

$11,081

(70)

(350)

$10,661

40.4%

42.9%

2015

1,2

$4,664

1

30

4,695

5

$4,700

$11,401

(55)

(402)

$10,944

40.9%

42.9%

2016 ²

$4,565

76

28

4,669

$4,669

$12,261

(1,198)

(410)

$10,653

37.2%

43.8%

2017 ²

$5,254

|||||

15

5,269

$5,269

$13,600

(1,183)

(480)

$11,937

38.6%

44.1%

2

2018 ²

$5,457

60

50

37

18

65

14

5,701

13.

$5,714

$14,198

(1,155)

(520)

$12,523

38.4%

45.6%

2019 ²

$5,551

97

65

18

53

5,784

61

$5,845

$14,539

(1,069)

(616)

$12,854

38.2%

45.5%

2020

2

$5,695

106

20

23

589

6,433

172

$6,605

$16,205

(1,131)

(704)

$14,370

35.1%

46.0%

2021

2

$7,450

147

88

34

28

7,747

284

$8,031

$19,374

(1,521)

(679)

$17,174

38.5%

46.8%

2022

2

$6,385

91

151

24

3

57

6,711

6

$6,717

Note: For additional information on the non-GAAP expense adjustments and explanations on the use of non-GAAP measures, see BlackRock's Form 10-K for the applicable period.

1. 2012 to 2015 information reflects accounting guidance prior to the adoption of the new revenue recognition standard. For further information, refer to Note 2, Significant Accounting Policies, in the consolidated financial statements in our 2018

Form 10-K.

$17,873

(1,381)

(798)

$15,694

35.7%

42.8%

2. Beginning in the first quarter of 2022, the BlackRock updated its definition of operating income, as adjusted, operating margin, as adjusted, and net income attributable to BlackRock, Inc., as adjusted, to include adjustments related to amortization

of intangible assets, other acquisition-related costs, including compensation costs for nonrecurring retention-related deferred compensation, and contingent consideration fair value adjustments incurred in connection with certain acquisitions.

Information from 2018 to 2022 reflects updated definitions. 2012 to 2017 does not reflect updated definitions. For further information, please see pages 37-38 of our 2022 Form 10-K.

137View entire presentation