PropertyGuru SPAC Presentation Deck

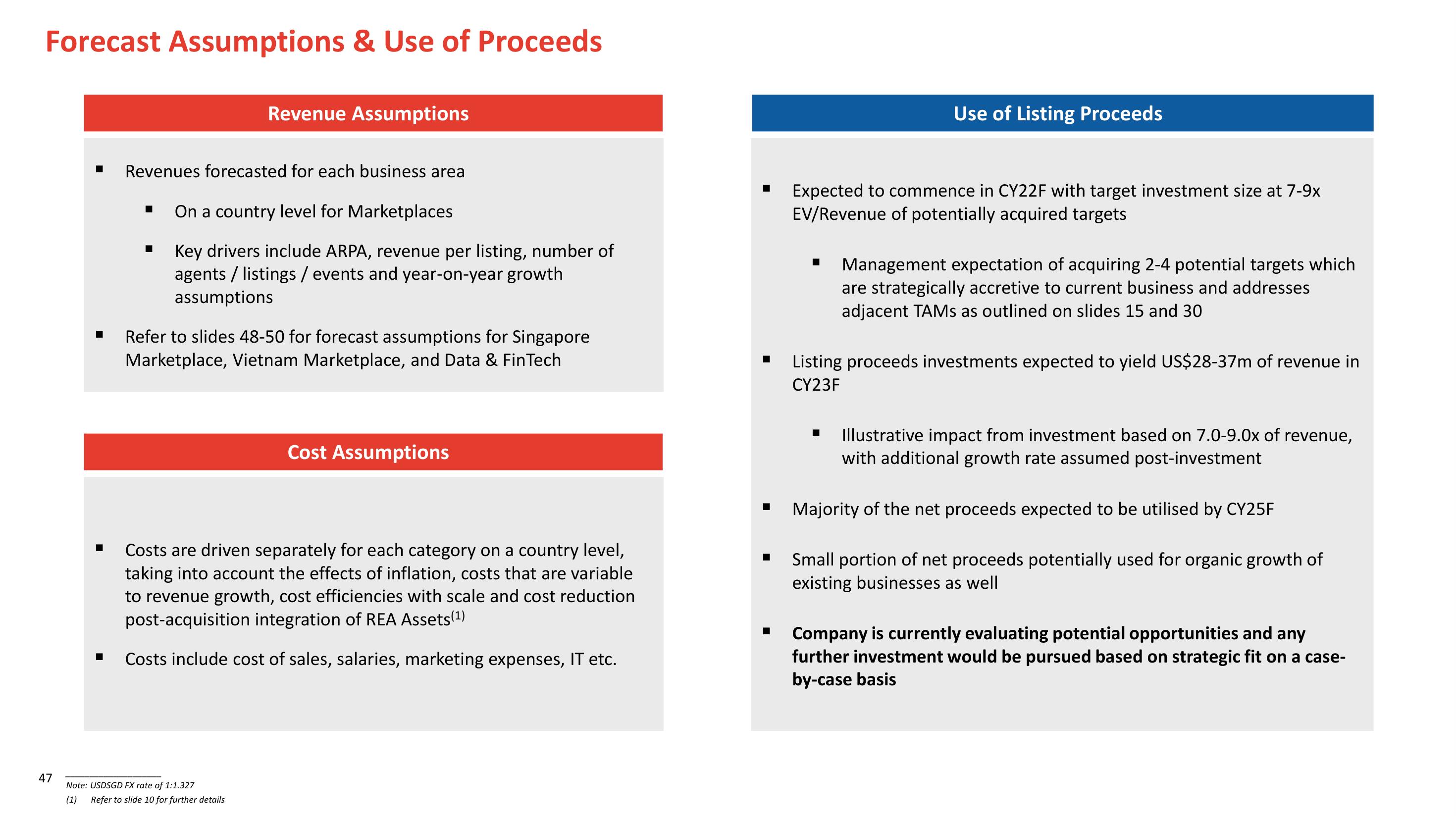

Forecast Assumptions & Use of Proceeds

47

Revenues forecasted for each business area

On a country level for Marketplaces

Key drivers include ARPA, revenue per listing, number of

agents/listings / events and year-on-year growth

assumptions

■

Revenue Assumptions

Refer to slides 48-50 for forecast assumptions for Singapore

Marketplace, Vietnam Marketplace, and Data & FinTech

Note: USDSGD FX rate of 1:1.327

(1) Refer to slide 10 for further details

Cost Assumptions

Costs are driven separately for each category on a country level,

taking into account the effects of inflation, costs that are variable

to revenue growth, cost efficiencies with scale and cost reduction

post-acquisition integration of REA Assets(1)

Costs include cost of sales, salaries, marketing expenses, IT etc.

Expected to commence in CY22F with target investment size at 7-9x

EV/Revenue of potentially acquired targets

■

Use of Listing Proceeds

■

Management expectation of acquiring 2-4 potential targets which

are strategically accretive to current business and addresses

adjacent TAMs as outlined on slides 15 and 30

Listing proceeds investments expected to yield US$28-37m of revenue in

CY23F

Illustrative impact from investment based on 7.0-9.0x of revenue,

with additional growth rate assumed post-investment

■ Majority of the net proceeds expected to be utilised by CY25F

Small portion of net proceeds potentially used for organic growth of

existing businesses as well

Company is currently evaluating potential opportunities and any

further investment would be pursued based on strategic fit on a case-

by-case basisView entire presentation