KKR Real Estate Finance Trust Investor Presentation Deck

Portfolio Benefits from Attractive in the Money LIBOR Floors

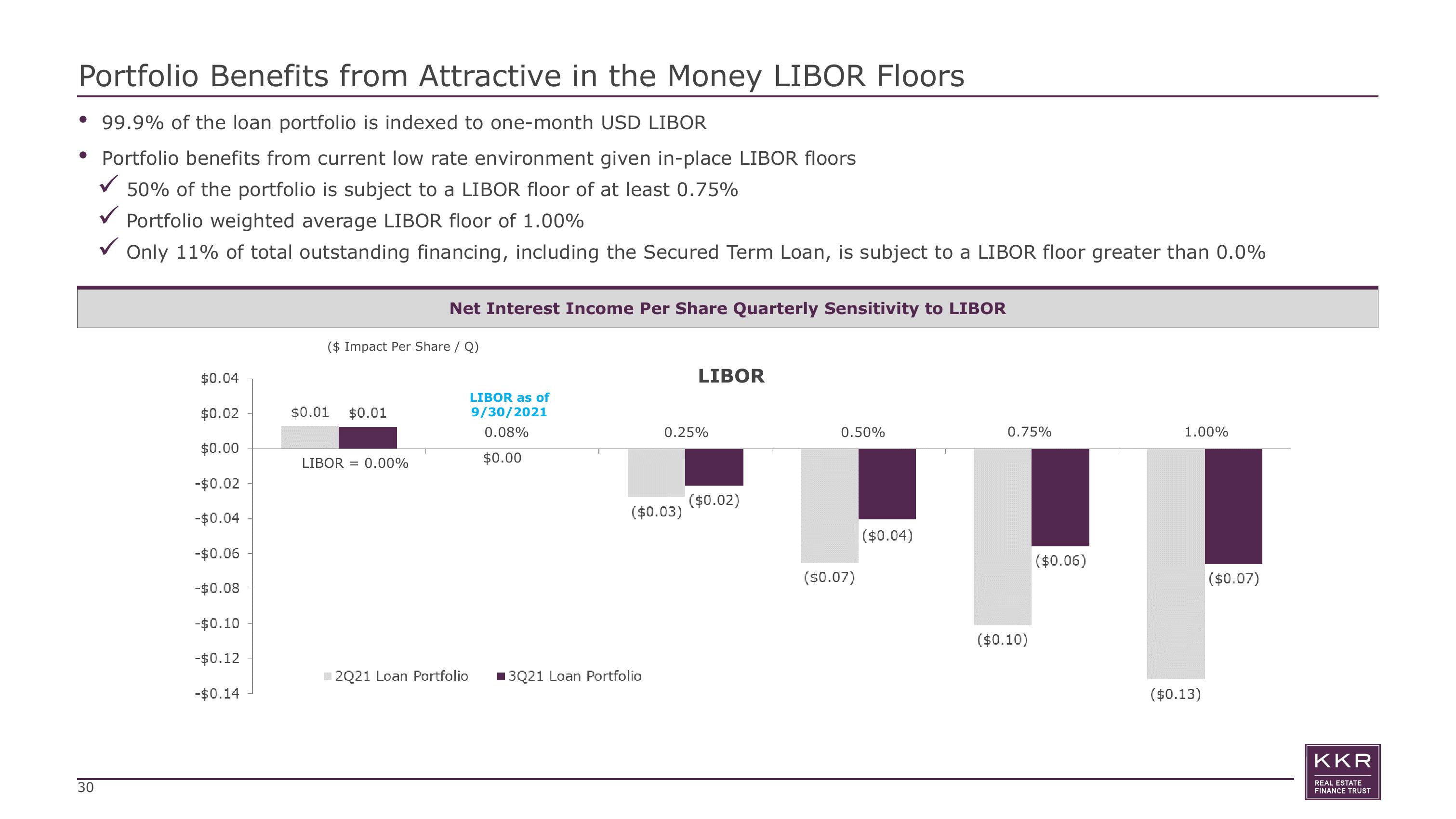

• 99.9% of the loan portfolio is indexed to one-month USD LIBOR

• Portfolio benefits from current low rate environment given in-place LIBOR floors

50% of the portfolio is subject to a LIBOR floor of at least 0.75%

✓ Portfolio weighted average LIBOR floor of 1.00%

✓

Only 11% of total outstanding financing, including the Secured Term Loan, is subject to a LIBOR floor greater than 0.0%

30

$0.04

$0.02

$0.00

-$0.02

-$0.04

-$0.06

-$0.08

-$0.10

-$0.12

-$0.14

($ Impact Per Share / Q)

$0.01 $0.01

Net Interest Income Per Share Quarterly Sensitivity to LIBOR

LIBOR = 0.00%

LIBOR as of

9/30/2021

0.08%

$0.00

($0.03)

2Q21 Loan Portfolio 13Q21 Loan Portfolio

LIBOR

0.25%

($0.02)

0.50%

($0.07)

($0.04)

0.75%

($0.10)

($0.06)

1.00%

($0.13)

($0.07)

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation